Maintaining a healthy investment portfolio is crucial to stay on track with your financial goals and risk preferences. But how often should you review and adjust it to ensure it remains aligned? In this article ‘Mastering Portfolio Management: Regular Reviews to Align with Your Financial Goals and Risk Tolerance’, we will explore the importance of regularly assessing your investment portfolio, understanding your goals and risk tolerance, and provide practical guidance on how frequently you should consider making adjustments. So, let’s dive into the world of portfolio management and discover the right balance for your investment strategy!

Setting Investment Goals and Risk Tolerance

Determining your investment goals

When it comes to investing, setting clear and specific goals is important. Start by asking yourself what you aim to achieve with your investments. Are you saving for retirement, a down payment on a house, or your children’s education? Defining your investment goals will give you direction and help you make informed decisions about your portfolio.

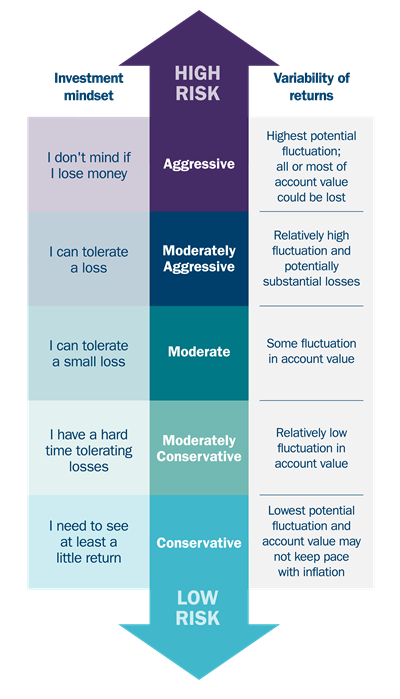

Assessing your risk tolerance

Understanding your risk tolerance is crucial to building a portfolio that aligns with your comfort level. Risk tolerance refers to the amount of volatility or potential loss you are willing to accept in pursuit of higher returns. Consider factors such as your age, financial responsibilities, and investment experience when assessing your risk tolerance. A younger individual with a steady income might have a higher risk tolerance compared to someone who is close to retirement and relying on their investments for income.

Identifying your investment time horizon

Your investment time horizon refers to the length of time you have until you need to access your funds. Different goals have different time horizons, and this will impact the investment strategy you choose. Short-term goals, such as saving for a vacation, might require low-risk investments with quick liquidity, while long-term goals like retirement can accommodate higher-risk investments that can potentially generate higher returns over time.

Considering your financial situation and objectives

Your financial situation and objectives play a significant role in shaping your investment strategy. Consider factors such as your income, expenses, and debts when determining how much you can afford to invest. Additionally, think about your objectives, such as capital growth, income generation, or preserving wealth. These factors will help guide your investment decisions and ensure that your portfolio is tailored to your specific needs.

Creating a Diversified Portfolio

Understanding the importance of diversification

Diversification is a strategy that involves spreading your investments across different asset classes and sectors. By diversifying, you can potentially reduce the impact of any individual investment’s performance on your overall portfolio. This is because different investments tend to have varying degrees of correlation, meaning they may not all move in the same direction at the same time. A well-diversified portfolio can help manage risk and increase the likelihood of achieving your investment goals.

Allocating assets across different investment categories

To create a diversified portfolio, it’s important to allocate your assets across different investment categories. These categories may include stocks, bonds, real estate, commodities, and cash equivalents. Each asset class carries its own risk and return characteristics, so a diverse mix can help balance your portfolio’s overall risk exposure. The specific allocation will depend on your risk tolerance, time horizon, and financial goals.

Building a balanced portfolio

Building a balanced portfolio involves selecting investments that complement each other and work together towards your goals. This means considering different factors such as asset allocation, investment style, and geographical diversification. By diversifying across these dimensions, you can potentially mitigate risk and increase the likelihood of stable returns. A balanced portfolio may include a mixture of growth-oriented assets like stocks and income-generating assets like bonds or dividend-paying stocks.

Choosing investment options that suit your goals and risk tolerance

When selecting specific investment options for your portfolio, it’s important to consider how well they align with your goals and risk tolerance. Different investments offer varying levels of risk and potential return. For example, stocks have historically provided higher returns but come with greater volatility, while bonds offer more stable income but lower long-term growth potential. Be sure to research and understand the characteristics of each investment option before adding it to your portfolio.

Establishing a Review Schedule

Determining the frequency of portfolio reviews

Regularly reviewing your portfolio is essential to ensure it remains aligned with your goals and risk tolerance. The frequency of these reviews will depend on your individual circumstances and preferences. Some investors choose to review their portfolios annually, while others prefer quarterly or even monthly reviews. It’s important to find a schedule that works for you and allows you to monitor your investments effectively.

Factors influencing review intervals

Several factors can influence the frequency of your portfolio reviews. These include the level of risk in your investments, the volatility of the market, and any significant changes in your personal or financial circumstances. If you have a more aggressive investment strategy or are exposed to high-risk assets, you may choose to review your portfolio more frequently to stay informed about any potential changes or adjustments needed.

Considering market conditions and economic trends

Market conditions and economic trends can impact the performance of your investments. When conducting portfolio reviews, it’s essential to consider these external factors and assess how they may affect your portfolio. Stay informed about current market trends, interest rates, economic indicators, and geopolitical events that could impact your investments. This will help you make informed decisions about whether adjustments are needed to maintain your desired portfolio allocation.

Analyzing Portfolio Performance

Monitoring investment returns

Monitoring investment returns is a crucial part of assessing your portfolio’s performance. Regularly track and analyze the returns earned by each investment in your portfolio. Compare these returns to relevant benchmarks or market indexes to gain a better understanding of how well your investments are performing. This analysis will help you identify any areas of underperformance or potential opportunities for improvement.

Assessing risk-adjusted performance

Evaluating risk-adjusted performance allows you to consider the amount of risk taken to achieve a specific return. Reviewing measures such as the Sharpe ratio or the Sortino ratio can help you assess how efficiently your portfolio generates returns given its level of risk. This analysis enables you to make more informed decisions about balancing risk and return in your investment strategy.

Measuring portfolio volatility

Volatility refers to the degree of fluctuation in the value of your investments. Measuring portfolio volatility helps you understand the potential ups and downs of your investment returns. If your portfolio is excessively volatile, it may indicate that you are taking on more risk than you are comfortable with. Consider adjusting your asset allocation or diversifying across different investment categories to manage volatility.

Evaluating the impact of fees and expenses

Fees and expenses can have a significant impact on your investment returns over time. As part of your portfolio analysis, evaluate the costs associated with each investment. This includes expense ratios, transaction fees, and any other charges. Make sure you understand how these fees can affect your overall returns and consider whether lower-cost alternatives are available.

Rebalancing Your Portfolio

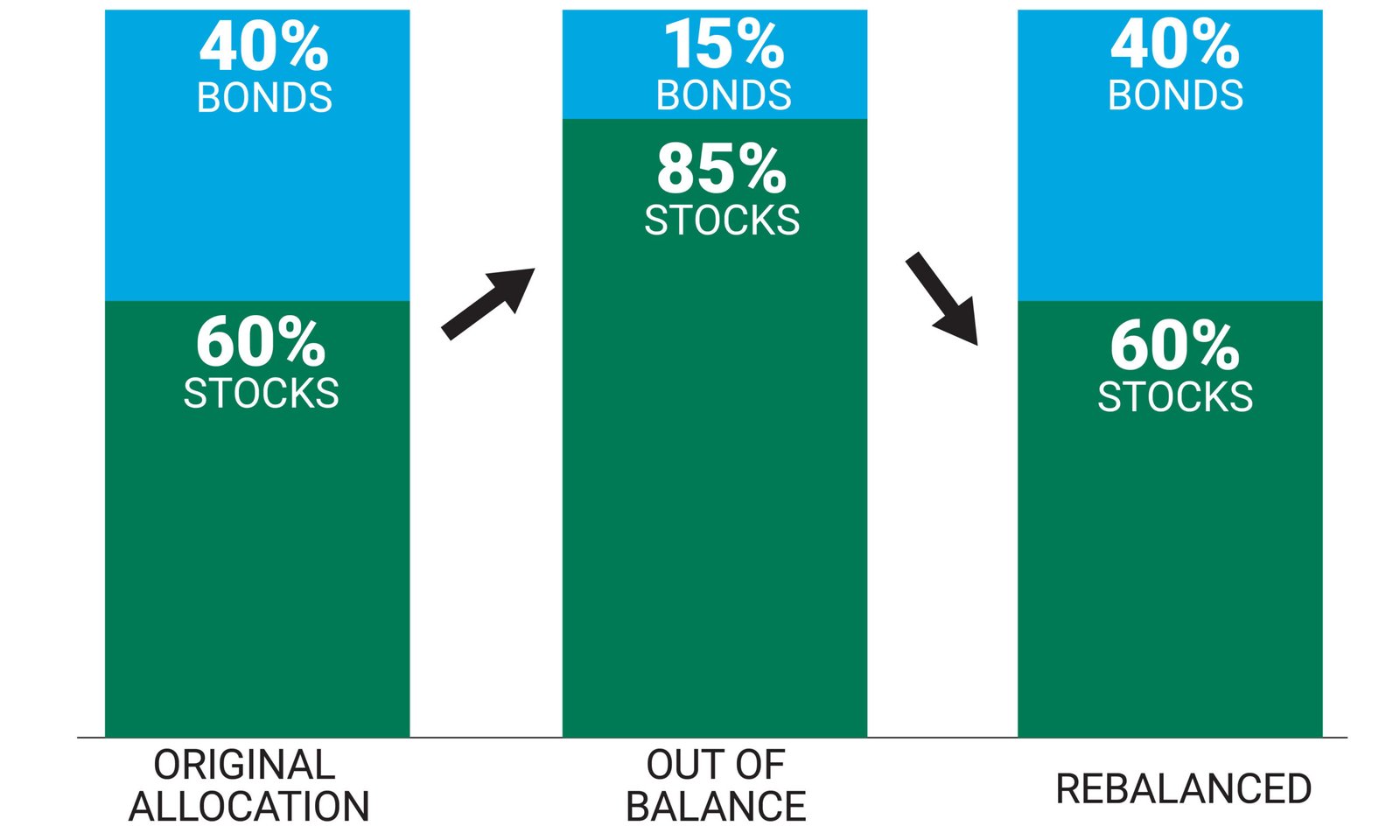

Understanding the concept of portfolio rebalancing

Rebalancing involves adjusting your portfolio by buying or selling investments to restore your desired asset allocation. Over time, the performance of different investments can cause your portfolio to deviate from its initial allocation. Rebalancing ensures that your portfolio remains in line with your risk tolerance and investment goals.

Setting tolerance bands for asset allocation

Tolerance bands refer to the acceptable range within which you allow your investments to deviate from their target allocation. By setting these bands, you establish specific thresholds for when to initiate the rebalancing process. For example, if your target allocation for stocks is 60%, you may set a tolerance band of +/- 5%. If the allocation moves beyond this range, you would rebalance your portfolio.

Identifying triggers for rebalancing

In addition to tolerance bands, there may be specific triggers that prompt you to rebalance your portfolio. Triggers can include changes in your risk tolerance, significant market events, or changes in your financial situation. It’s important to establish clear triggers to ensure that you rebalance your portfolio in a timely manner.

Adjusting your portfolio to restore desired asset allocation

When rebalancing your portfolio, you will need to buy or sell investments to restore your desired asset allocation. This may involve selling investments that have appreciated to reduce their allocation and buying investments that have underperformed to increase their allocation. Rebalancing helps to ensure that your portfolio remains aligned with your investment strategy and maintains the desired risk-return tradeoff.

Considering Life Events

Taking into account major life changes

Major life changes such as marriage, the birth of a child, or a career transition can have a significant impact on your financial situation and goals. When such events occur, it’s important to reassess your investment strategy and make any necessary adjustments. For example, the addition of a new family member may prompt you to increase your savings or adjust your investment time horizon.

Adjusting investment strategy based on new goals

Life events often bring about new goals or priorities that require adjustments to your investment strategy. For instance, if you decide to start your own business, you may need to allocate more funds to support the venture. It’s crucial to align your investments with these new goals to ensure you are on track to achieve them.

Reassessing risk tolerance with changing circumstances

Life events can also impact your risk tolerance. For example, if you experience a significant increase in your income, you may be more willing to take on higher-risk investments. Conversely, a decrease in income or an upcoming retirement might result in a lower risk tolerance. Regularly reassess your risk tolerance to ensure that it aligns with your changing circumstances.

Seeking professional advice in complex situations

In complex situations, it’s advisable to seek professional advice. Financial advisors can help you navigate the complexities of investment planning, especially during major life changes. They can provide personalized advice based on your individual circumstances, goals, and risk tolerance. Additionally, they can help you optimize your investment strategy and ensure that it remains aligned with your evolving needs.

Staying Informed and Educated

Keeping up with financial news and market updates

Staying informed about financial news and market updates is essential for making informed investment decisions. Regularly read reputable financial publications and news sources to stay updated on market trends, economic indicators, and global events that may impact your investments. This knowledge will help you make better-informed decisions and react prudently to market changes.

Understanding the impact of economic factors on investments

Economic factors, such as interest rates, inflation, and GDP growth, can have a significant impact on various investments. Understanding these factors and their implications for different asset classes can help you make informed investment decisions. Stay informed about economic indicators and their potential effects on your portfolio to make proactive adjustments when necessary.

Gaining knowledge about different asset classes and investment products

Expanding your knowledge about different asset classes and investment products can help you diversify your portfolio and maximize potential returns. Learn about the characteristics, risks, and historical performance of various investment options. This knowledge will enable you to make well-informed decisions based on a broader range of investment opportunities.

Considering the guidance of financial advisors and experts

Financial advisors and experts can provide valuable guidance when it comes to investment decisions. They have the knowledge and experience to analyze your financial situation, risk tolerance, and goals, and offer personalized advice. If you are unsure about a specific investment or need help crafting an investment strategy, consulting with a financial advisor can provide invaluable insights and support.

Utilizing Technology for Portfolio Management

Exploring investment tracking and management tools

Technology offers a myriad of tools and platforms designed to simplify investment tracking and management. Explore investment tracking tools that allow you to consolidate your accounts, monitor performance, and assess your asset allocation. These tools provide a comprehensive overview of your portfolio and make it easier to evaluate your investments.

Using online platforms for monitoring portfolio performance

Online investment platforms provide real-time access to your portfolio performance. These platforms often offer detailed analytics and reporting features, allowing you to analyze your investments and evaluate their performance. Take advantage of these tools to track your portfolio’s progress towards your investment goals and make informed decisions.

Accessing real-time data and analytics

Real-time data and analytics are valuable resources for monitoring and managing your portfolio. Access to up-to-date market information, key performance indicators, and investment research can strengthen your investment decision-making process. Utilize online platforms and financial websites that provide real-time data and analytics to help you stay informed and identify investment opportunities.

Automating investment decisions through robo-advisors

Robo-advisors are automated investment platforms that use algorithms to create and manage investment portfolios. These platforms consider your risk tolerance, goals, and time horizons to provide personalized investment recommendations. Robo-advisors can streamline the investment process, automate rebalancing, and offer cost-effective solutions. Consider utilizing robo-advisors as a convenient and efficient way to manage your portfolio.

Maximizing Tax Efficiency

Understanding the tax implications of your investment portfolio

Investments can have varying tax implications, and understanding these implications is crucial for maximizing tax efficiency. Different investments are subject to different tax rates, and certain investment strategies can have tax advantages or disadvantages. Educate yourself on the tax consequences of your investment choices to minimize tax liabilities and optimize your after-tax returns.

Utilizing tax-efficient investment strategies

Tax-efficient investment strategies are designed to minimize the impact of taxes on your investment returns. These strategies may include tax-loss harvesting, utilizing tax-efficient funds, and maximizing contributions to tax-advantaged retirement accounts. By implementing these strategies, you can reduce your tax burden and potentially increase your overall investment returns.

Taking advantage of tax-advantaged accounts

Tax-advantaged accounts, such as individual retirement accounts (IRAs) and 401(k) plans, offer tax benefits that can help boost your investment returns. Contributions to these accounts may be tax-deductible, and the earnings within the account can grow tax-deferred or tax-free. Taking advantage of these tax-advantaged accounts can provide significant long-term benefits and help you achieve your financial goals.

Consulting tax professionals for comprehensive tax planning

For comprehensive tax planning, it is advisable to consult with tax professionals who can provide personalized advice based on your specific tax situation. Tax professionals can help you navigate complex tax rules, optimize your investment strategy from a tax perspective, and ensure compliance with applicable tax regulations. Their expertise can help you maximize tax efficiency and minimize potential tax liabilities.

Periodic Evaluation of Investment Goals

Reviewing and revisiting investment objectives

Periodically reviewing your investment objectives is essential to ensure that they remain relevant and aligned with your overall financial plan. As your circumstances and priorities change, it’s important to reassess the goals you set for your investments. Regularly revisit your investment objectives to confirm that they reflect your current financial situation and aspirations.

Assessing the progress towards long-term goals

Regularly assessing the progress towards your long-term goals allows you to determine whether adjustments to your investment strategy are necessary. Compare the current value of your investments to the target value needed to achieve your goals. If you are falling behind, you may need to reassess your investment allocations and make any necessary changes to stay on track.

Modifying goals based on changing circumstances

Life is dynamic, and your goals may change over time. Major life events, shifts in personal circumstances, or changes in economic conditions can influence the relevance of your goals. Be open to modifying your goals as needed to ensure that they remain realistic and achievable. Regularly reassess your goals and make adjustments as necessary to stay on track.

Aligning portfolio strategy with updated goals

Once you have evaluated your investment goals, progress, and any necessary modifications, make sure to align your portfolio strategy accordingly. Reassess your asset allocation, investment options, and risk tolerance to ensure they are in line with your updated goals. Regularly review and adjust your portfolio to maximize your chances of meeting your objectives.

In conclusion, setting investment goals and assessing risk tolerance, creating a diversified portfolio, establishing a review schedule, analyzing portfolio performance, rebalancing, considering life events, staying informed, utilizing technology, maximizing tax efficiency, and periodically evaluating investment goals are all important components of effective portfolio management. By following these guidelines and regularly reviewing your portfolio, you can ensure that your investments align with your objectives, risk tolerance, and changing circumstances. Remember to seek professional advice when needed and stay informed to make informed investment decisions.