Have you ever found yourself in a situation where unexpected expenses arise and you’re left scrambling to cover the costs? It can be incredibly stressful and put a strain on your finances. That’s why it’s important to have a solid emergency fund in place. In this article, we’ll explore some practical strategies to help you save money and build that much-needed financial safety net. From cutting back on unnecessary expenses to automating your savings, we’ll provide you with actionable tips to ensure you’re prepared for those unexpected financial curveballs. Let’s get started!

1. Budgeting

1.1 Track your expenses

To effectively save money and build an emergency fund, it is crucial to track your expenses. By keeping a record of where your money is going, you can identify areas where you might be overspending or areas where you can cut back. There are many budgeting apps and tools available that can help you track your expenses easily and conveniently.

1.2 Cut unnecessary spending

Reducing unnecessary spending is another effective strategy to save money. Take a closer look at your expenses and identify items or activities that are not essential. This could include eating out frequently, excessive shopping, or costly subscriptions that you don’t fully utilize. By eliminating or reducing these expenses, you can redirect those funds towards your emergency fund.

1.3 Set savings goals and prioritize

Setting specific savings goals can provide you with a clear target to work towards. Whether it’s saving a certain amount each month or aiming to reach a specific savings milestone, having a goal in mind can help you stay motivated and focused. Prioritize your savings goals based on their importance and allocate your resources accordingly.

1.4 Automate your savings

Automating your savings is an effective way to ensure consistent contributions to your emergency fund. Set up an automatic transfer from your checking account to your savings account each month. This way, you won’t have to rely on remembering to save manually, and the money will be safely tucked away towards your financial goals.

2. Reduce Monthly Bills

2.1 Negotiate with service providers

Take the time to negotiate with your service providers, such as cable and internet companies, insurance providers, and even your cell phone carrier. You may be able to secure discounts or find better deals simply by asking. Comparing prices and switching to more affordable options can significantly reduce your monthly bills and free up extra funds for your emergency fund.

2.2 Cut cable and switch to streaming services

Consider cutting the cord on cable and switching to streaming services. Streaming platforms provide a wide variety of entertainment options at a fraction of the cost of cable subscriptions. By making this switch, you can substantially reduce your monthly entertainment expenses and redirect that money towards your emergency savings.

2.3 Lower energy consumption

Lowering your energy consumption not only benefits the environment but also helps you save money on your utility bills. Simple actions like turning off lights when not in use, using energy-efficient appliances, and better insulating your home can lead to significant savings over time. These small changes add up and contribute to your emergency fund.

2.4 Refinance debt or consolidate loans

If you have multiple debts with high-interest rates, consider refinancing or consolidating your loans. By consolidating your debts, you can potentially lower your interest rates and streamline your payments, making it easier to manage and save money. Be sure to carefully compare loan terms and seek professional advice before making any decisions.

3. Increase Income

3.1 Take on a side hustle or part-time job

Taking on a side hustle or a part-time job can provide you with additional income to boost your savings. Look for opportunities in areas where you have skills or expertise, whether it’s freelance work, tutoring, or providing services that align with your hobbies. This extra income can help you accelerate your emergency fund growth.

3.2 Rent out space or belongings

If you have additional space in your home or belongings that you don’t use regularly, consider renting them out. Platforms like Airbnb allow you to rent out a spare room, while rental websites enable you to lend out items such as tools or equipment. By utilizing these sharing economy platforms, you can generate extra income to contribute towards your emergency fund.

3.3 Monetize skills or hobbies

Do you have a talent or hobby that can be monetized? Whether it’s photography, writing, gardening, or crafting, there may be opportunities to turn your skills and hobbies into a side business. Explore ways to market and sell your creations or offer your services to others. This not only generates income but also allows you to do something you enjoy.

3.4 Ask for a raise or promotion

If you’ve been working diligently and feel that you deserve it, consider asking for a raise or promotion at your current job. Prepare a well-constructed case highlighting your accomplishments and the value you bring to the company. Demonstrating your dedication and commitment can increase your chances of a salary increase, which can significantly boost your savings potential.

4. Modify Spending Habits

4.1 Prioritize needs over wants

Differentiating between needs and wants is crucial when trying to save money. Before making a purchase, ask yourself if it is a necessity or something you can do without. By prioritizing your needs over wants, you can make conscious spending decisions and allocate more of your income towards saving for unexpected expenses.

4.2 Avoid impulse purchases

Impulse purchases can quickly derail your saving efforts. To avoid succumbing to impulse buying, implement a cooling-off period before making any non-essential purchases. Take a day or two to consider whether the purchase is necessary and aligns with your financial goals. This pause can help you make more informed choices and prevent unnecessary spending.

4.3 Shop smarter and use coupons

When shopping for essentials, make an effort to shop smarter and seek out the best deals. Compare prices, look for sales or discounts, and consider using coupons or promotional codes whenever possible. Utilizing money-saving apps or websites can help you find the best prices and save money on your purchases.

4.4 Cook at home and pack lunches

Eating out adds up quickly and can be a significant drain on your finances. By cooking meals at home and packing lunches, you can save a considerable amount of money over time. Plan your meals in advance, create a shopping list, and be mindful of using ingredients that are already in your pantry to optimize savings.

5. Eliminate or Reduce Debt

5.1 Create a debt repayment plan

To build your emergency fund effectively, it’s important to tackle your existing debt. Create a debt repayment plan by prioritizing debts with high-interest rates or those with the smallest balances if you prefer the snowball method. Allocate as much money as possible towards paying off your debts while making regular minimum payments on all other debts.

5.2 Consolidate high-interest debts

Consider consolidating high-interest debts into a single loan with a lower interest rate. This can simplify your payments and potentially save you money on interest charges. However, carefully evaluate the terms and conditions of debt consolidation options to ensure they are a viable and beneficial solution for your financial situation.

5.3 Negotiate lower interest rates

Reach out to your creditors and negotiate lower interest rates on your existing debts. Explain your situation and provide evidence of your dedication to paying off your debt. Creditors may be more willing to work with you if they see your commitment. Lower interest rates can help reduce the overall amount you’ll need to pay back, allowing you to save more towards your emergency fund.

5.4 Seek professional debt counseling

If you’re struggling with overwhelming debt, consider seeking professional debt counseling services. Debt counselors can provide guidance and help you create a repayment plan tailored to your financial circumstances. They can negotiate with creditors on your behalf, potentially reducing interest rates or creating more manageable payment arrangements.

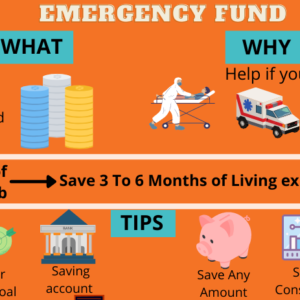

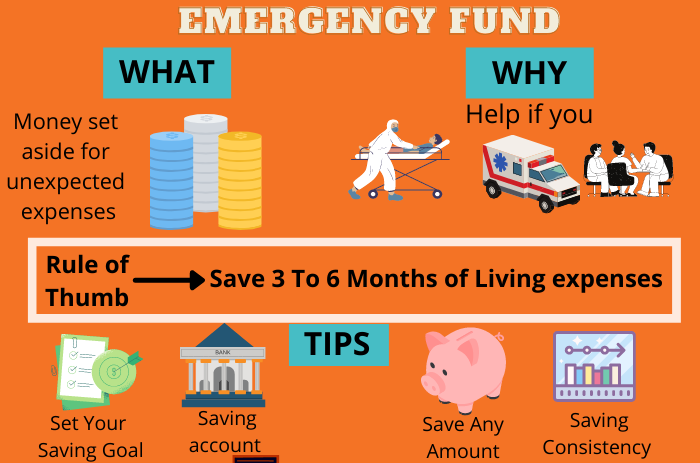

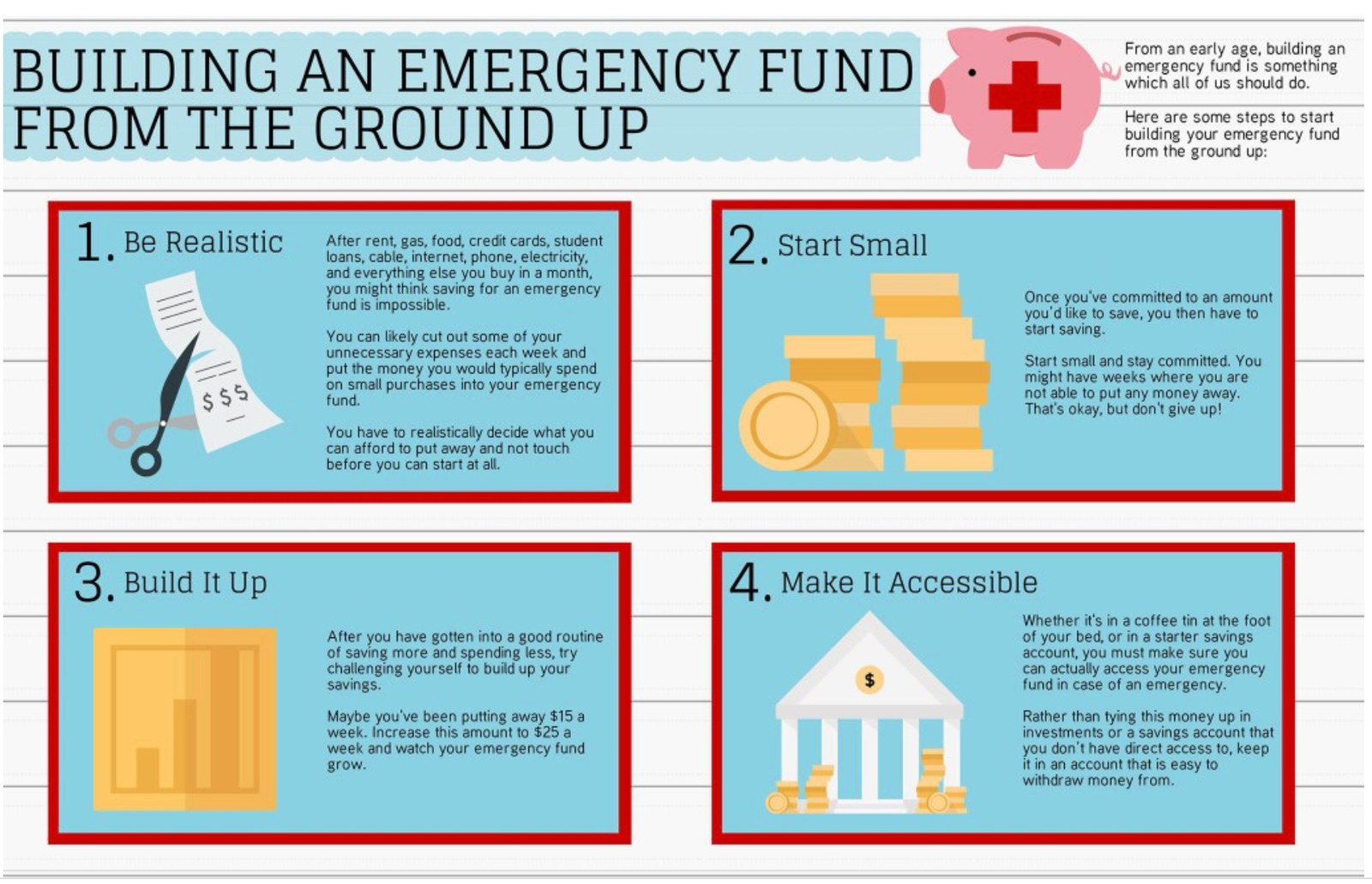

6. Establish an Emergency Fund

6.1 Determine your emergency fund target

Before building your emergency fund, it’s important to determine how much you should aim to save. Financial experts generally recommend having three to six months’ worth of living expenses as a target. Assess your monthly expenses and calculate the amount accordingly. Adjust the target based on your personal circumstances such as job stability, dependents, and healthcare needs.

6.2 Set up a separate savings account

To keep your emergency fund separate and easily accessible, it’s advisable to open a dedicated savings account. This separates your emergency fund from your regular day-to-day expenses and reduces the temptation to dip into it for non-emergency purposes. Look for savings accounts with competitive interest rates to make your emergency fund work harder for you.

6.3 Contribute regularly and consistently

Consistency is key when it comes to building an emergency fund. Set up a regular contribution schedule that aligns with your income and budget. Aim to put a percentage of your income into your emergency fund every month, even if it’s a small amount. Over time, these regular contributions will accumulate and help you reach your savings goal.

6.4 Consider windfalls or extra income

Maximize the growth of your emergency fund by allocating any windfalls or extra income towards it. This includes bonuses, tax refunds, or unexpected cash inflows. Instead of immediately splurging on non-essential items, set aside a portion or the entirety of these windfalls towards your emergency fund. It can provide a significant boost and expedite your savings progress.

7. Downsize and Cut Expenses

7.1 Evaluate housing costs

Housing costs can be a major drain on your finances, especially if you’re living beyond your means. Consider downsizing to a smaller, more affordable home or apartment. This can significantly reduce your monthly expenses, allowing you to save more towards your emergency fund.

7.2 Reduce transportation costs

Transportation expenses, such as car payments, gas, and maintenance, can quickly add up. Evaluate your transportation needs and consider downsizing to a more fuel-efficient vehicle or explore alternative transportation methods like public transit or cycling. By reducing transportation costs, you can save a substantial amount of money each month.

7.3 Minimize dining out and entertainment

Dining out and entertainment expenses can quickly drain your budget. Be mindful of how often you eat out or engage in costly entertainment activities. Instead, prioritize free or low-cost alternatives such as home-cooked meals, picnics in the park, or movie nights at home. These small adjustments can lead to significant savings.

7.4 Cut back on subscriptions and memberships

Evaluate your subscriptions and memberships to identify any that are unnecessary or underutilized. Cancel or pause subscriptions that you don’t actively use or that don’t align with your financial goals. By trimming these expenses, you can free up additional funds to contribute towards your emergency fund.

8. Save on Insurance and Healthcare

8.1 Shop around for insurance policies

Insurance is a necessary expense, but that doesn’t mean you have to overpay for coverage. Take the time to shop around for insurance policies and compare prices from multiple providers. Look for policies that offer adequate coverage at competitive rates. By finding more affordable options, you can reduce your monthly insurance expenses.

8.2 Increase deductibles or coverage limits

Increasing deductibles or coverage limits can help lower your insurance premiums. While this does increase the out-of-pocket amount you would need to pay in the event of a claim, it can lead to significant savings on your monthly premiums. Evaluate your insurance needs and adjust deductibles or coverage limits accordingly.

8.3 Utilize preventive healthcare

Investing in preventive healthcare can help you avoid costly medical bills down the line. Take advantage of regular check-ups, screenings, and vaccinations to maintain your health and catch any potential issues early. This proactive approach can lead to savings on medical expenses over time.

8.4 Take advantage of employer benefits

If your employer offers benefits such as health insurance or a flexible spending account, make sure you take full advantage of them. Review your benefits package and understand the resources available to you. This can help you save money on healthcare-related expenses and contribute to your emergency fund.

9. Set Financial Goals

9.1 Define short-term and long-term goals

Setting specific financial goals is essential for staying motivated and focused on saving money. Define both short-term and long-term goals that are meaningful to you. Short-term goals could include saving for a vacation or paying off a specific debt, while long-term goals could involve saving for retirement or purchasing a home.

9.2 Make a plan to achieve each goal

Once you’ve defined your financial goals, create a plan to achieve them. Break each goal down into actionable steps and establish a timeline for achieving them. This plan will provide you with a roadmap to follow and make your goals more attainable. Having a clear plan in place can help you budget effectively and allocate funds towards your goals.

9.3 Regularly review and adjust goals

Life is dynamic, and circumstances may change along the way. Regularly review your financial goals to ensure they are still aligned with your priorities and adjust them as necessary. For instance, if you receive a promotion and salary increase, you may want to revisit your goals and reassess the timelines or adjust the savings amounts accordingly.

9.4 Celebrate milestones along the way

Celebrate each milestone you achieve along your financial journey. Recognize your progress and reward yourself when you hit significant savings milestones. This positive reinforcement can help you stay motivated and inspired to continue saving money and building your emergency fund.

10. Tap into Tax Strategies

10.1 Contribute to retirement accounts

Contributing to retirement accounts, such as a 401(k) or an Individual Retirement Account (IRA), can have dual benefits. Not only are you saving for your future, but you can also benefit from potential tax savings. Contributions to these accounts are often tax-deductible, helping reduce your taxable income and potentially lowering your tax bill.

10.2 Maximize tax deductions and credits

Make sure you are aware of the available tax deductions and credits that can help you save money. Deductions such as mortgage interest, student loan interest, or medical expenses can lower your taxable income. Tax credits for education, homeownership, or energy-efficient upgrades can reduce your overall tax liability. Research and consult with a tax professional to ensure you are taking full advantage of these opportunities.

10.3 Seek professional tax advice

Navigating the complexities of the tax system can be challenging. Consider seeking professional tax advice to ensure you are optimizing your tax strategies. Tax professionals can provide guidance on deductions, credits, and strategies to minimize your tax liability while staying compliant with tax laws.

10.4 Utilize tax-free savings options

Explore tax-free savings options such as Health Savings Accounts (HSA) or Flexible Spending Accounts (FSA) if they are available to you. These accounts allow you to set aside pre-tax money for eligible healthcare expenses, reducing your taxable income and potentially saving you money on taxes. Familiarize yourself with the rules and contribution limits associated with these accounts to make the most of the tax benefits they offer.

By implementing these practical strategies, you can save money and build an emergency fund to prepare for unexpected expenses. Remember, it’s crucial to be consistent and disciplined in your approach, prioritizing your financial goals and making conscious choices that support your long-term financial well-being.