Have you ever experienced the frustration of expecting a direct deposit, only to realize that the funds were deposited into the wrong bank account? It’s an all too common occurrence that can leave you feeling helpless and stressed. In this article ‘Common Mistakes in Direct Deposit Setup and How to Avoid Them’, we will explore the reasons behind this issue and provide you with practical advice on how to avoid it in the future. So, sit back, relax, and let’s navigate through the world of wrong bank account information for direct deposit together!

Overview

In today’s digital age, providing accurate bank account information is crucial, especially when it comes to direct deposits. Whether you are an employee receiving payments or an employer facilitating payroll, the ramifications of providing incorrect bank account information can be significant. In this article, we will explore the consequences of inaccurate bank account information, the common causes behind such errors, and the implications it has for both employees and employers. By understanding the potential pitfalls, you can ensure that you take steps to prevent these issues and safeguard your financial well-being.

Consequences of Providing Incorrect Bank Account Information

Providing incorrect bank account information can lead to a range of negative consequences for both employees and employers. From delayed or missed payments to additional fees and charges, the impact of such errors can be far-reaching. Furthermore, there is a risk of damage to credit scores and even the potential for identity theft. Let us delve into each of these consequences in detail and understand the implications they carry.

Common Causes of Providing Wrong Bank Account Information

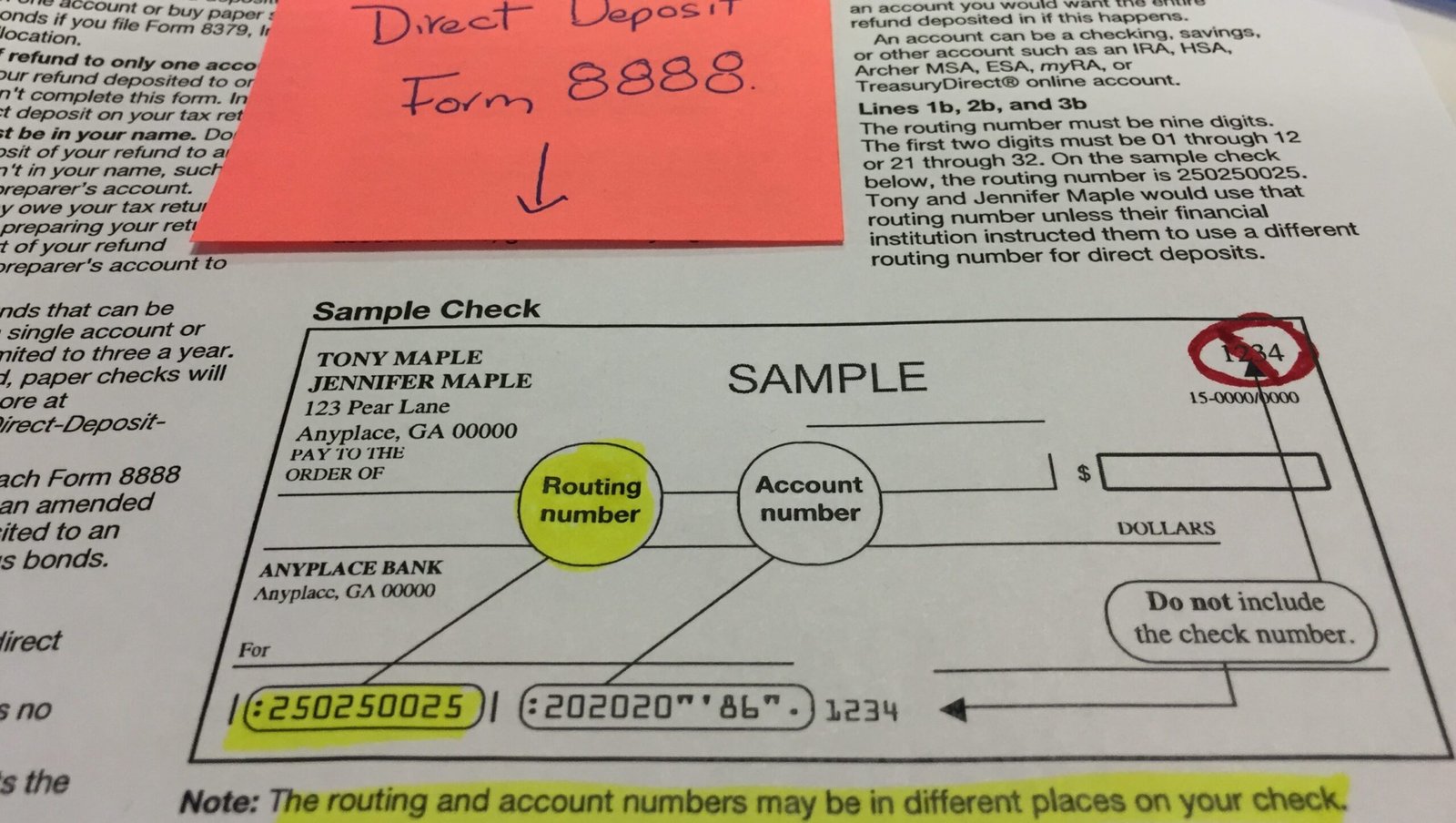

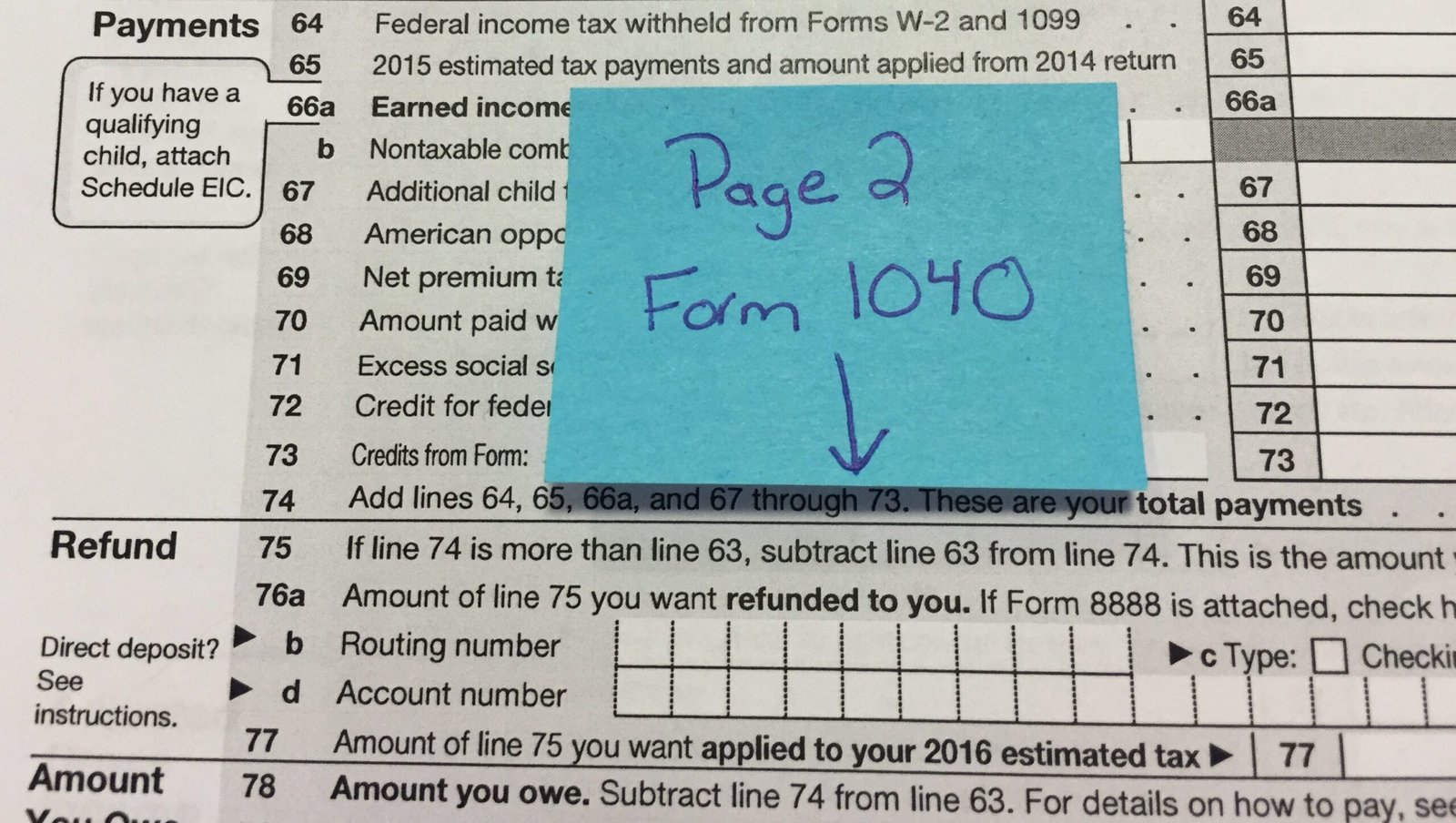

Typos in account or routing numbers

One of the most common causes of incorrect bank account information is simple human error. Typos can easily occur when entering long account or routing numbers, especially when done manually. A single mistyped digit can result in the wrong bank account being linked to direct deposits.

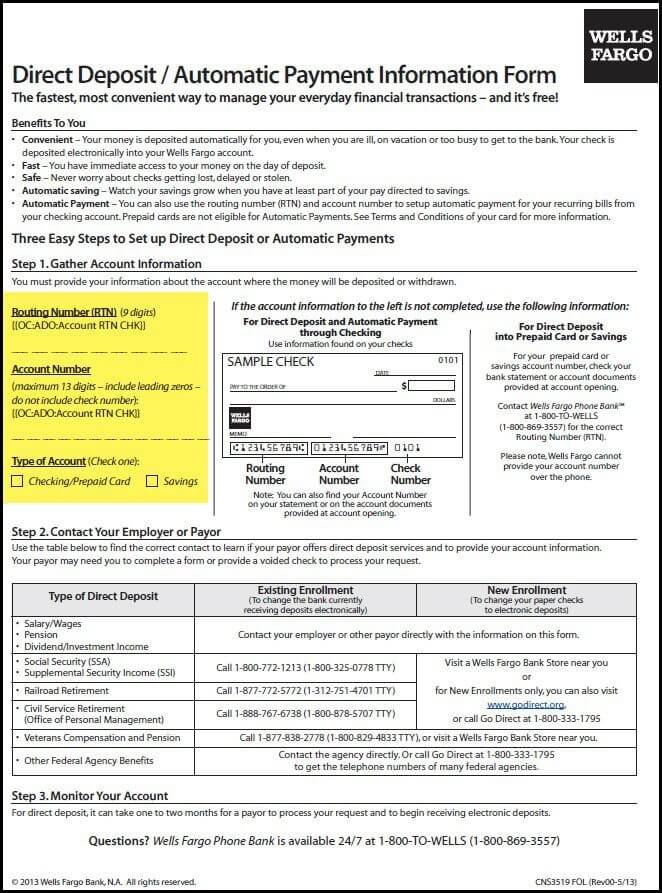

Using outdated or inactive bank accounts

Another prevalent cause is the use of outdated or inactive bank accounts. When individuals fail to update their account information with their employer, the direct deposit may continue to be sent to a closed or dormant account. This can create a frustrating experience for employees as they are left without their rightful payments.

Transposing digits in account or routing numbers

Transposing digits is another mistake that can easily happen when providing bank account information. When individuals accidentally reverse the order of numbers, the entered account or routing number becomes incorrect. This simple yet costly error can lead to a range of complications that can affect both parties involved.

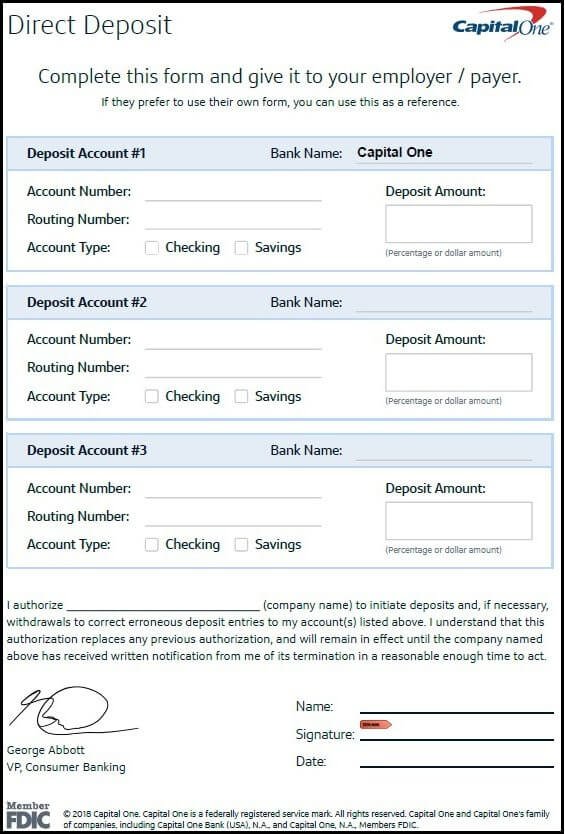

Providing inaccurate bank account details

Whether due to carelessness or lack of awareness, providing inaccurate bank account details can have dire consequences. Individuals may mistakenly provide partial or incorrect information, rendering the direct deposit process ineffective. Such errors can cause unnecessary delays and complications.

Not verifying account information with the bank

Failing to verify account information with the bank is an oversight that often occurs. Regardless of how confident one may feel about their bank account details, it is always advisable to double-check with the bank. By doing so, individuals can ensure that the information provided is accurate, minimizing the risks associated with incorrect direct deposit information.

Implications for Employees

When employees provide incorrect bank account information, they may face a variety of unfortunate outcomes. Understanding these implications is crucial for individuals as it highlights the importance of providing accurate details.

Delayed or Missed Payments

One of the immediate implications of inaccurate bank account information is the potential for delayed or missed payments. Whether it is your monthly paycheck or an important bonus, having the wrong bank account linked to direct deposits can create significant delays in receiving your hard-earned income. This delay can cause financial strain and inconvenience for individuals who rely on their regular pay schedule.

Additional Fees and Charges

In addition to delayed payments, using incorrect bank account information can result in additional fees and charges. If funds are inadvertently deposited into the wrong account, the rightful account owner may incur penalties for receiving unexpected payments. Furthermore, individuals may face charges for failed transactions or insufficient fund transfers due to the incorrect account details provided.

Negative Impact on Credit Score

Consistently delayed or missed payments due to incorrect bank account information could negatively impact an individual’s credit score. Many financial institutions report payment activity to credit bureaus, and repeated late or missed payments can lower one’s creditworthiness. This can make it challenging to secure loans or credit in the future, affecting personal financial goals and opportunities.

Potential for Identity Theft

Providing incorrect bank account details also carries a risk of identity theft. If an employee’s direct deposit is mistakenly sent to someone else’s bank account, there is a possibility that personal information may fall into the wrong hands. This can potentially lead to fraudulent activity and cause significant harm to an individual’s financial security.

Implications for Employers

While the consequences for employees are apparent, employers also face their share of challenges when incorrect bank account information is provided.

Ensuring timely and accurate payment to employees is the responsibility of employers. When incorrect bank account information is provided, employers may encounter the following implications:

Administrative Hassles

When direct deposits fail due to incorrect bank account information, employers must allocate resources to rectify the situation. This involves contacting the employee, verifying the correct details, and initiating a new direct deposit. These additional administrative tasks can be time-consuming and divert valuable resources from other important business operations.

Employee Dissatisfaction

Delayed or missed payments can lead to employee dissatisfaction and lower morale within the workplace. Employees who rely on their regular pay schedule to cover their financial obligations may feel anxious or frustrated if payments are not received on time. Such grievances can impact overall employee satisfaction, productivity, and retention rates.

Damage to Employer Reputation

Inaccurate direct deposits can tarnish an employer’s reputation. If employees repeatedly experience delayed or missed payments, word may spread within the workforce or even beyond. This can lead to negative perceptions of the company’s financial management and reliability, potentially affecting its ability to attract and retain top talent.

Conclusion

Providing accurate bank account information for direct deposits is of utmost importance for both employees and employers. By understanding the consequences of providing incorrect details, individuals can take necessary steps to ensure accuracy and prevent potential issues. Employers, too, must prioritize accuracy and verify account information to mitigate administrative hassles and maintain employee satisfaction. By treating bank account information with care, both parties can avoid delayed payments, additional fees, damage to credit scores, and even the potential for identity theft. Remember, prevention is key when it comes to safeguarding your financial well-being.