When it comes to filing your taxes, one thing that we all want to avoid is paying more than necessary. However, failing to claim eligible deductions and credits can lead to exactly that. Whether it’s overlooking a deduction for charitable donations or forgetting to take advantage of education credits, these missed opportunities can add up quickly. By staying informed about the various deductions and credits that you may be eligible for, you can ensure that you’re getting the most out of your tax return and keeping more money in your pocket.

Understanding Deductions and Credits

Definition of deductions

Deductions are allowable expenses that can be subtracted from your total income, potentially reducing the amount of taxable income you have. These expenses can range from mortgage interest and student loan interest to medical expenses and state and local taxes. Deductions are valuable because they can lower the amount of income that is subject to taxation.

Definition of credits

Unlike deductions, which reduce your taxable income, tax credits directly reduce the amount of tax you owe. They serve as a dollar-for-dollar reduction of your tax liability. Credits can be refundable or non-refundable. Refundable credits can lower your tax liability beyond zero, potentially leading to a refund. Non-refundable credits, on the other hand, can only reduce your tax liability to zero. Popular tax credits include the Child Tax Credit, Earned Income Tax Credit (EITC), and education tax credits.

Importance of maximizing deductions and credits

Maximizing deductions and credits is crucial for minimizing your tax burden and maximizing your tax savings. Failing to claim eligible deductions and credits can result in paying more taxes than necessary. By taking advantage of all the deductions and credits available to you, you can legally reduce your taxable income and potentially lower your overall tax liability. It is important to understand these tax benefits to ensure you are not leaving money on the table during tax season.

Commonly Overlooked Deductions

Home office expenses

If you work from home or have a designated area solely used for business purposes, you may be eligible to deduct home office expenses. These expenses can include a portion of your rent or mortgage, utilities, and even repairs and maintenance costs. To claim these deductions, you’ll need to accurately calculate the square footage of your home office and allocate the corresponding expenses.

Student loan interest

For many individuals burdened with student loans, the student loan interest deduction can provide significant tax relief. You can deduct up to $2,500 of the interest paid on qualified student loans each year, even if you don’t itemize deductions. This deduction is subject to income limitations, so it’s important to review the eligibility criteria. By claiming this deduction, you can reduce your taxable income, potentially leading to a lower tax bill.

Medical expenses

Medical expenses can quickly add up, especially for individuals with ongoing health issues. While medical expenses can be a financial strain, they can also provide tax benefits. If your medical expenses exceed a certain percentage of your adjusted gross income (AGI), usually 7.5% or 10%, you may be able to deduct them on your tax return. This includes expenses such as doctor visits, prescription medications, and certain medical procedures not covered by insurance.

State and local taxes

State and local taxes, commonly referred to as SALT, can be deducted on your federal tax return. This includes income taxes paid to your state or local government. Additionally, you can deduct either state income tax or state sales tax, whichever is higher. This deduction is especially valuable if you live in a state with high income or sales tax rates. Be sure to keep accurate records of your state and local tax payments to claim this deduction accurately.

Charitable contributions

If you make charitable donations throughout the year, you may be eligible for a tax deduction. Donations to eligible charitable organizations can reduce your taxable income. It’s important to keep records of your charitable contributions, including receipts or acknowledgment letters from the organizations. Depending on the value of your donations, you may need to provide additional documentation to claim the deduction.

Maximizing Deductions

Keeping accurate records

To maximize your deductions, it is essential to keep accurate and organized records throughout the year. This includes maintaining receipts, invoices, and any other documentation related to deductible expenses. By having detailed records readily available, you can easily identify and claim all eligible deductions when it’s time to prepare your tax return. Utilizing digital tools or apps can help streamline the record-keeping process and ensure you don’t overlook any potential deductions.

Working with a tax professional

Navigating the complexities of the tax code can be challenging, especially when it comes to maximizing deductions. Consider working with a qualified tax professional who can help identify all applicable deductions based on your unique financial situation. Tax professionals are well-versed in the latest tax laws and regulations, ensuring you take advantage of all available deductions. They can also provide guidance on record-keeping practices and help prepare an accurate tax return.

Understanding IRS guidelines

The IRS provides guidelines and resources to help taxpayers understand and claim deductions correctly. Familiarize yourself with the IRS guidelines specific to each deduction you plan to claim. This includes reviewing the eligibility criteria, documentation requirements, and any limitations or restrictions. By adhering to the IRS guidelines, you can ensure that your deductions are legitimate and supportable, reducing the risk of audit or denied claims.

Tax Credits to Consider

Child tax credit

The Child Tax Credit is a valuable credit for parents or guardians with dependent children. Depending on your income, you may be eligible for a credit of up to $2,000 per child. This credit directly reduces your tax liability, potentially resulting in a lower tax bill or even a refund if the credit exceeds the amount of taxes owed. Additional requirements and phase-outs may apply, so it’s important to review the eligibility criteria.

Earned Income Tax Credit (EITC)

The Earned Income Tax Credit is designed to assist low-to-moderate income individuals and families. Depending on your income and the number of qualifying children, you may be eligible for a substantial credit. The EITC is a refundable credit, meaning it can potentially result in a refund even if you had no tax liability. To claim this credit, you must meet specific income and filing status requirements outlined by the IRS.

Education tax credits

Education tax credits, such as the American Opportunity Credit and the Lifetime Learning Credit, can help offset the cost of higher education. These credits can apply to tuition, fees, textbooks, and other qualified educational expenses. Depending on your income and the expenses incurred, you may be eligible for a credit of up to $2,500 per student. It’s important to review the requirements and limitations of each credit to determine which one is most beneficial for your situation.

Solar energy tax credit

If you’ve installed solar panels or other qualifying renewable energy systems in your home, you may be eligible for a tax credit. The Solar Energy Investment Tax Credit allows homeowners to claim a percentage of the cost of the system installation as a credit. The credit can help offset the upfront expenses of going solar and can potentially lead to long-term energy savings. Be sure to consult IRS guidelines and local regulations to determine your eligibility for this credit.

Adoption tax credit

Adopting a child can be a costly endeavor, but the Adoption Tax Credit can provide financial relief. This credit allows adoptive parents to claim expenses related to the adoption process, including agency fees, legal fees, and travel expenses. The credit is non-refundable but can be carried forward for up to five years. If you’ve recently adopted or are considering adoption, familiarize yourself with the eligibility requirements and documentation needed to claim this credit.

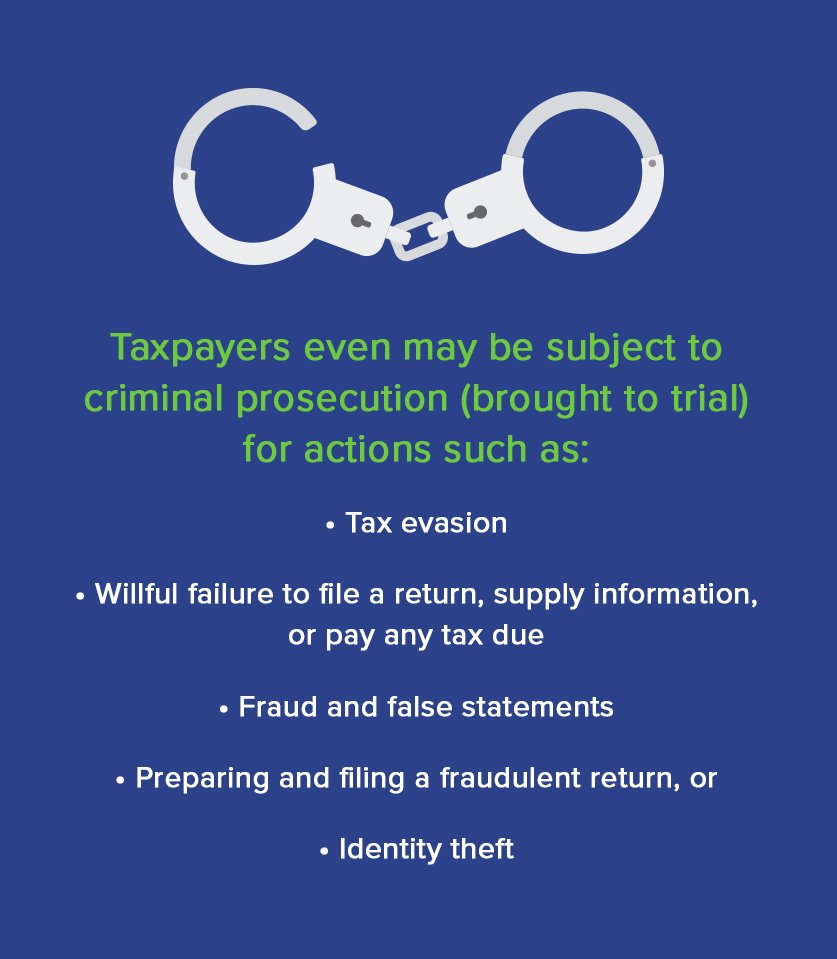

Mistakes to Avoid

Failure to report income correctly

Accurately reporting all sources of income is essential to avoid potential penalties and interest from the IRS. Failing to report income correctly can result in an audit or other legal consequences. Ensure that you include all W-2s, 1099s, and other relevant tax documents when preparing your tax return. If you’re uncertain about how to report a specific type of income, seek guidance from a tax professional to ensure compliance.

Neglecting to claim eligible dependents

Claiming eligible dependents can provide significant tax benefits, such as the Child Tax Credit and Head of Household filing status. It’s important to understand the criteria for claiming dependents, including relationship requirements, residency, and support tests. Failing to claim eligible dependents can result in missed opportunities for credits and deductions, ultimately increasing your tax liability. Review the IRS guidelines or consult a tax professional to determine if you have eligible dependents.

Not taking advantage of tax breaks for retirement savings

Contributing to retirement accounts, such as Traditional IRAs or employer-sponsored 401(k) plans, can provide both immediate and long-term tax benefits. Contributions to these accounts are typically tax-deductible, reducing your taxable income for the year. Additionally, the growth within these accounts is tax-deferred or tax-free, depending on the type of account. Failing to take advantage of these tax breaks can mean missing out on potential savings and the opportunity for tax-deferred growth.

Forgetting to include self-employment deductions and credits

If you’re self-employed or have a side gig, it’s important to understand the tax benefits available to you. Self-employment can come with various deductions, such as home office expenses, business-related travel, and equipment purchases. Additionally, you may be eligible for certain credits, such as the Self-Employment Tax Deduction. Failing to include these deductions and credits can result in paying more in taxes and missing out on potential savings. Keep detailed records and consult a tax professional for guidance on maximizing self-employment tax benefits.

Exploring Additional Deduction Opportunities

Employment-related expenses

Certain employment-related expenses can potentially be claimed as deductions if they are necessary for your job and not reimbursed by your employer. These expenses can include professional dues, work-related education, and job search expenses. While there are limitations and restrictions, it’s worth exploring these deductions if you incur qualifying expenses directly related to your employment.

Educator expenses

Teachers and educators often spend their own money on classroom supplies and materials. The Educator Expense Deduction allows eligible educators to deduct up to $250 ($500 if married filing jointly) of qualified out-of-pocket expenses. It’s important to keep careful records of these expenses, including receipts, to support your deduction claim. If you are an educator, make sure to take advantage of this deduction to offset some of the money you spend on your students.

Charitable mileage

If you use your personal vehicle for charitable purposes, such as volunteering at a nonprofit organization, you may be eligible to deduct the associated mileage. The current standard mileage rate for charitable mileage is set by the IRS each year. Be sure to accurately track your charitable mileage and document the purpose of each trip to support your deduction claim.

Losses from natural disasters

If you’ve experienced property damage or losses due to a natural disaster, you may be able to claim deductions for unreimbursed losses. This includes damage to your home, vehicles, or personal belongings not covered by insurance. It’s important to document the losses and obtain any necessary certifications or reports to support your claim. However, the rules and limitations for claiming these deductions can vary based on the extent and cause of the losses, so consult a tax professional for guidance.

The Consequences of Overlooking Deductions and Credits

Increased tax liability

By overlooking eligible deductions and credits, you may end up with a higher tax liability than necessary. Deductions and credits can significantly reduce your taxable income and, subsequently, your tax bill. Failing to claim these benefits means missing out on potential tax savings and ultimately paying more in taxes than you should.

Missed opportunities for refunds

Certain credits, such as refundable tax credits, can potentially result in a refund even if you had no tax liability. By not claiming these credits or failing to maximize them, you may be leaving money on the table. Refunds can provide financial relief and help offset other expenses or contribute to savings. By properly identifying and claiming all eligible credits, you increase your chances of receiving a refund if applicable.

Higher tax bracket placement

Without the benefit of deductions and credits, your taxable income may be higher, potentially pushing you into a higher tax bracket. This can result in a higher tax rate and an overall increase in your tax liability. Maximizing deductions and credits can help you stay within a lower tax bracket and maximize your tax savings. By diligently identifying and claiming all applicable deductions and credits, you can keep more of your hard-earned money.

Amending Past Tax Returns

The process of amending a tax return

If you realize you made an error or omitted information on a previously filed tax return, you may need to amend it. The process of amending a tax return involves filing Form 1040X, Amended U.S. Individual Income Tax Return. In this form, you will need to provide the corrected or additional information, along with an explanation of the changes. It’s important to carefully review and double-check the amended return to ensure accuracy.

Time limitations for amending returns

There is a time limit for amending tax returns. Generally, you have three years from the original tax return filing deadline to amend a return and claim a refund. For example, for the 2020 tax year, the original filing deadline is typically April 15, 2021. Therefore, you have until April 15, 2024, to submit an amended return for that year. However, if you filed an extension, the deadline may differ. It’s important to consult IRS guidelines or seek professional assistance to determine your specific timeframe for amending returns.

Seeking professional assistance for amendments

Amending a tax return can be a complex process, especially if you’re not familiar with the tax laws and regulations. Consider seeking professional assistance from a tax advisor or accountant when amending a return. They can help navigate the process, ensure accuracy, and provide guidance on any additional steps or documentation required. Professional assistance can help you avoid potential errors and further complications while amending your tax return.

Strategies for Avoiding Common Mistakes

Utilizing tax preparation software

Tax preparation software can simplify the tax filing process and help prevent common mistakes. These software programs guide you through each step of the tax return, prompting you to enter the necessary information and calculate the relevant deductions and credits. They also provide built-in error checks to identify potential issues or missing information. Utilizing tax preparation software can increase accuracy and reduce the likelihood of errors on your tax return.

Reviewing eligibility criteria annually

Tax laws and regulations can change annually, affecting the eligibility criteria for certain deductions and credits. It is essential to review the eligibility criteria each year to ensure you meet the requirements. Additionally, your personal circumstances may change, affecting your eligibility for specific tax benefits. By reviewing the criteria annually, you can accurately determine your eligibility and claim all deductions and credits for which you qualify.

Staying updated on tax laws and changes

Tax laws and regulations are subject to change, often due to legislative updates or economic conditions. It’s important to stay informed about any changes that may impact your tax situation. This can include changes to deduction limits, income thresholds, or the introduction of new credits. Regularly reviewing tax-related news, consulting IRS resources, or seeking professional guidance can help keep you updated and ensure compliance with the latest tax laws.

Double-checking all forms and documentation

Before submitting your tax return, take the time to thoroughly review all forms and documentation. Ensure that all information is accurate, and all necessary attachments or schedules are included. Double-check for any mathematical errors or missing data. By taking the extra time to review your return, you can minimize the risk of errors, discrepancies, or omissions that may result in IRS inquiries or penalties.

Conclusion

Understanding deductions and credits is essential for minimizing your tax liability and maximizing your tax savings. Failing to claim eligible deductions and credits can result in paying more in taxes than necessary. By taking advantage of all available deductions and credits and avoiding common mistakes, you can ensure you’re maximizing your tax benefits. Stay organized, seek professional assistance if needed, and stay informed about changes in tax laws. By doing so, you can navigate the tax landscape with confidence and optimize your financial situation during tax season.