Hey there! Have you ever had that sinking feeling when you realize you’ve forgotten to fill out an important form? Maybe it’s a tax document or a permission slip for your child’s school trip. Whatever it is, we’ve all been there, and it can be incredibly frustrating. In this article ‘Never Miss Important Forms Again: Tips for Staying Organized and Avoiding Penalties’, we’ll explore the consequences of missing these crucial forms and provide some tips on how to stay organized and never let it happen again. So, let’s jump right in and tackle this problem head-on!

The Consequences of Missing Important Forms

When it comes to dealing with paperwork, it’s common to feel overwhelmed and to let some forms slip through the cracks. However, failing to submit important forms can have serious consequences. From legal issues to financial penalties, here are some of the potential outcomes of missing important forms:

Loss of Legal Rights

One of the most significant consequences of missing important forms is the loss of legal rights. Whether it’s failing to file the necessary paperwork for a lawsuit or neglecting to sign a contract, not completing essential forms can result in you forfeiting your rights and leaving yourself vulnerable in legal situations.

Financial Penalties

In addition to legal ramifications, missing important forms can lead to financial penalties. For instance, failing to file your tax forms by the deadline can result in late filing penalties and interest accumulation, causing you to owe more money to the government. Similarly, skipping insurance forms or failing to report changes in circumstances may leave you exposed to financial loss or higher premium costs.

Missed Opportunities

Completing important forms is often a prerequisite for various opportunities. Whether it’s applying for a loan or renting an apartment, not having the necessary paperwork can lead to missed opportunities. You may find yourself unable to take advantage of favorable financial deals or losing out on valuable opportunities for personal or professional advancement.

Delays or Rejection of Applications

Missing required forms can also cause delays or even rejection of your applications. Whether you’re applying for a government program, seeking employment, or submitting an insurance claim, failure to provide the necessary paperwork can result in your application being rejected or put on hold. This can lead to frustrating delays and may even cause you to lose out on specific benefits or opportunities.

Inability to Claim Benefits

Certain forms are essential for accessing various benefits. For example, if you fail to complete healthcare forms or submit the necessary paperwork for government assistance programs, you may be ineligible to receive crucial benefits such as healthcare coverage or financial support. Missed forms can prevent you from accessing the resources and support you need for your well-being and financial security.

Legal Troubles

Lastly, missing important legal forms can land you in legal trouble. Whether it’s omitting vital information in an employment form or neglecting to file the appropriate legal documents, failing to comply with legal requirements can result in serious consequences. From fines to legal battles, not completing essential forms can lead to unnecessary stress and legal entanglements.

Common Forms That Should Not Be Missed

To help you stay organized and ensure you don’t overlook any critical paperwork, here are some common forms that should never be missed:

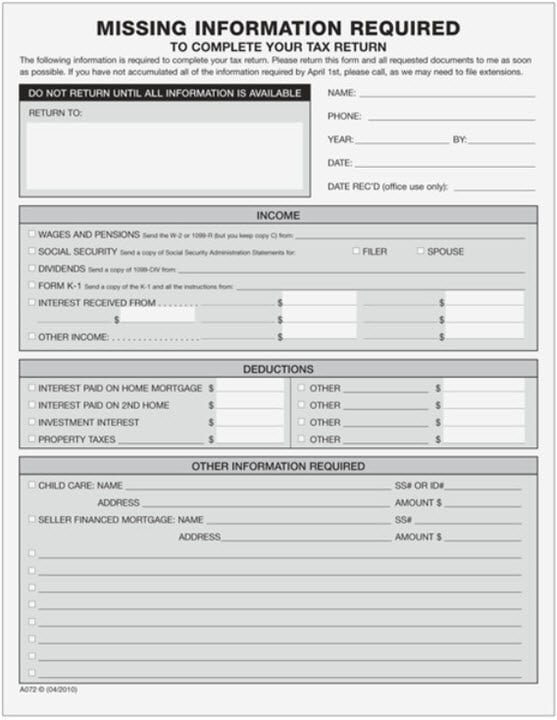

Tax Forms

Tax forms are crucial for fulfilling your legal and financial obligations. Missing tax forms can result in late filing penalties, interest accumulation, and potentially lead to legal ramifications. Examples of important tax forms include W-2 forms for reporting your income, 1099 forms for self-employed individuals, and Form 1040 for filing your annual tax return.

Insurance Forms

Understanding and completing insurance forms is essential to ensure proper coverage and avoid complications with your insurance provider. Missing insurance forms can lead to delayed or denied claims, lack of coverage when you need it the most, and difficulties in renewing your policy. Examples of insurance forms include application forms, claim forms, and policy update forms.

Employment Forms

When starting a new job or making changes in your employment, it’s crucial to complete the necessary forms to ensure a smooth transition. Missing employment forms can cause delays in starting your new position, payroll issues, tax withholding errors, and even make you ineligible for employee benefits. Examples of employment forms include job applications, tax withholding forms (such as W-4), and employee benefit enrollment forms.

Government Forms

Government forms are often required for accessing various programs and benefits. Failing to complete these forms can result in the delay or rejection of your applications, making you ineligible for important benefits. Examples of government forms include passport applications, Social Security forms, and applications for government assistance programs like Medicaid or unemployment benefits.

Healthcare Forms

Completing healthcare forms is vital for accessing medical services and ensuring proper billing and coverage. Failure to submit healthcare forms can result in delays in receiving medical care, denied claims, and difficulties in managing your healthcare expenses. Examples of healthcare forms include insurance enrollment forms, medical history forms, and claim submission forms.

Legal Forms

Legal forms play a crucial role in safeguarding your rights and ensuring compliance with legal requirements. Neglecting to complete legal forms can lead to various legal troubles and jeopardize your legal standing in certain situations. Examples of legal forms include contracts, wills, power of attorney forms, and court-related forms.

Tips to Avoid Missing Important Forms

Now that you understand the potential consequences of missing important forms, here are some tips to help you stay organized and ensure you never overlook critical paperwork:

Create a System for Organization

Establish a system for organizing your forms and important paperwork. This could include physical folders, digital folders on your computer, or using organization apps that allow you to store and categorize your forms efficiently. Having a well-organized system will make it easier for you to find and complete the necessary forms promptly.

Set Reminders and Deadlines

Use calendars, task management tools, or smartphone reminders to set alerts for upcoming deadlines or due dates for important forms. By proactively scheduling reminders, you’ll be less likely to forget to complete and submit the necessary paperwork in a timely manner.

Stay Informed

Stay updated on any changes or requirements related to the forms you need to complete. Subscribe to relevant newsletters, follow official government websites or organizations related to your specific forms, and stay informed about any applicable deadlines or regulatory updates. Being informed will help you plan ahead and avoid any last-minute surprises.

Seek Professional Help

When in doubt, don’t hesitate to seek professional help. Depending on the complexity of the forms you’re dealing with, consulting with legal professionals, tax advisors, insurance agents, or HR representatives can provide valuable guidance and ensure you understand the requirements and implications of the forms you need to complete.

Double-Check Before Submission

Before submitting any forms, take the time to double-check and review them for accuracy and completeness. Ensure that all mandatory fields are filled out, signatures are obtained when required, and supporting documentation is included. Double-checking your forms will help minimize errors and increase the chances of successful submission.

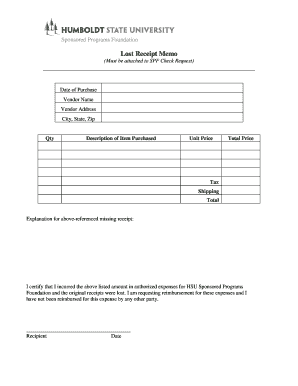

Consequences of Missing Tax Forms

Tax forms hold particular importance due to their legal and financial implications. Here are some specific consequences of missing tax forms:

Late Filing Penalties

Failing to submit your tax forms by the deadline can result in late filing penalties. The IRS imposes this penalty to encourage timely filing and to ensure the government receives the necessary tax revenue. Late filing penalties can accumulate daily and may be calculated based on a percentage of the unpaid taxes owed.

Interest Accumulation

In addition to late filing penalties, interest begins to accrue on any unpaid taxes from the original due date until the date of payment. The interest rate is determined by the IRS and is typically compounded daily. Failing to submit your tax forms and pay your taxes on time can lead to a significant increase in the amount you owe.

Loss of Deductions and Credits

Missing tax forms can also result in the loss of deductions and credits you may be entitled to. Certain deductions and credits require specific forms or documentation to be submitted with your tax return. Failing to include these forms can mean missing out on valuable tax savings and potentially paying more in taxes than necessary.

Legal Ramifications

Lastly, failure to submit your tax forms can have legal ramifications. The IRS has the authority to take legal action against individuals who deliberately evade their tax obligations. While missing a tax form may not automatically result in legal action, repeated non-compliance or intentional tax evasion can lead to fines, penalties, and even criminal charges.

Avoiding Missing Tax Forms

To avoid the potential consequences of missing tax forms, here are some tips to help you stay on top of your tax obligations:

Know Important Tax Deadlines

Familiarize yourself with the key tax deadlines, such as the deadline for filing your annual tax return and the due dates for estimated tax payments. Mark these dates on your calendar or set reminders to ensure you don’t forget. You can find the specific deadlines on the IRS website or consult with a tax professional.

Gather and Organize Required Documents

Before starting your tax return, gather all the necessary documents, such as W-2s, 1099s, receipts, and records of any deductions or credits you plan to claim. Having everything organized and readily accessible will make the process smoother and help ensure you don’t miss any crucial information required for your tax forms.

Use Tax Software or Hire a Tax Professional

Consider using tax software or seeking assistance from a tax professional. Tax software can guide you through the filing process, help you identify any missing forms, and reduce the chances of errors. If your tax situation is complex or you prefer professional guidance, hiring a tax professional can provide peace of mind and ensure accuracy.

File for an Extension, if Needed

If you anticipate having difficulty completing your tax forms by the deadline, you can request an extension from the IRS. Filing for an extension gives you additional time to submit your completed tax forms without incurring late filing penalties. However, it’s important to note that an extension only extends the deadline for filing your return, not for paying any taxes owed.

Importance of Not Missing Insurance Forms

Insurance forms play a critical role in ensuring that you have the coverage you need, and failing to complete them can have significant implications. Here are some reasons why you should not miss insurance forms:

Delayed or Denied Claims

Missing insurance forms or failing to submit the required documentation can result in delays or denials of your insurance claims. Insurance companies rely on accurate and complete information to process claims efficiently. If you fail to provide the necessary forms or documentation, it can lengthen the claim process, leaving you waiting for reimbursement or potentially being denied coverage altogether.

Lack of Coverage

Certain insurance forms, such as enrollment forms or policy update forms, are necessary for maintaining your coverage. If you fail to complete these forms within the required timeframe, your coverage may lapse, leaving you uninsured. Without adequate insurance, you risk bearing the full financial burden of unexpected events, medical expenses, or property damage.

Difficulties in Policy Renewal

Completion of insurance forms is often essential for policy renewal. Failure to submit the necessary renewal forms can lead to the cancellation or non-renewal of your policy. Losing your insurance coverage due to missing forms can be troublesome, especially if you need to find alternative coverage or face higher premiums when reapplying for insurance in the future.

Financial Loss

Missing insurance forms can result in financial loss. For example, failing to provide proper documentation for a claim may mean you have to pay out of pocket for expenses that should have been covered. Additionally, if you’re entitled to discounts or lower premiums based on specific forms or information, not submitting them may result in higher insurance costs.

Preventing Missing Insurance Forms

To avoid the potential consequences of missing insurance forms, consider implementing these preventive measures:

Read and Understand Policy Requirements

Take the time to thoroughly read and understand your insurance policy requirements. Familiarize yourself with the specific forms that need to be completed at different stages, such as enrollment, policy updates, or claim submissions. Understanding the requirements will help you stay proactive in completing the necessary forms.

Set Reminders for Premium Payments

One form that should not be missed is the premium payment form. Ensure you set reminders for premium due dates to avoid accidental lapses in coverage. Consider setting up automatic payments or electronic reminders to help you stay on top of your premium payments.

Report Changes in Circumstances

If there are any changes to your personal circumstances that may impact your insurance coverage, make sure you promptly notify your insurance provider and complete any required forms. This can include changes in address, marital status, the addition of dependents, or significant changes to your property or assets. Keeping your insurance provider informed ensures that your coverage reflects your current situation and helps prevent any gaps or discrepancies.

Regularly Review Policy Coverage

Take the time to review your insurance policy coverage periodically. By reviewing your policy, you can identify any gaps in coverage, determine if additional forms or updates are needed, and ensure that your policy aligns with your current needs. Regular reviews help you stay proactive and avoid missing any important forms.

Implications of Missing Employment Forms

When it comes to employment, missing essential forms can have negative consequences. Here are some potential implications of missing employment forms:

Delays in Starting Employment

Missing employment forms can cause delays in starting a new job. Employers often require completion of specific forms as part of the onboarding process. Failure to submit these forms promptly can result in delays in processing your paperwork, leading to a delayed start date and potential frustration for both you and your employer.

Payroll Issues

Certain employment forms, such as tax withholding forms (like Form W-4), impact your payroll. Missing or incorrectly completing these forms can lead to errors in your paycheck, including incorrect tax withholding or the mishandling of deductions. These issues can result in financial complications and may require time-consuming efforts to correct.

Tax Withholding Errors

Failing to complete tax withholding forms accurately can lead to errors in the amount of taxes withheld from your paycheck. This can have significant implications when it comes time to file your tax return. If too little tax is withheld, you may owe a substantial amount at tax time. Conversely, if too much tax is withheld, you may be deprived of much-needed income throughout the year.

Ineligibility for Benefits

Employment forms often determine your eligibility for employee benefits, such as health insurance, retirement plans, or paid time off. Failure to complete the necessary forms may result in you being ineligible for certain benefits or missing out on valuable opportunities to secure your financial future and well-being.

Avoiding Missing Employment Forms

To ensure you don’t miss any critical employment forms, follow these tips:

Read and Complete Onboarding Documents

When starting a new job or making changes in your employment, carefully read and complete all the required onboarding documents. These may include forms related to tax withholding, direct deposit, benefits enrollment, and employment agreements. Take the time to review the forms thoroughly, seek clarification if needed, and complete them accurately.

Notify HR of Any Changes

If there are any changes to your personal information or circumstances, promptly notify your human resources department and complete any required forms. This may include changes in your address, marital status, or the addition of dependents. Keeping your HR department informed ensures that your employment records and benefits are up to date.

Review Paycheck for Accuracy

Regularly review your pay stubs to ensure that your paycheck accurately reflects the details provided on your employment forms. Check for inconsistencies or errors, such as incorrect tax withholding or missing deductions. If you notice any issues, notify your HR department immediately to rectify the situation.

Stay Informed About Employee Benefits

Stay informed about the employee benefits offered by your employer. Familiarize yourself with the enrollment periods, the necessary forms, and the eligible options. Set reminders to ensure you complete the required forms within the designated timeframe and take full advantage of the benefits offered to you.

Preventing Missing Legal Forms

When it comes to legal matters, missing important forms can have significant consequences. Here are some preventive measures to help you avoid missing legal forms:

Consult with Legal Professionals

If you’re dealing with legal forms, consider seeking guidance from legal professionals. Lawyers and attorneys can provide valuable advice, review the forms, and ensure that you understand the legal implications of the documents you’re dealing with. Their expertise can help you navigate the complex legal landscape and avoid any missteps.

Read and Understand Legal Documents

Take the time to thoroughly read and understand any legal documents or forms you are required to complete. Whether it’s contracts, agreements, or court-related forms, make sure you comprehend the purpose, terms, and implications of the documents. If there are any concerns or confusing aspects, seek clarification from legal experts.

Keep Track of Court Deadlines

If you’re involved in a legal case or have ongoing legal proceedings, it’s vital to keep track of all court deadlines. Missing court-related forms or failing to meet filing deadlines can have severe consequences, including case dismissal or legal penalties. Utilize calendars, reminder systems, or legal software to stay organized and ensure timely submission of court documents.

File Documents in a Timely Manner

When it comes to legal forms, timeliness is crucial. Ensure you promptly file any necessary documents with the appropriate authorities or parties. Neglecting to file in a timely manner can result in legal complications, missed opportunities, or adverse outcomes in your legal matter.

By understanding the consequences of missing important forms and implementing preventive measures, you can stay on top of your paperwork and avoid the potential headaches and hassles that come with overlooking critical documents. Remember, staying organized, seeking professional assistance when needed, and double-checking your forms are key to ensuring your legal rights, financial well-being, and access to valuable benefits and opportunities.