Are you someone who is curious about your risk tolerance and how comfortable you are with the ups and downs of the stock market? Perhaps you’re also wondering about your investment strategy – whether you lean towards a more passive approach with index funds and ETFs, or if you prefer to actively pick individual stocks and engage in frequent trading. Whatever your investment style may be, it’s important to understand your risk tolerance and comfort level when it comes to the unpredictable nature of the stock market. In this article, we’ll explore how you can assess your risk tolerance and determine what investment strategy aligns best with your comfort level.

Understanding Risk Tolerance

Defining risk tolerance

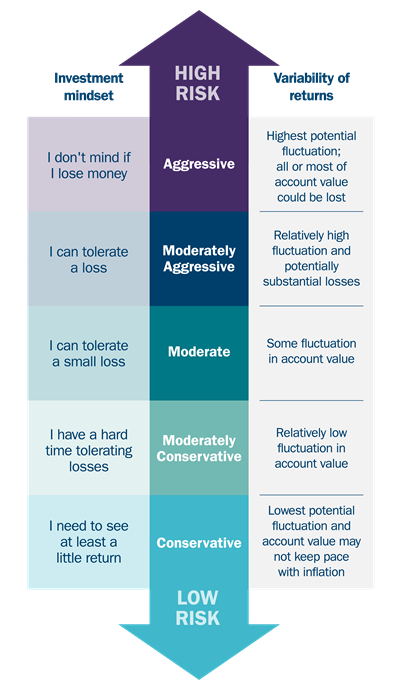

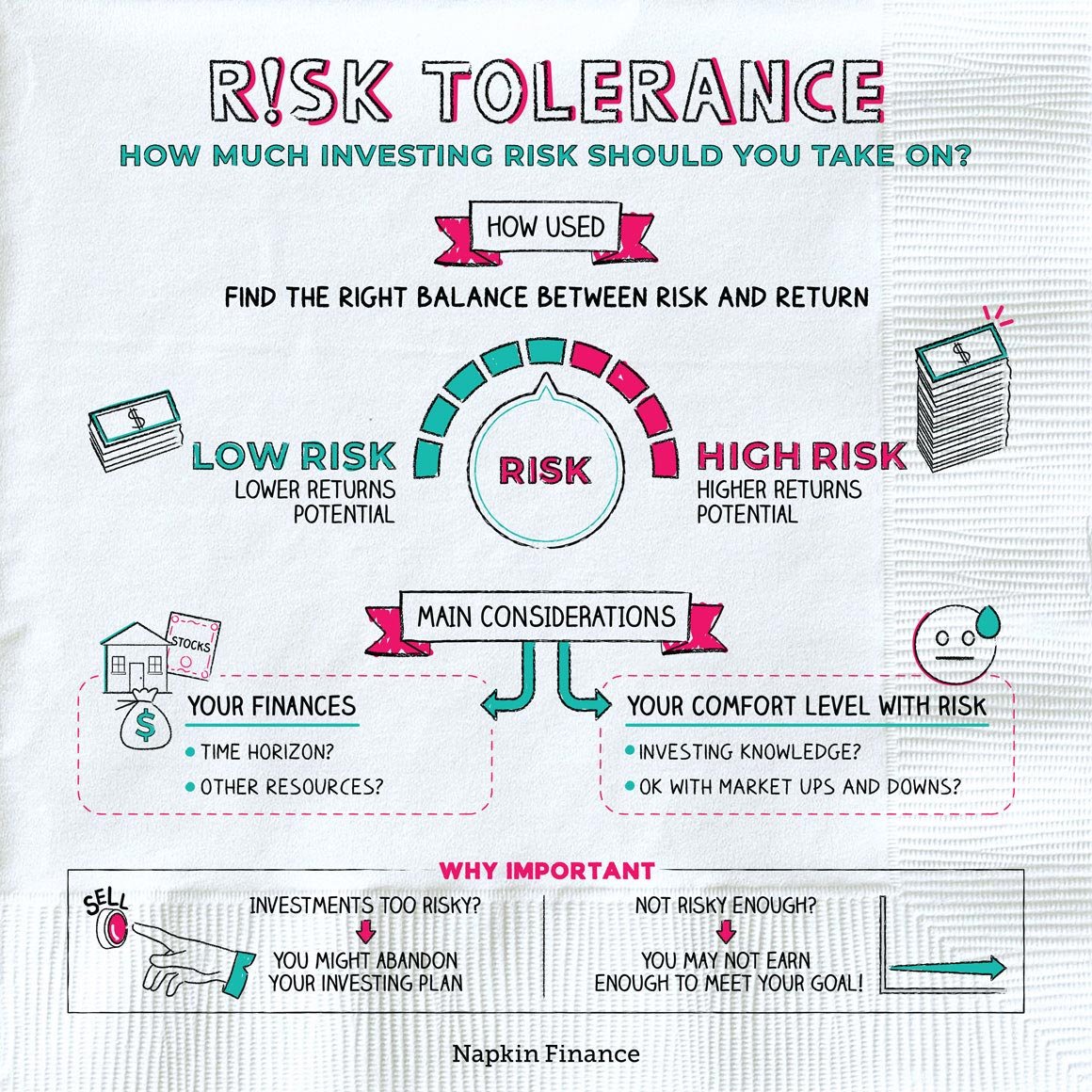

Risk tolerance refers to your ability to handle the uncertainty and potential losses associated with investment decisions. It is the level of risk that you are comfortable with in your investment portfolio. Every individual has a different level of risk tolerance, influenced by various factors such as financial goals, timeline, past experiences, and emotions.

Factors influencing risk tolerance

Several factors can impact your risk tolerance. One of the primary factors is your financial goals and timeline. If you have short-term goals, such as saving for a down payment on a house within the next two years, you may have a lower risk tolerance as you cannot afford significant losses. On the other hand, if you have long-term goals like retirement planning, you might be willing to take on higher risks for potentially higher returns.

Past investment experiences also play a role in determining your risk tolerance. If you have experienced significant losses in the past, you might be more risk-averse. Conversely, if you have seen positive returns and have a higher risk appetite, you may be willing to take on more risk.

Your emotional response to market fluctuations is another crucial factor. Some individuals may become anxious or fearful during market downturns and prefer more conservative investments. Others may view market fluctuations as opportunities for potential gains and maintain a higher risk tolerance.

Importance of assessing risk tolerance

Assessing your risk tolerance is a critical step in developing a sound investment strategy. It helps align your investments with your financial goals, ensuring a balance between risk and potential rewards. By understanding your risk tolerance, you can choose investments that provide a comfortable level of uncertainty and minimize the chances of making impulsive decisions during market volatility.

Determining Your Risk Tolerance

Self-reflection and understanding

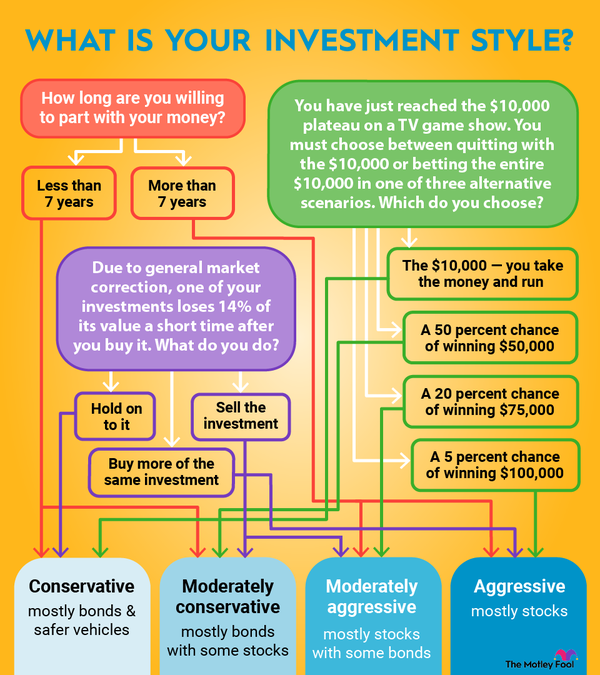

Determining your risk tolerance requires self-reflection and understanding of your own financial situation, goals, and emotions. Take the time to evaluate your risk appetite and consider how comfortable you are with potential losses. Reflect on your financial stability, timeline for reaching your goals, and overall financial situation.

Assessing financial goals and timeline

Your financial goals and timeline play a significant role in determining your risk tolerance. Consider the specific goals you have and the time you have to achieve them. If you have longer-term goals, such as retirement planning, you might be able to tolerate more risk as you have more time to recover from potential losses. Alternatively, if you have shorter-term goals, like saving for a house down payment, you might prefer lower-risk investments to protect your capital.

Evaluating past investment experiences

Reflecting on your past investment experiences can provide insights into your risk tolerance. Consider how you reacted to previous market fluctuations and losses. Did you panic and sell your investments? Or did you stay focused on the long-term and ride out the volatility? Your past experiences can give you an idea of how much risk you can handle going forward.

Considering emotions and reaction to market fluctuations

Emotions can significantly impact your risk tolerance. Consider how you emotionally react to market fluctuations. Do you tend to get anxious or fearful during downturns? Or do you remain calm and see them as potential buying opportunities? Understanding your emotional response to market fluctuations can help you determine the appropriate level of risk you can handle.

Passive vs Active Investment Strategies

Introduction to passive investment strategies

Passive investment strategies involve investing in a diversified portfolio of assets that aim to replicate a specific market index, such as the S&P 500. These strategies usually involve investing in index funds or exchange-traded funds (ETFs). The goal of passive strategies is to match the market’s overall performance rather than trying to outperform it through active decision-making.

Benefits and limitations of passive strategies

Passive investment strategies offer several benefits. They tend to have lower fees compared to actively managed funds due to their focus on tracking an index rather than relying on active management. Additionally, passive strategies provide broad market exposure, reducing the risk associated with individual stock selection. However, one limitation of passive strategies is the inability to outperform the market as they aim to match its performance.

Overview of active investment strategies

Active investment strategies involve making frequent buying and selling decisions in an attempt to outperform the market. These strategies often involve individual stock picking, market timing, and extensive research and analysis. Active investors aim to identify mispriced or undervalued securities to achieve higher returns than the market average.

Pros and cons of active strategies

Active investment strategies offer the potential for higher returns if successful. Skilled active managers can exploit market inefficiencies and generate alpha, which is the measure of their ability to outperform the market. However, active strategies come with higher costs, including management fees and trading expenses. Additionally, the majority of active managers underperform their benchmarks over the long term, making it challenging to consistently achieve superior returns through active management.

Analyzing Stock Market Ups and Downs

Understanding market volatility

Market volatility refers to the price fluctuations of various financial assets in the market. It can be caused by a variety of factors, including economic indicators, geopolitical events, and investor sentiment. Understanding market volatility is crucial for investors as it helps anticipate potential risks and opportunities.

Historical trends and patterns

Analyzing historical market trends and patterns can provide insights into how the stock market behaves. It helps investors identify recurring cycles, such as bull markets (upward trends) and bear markets (downward trends). By studying historical data, investors can gain a better understanding of the market’s ups and downs and make informed investment decisions.

Market cycles and their impact

Market cycles have a significant impact on investment performance. Investors must recognize that market cycles are a natural part of the stock market and that they can experience both periods of growth and decline. By understanding these cycles, investors can adjust their investment strategies accordingly and make informed decisions during different market phases.

Psychological aspects of market fluctuations

Psychology plays a crucial role in how investors react to market fluctuations. Fear and greed are common emotions that can drive investment decisions. During market downturns, fear may lead some investors to panic and sell, potentially locking in losses. Conversely, greed can drive investors to make impulsive buying decisions during market highs. Understanding and managing these psychological aspects are essential to maintain a disciplined investment approach.

Managing Emotional Responses to Market Fluctuations

Recognizing common emotional reactions

Investors often experience various emotional reactions to market fluctuations. Common reactions include fear, panic, and anxiety during market downturns, and excitement and overconfidence during market upswings. Recognizing these emotional reactions is crucial for managing them effectively and making rational investment decisions.

Strategies for maintaining emotional balance

To maintain emotional balance during market fluctuations, it is essential to have a well-defined investment plan and stick to it. Avoid making impulsive decisions based on short-term market movements. Diversifying your portfolio across different asset classes and regularly reviewing your investments can also help reduce emotional responses to market volatility.

Setting realistic expectations

Setting realistic expectations is crucial for managing emotional responses to market fluctuations. Understand that the stock market goes through cycles and that short-term volatility is a normal part of investing. Avoid chasing quick gains and focus on long-term goals. By setting realistic expectations, you can maintain a calm and rational approach to investment decisions.

Seeking professional advice

If you find it challenging to manage your emotional responses to market fluctuations, seeking professional advice from a financial advisor is a wise decision. A qualified advisor can provide objective guidance and help you stay focused on your long-term goals, reducing emotional biases in your investment decisions.

Assessing Short-Term vs Long-Term Investment Goals

Defining short-term and long-term goals

Short-term investment goals typically have a time horizon of a few months to a few years. These goals may include saving for a down payment on a house, funding a vacation, or purchasing a car. Long-term investment goals, such as retirement planning or funding a child’s education, have a time horizon of several years or more.

Different risk tolerances for short vs long-term

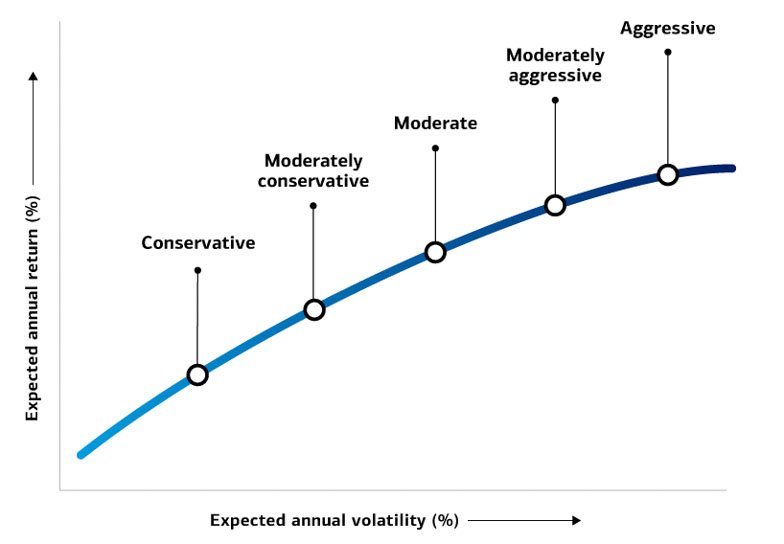

The risk tolerance for short-term goals generally tends to be lower as there is less time to recover from potential losses. Protecting the capital becomes a priority in these cases. Long-term goals, however, allow for a higher risk tolerance as there is more time to ride out market fluctuations and potentially benefit from higher returns.

Balancing risk with expected returns

When assessing your risk tolerance for short-term and long-term goals, consider the relationship between risk and expected returns. Higher risks are often associated with the potential for higher returns, but they also come with increased volatility and the possibility of losses. Balancing risk with the expected returns based on the time horizon of your goals is crucial to align your investments with your objectives.

Adapting risk tolerance based on goals

It is important to adapt your risk tolerance based on your specific goals and changing circumstances. As you approach a short-term goal, gradually reducing risk and transitioning to more conservative investments can help protect your capital. For long-term goals, you may have the flexibility to take on more risk early on and gradually reduce it as you approach the target date.

Evaluating Risk vs Reward

Understanding the risk-return tradeoff

The risk-return tradeoff refers to the relationship between the level of risk assumed and the potential rewards or returns expected from an investment. Higher-risk investments offer the potential for higher returns, while lower-risk investments tend to provide more modest returns. Evaluating the risk-return tradeoff is crucial for determining the appropriate level of risk in your investment portfolio.

Determining optimal risk levels

Optimal risk levels vary for each investor based on their risk tolerance, goals, and investment horizon. It is important to strike a balance between taking on enough risk to achieve your investment objectives while avoiding excessive risk that could result in significant losses. Determining optimal risk levels involves carefully assessing your risk tolerance and aligning it with your financial goals.

Assessing potential rewards and losses

When evaluating risk vs. reward, consider the potential rewards and losses associated with different investments. Higher-risk investments may offer the potential for superior returns, but they also carry a higher chance of losses. Lower-risk investments may provide more stable returns but can have lower growth potential. Assessing the potential rewards and losses can help you make informed investment decisions.

Calculating risk-adjusted returns

Risk-adjusted returns provide a measure of an investment’s performance relative to the amount of risk taken. By factoring in the level of risk, risk-adjusted returns allow for a more accurate comparison between different investments. Calculating risk-adjusted returns helps investors assess whether the return is commensurate with the volatility or level of risk in the investment.

Diversification as a Risk Management Strategy

Purpose of diversification

Diversification is a risk management strategy that involves spreading investments across different asset classes, sectors, and geographical regions. The purpose of diversification is to reduce exposure to any single investment, reducing the overall risk in a portfolio. By diversifying, investors can mitigate the impact of poor-performing investments on the overall portfolio.

Types of assets for diversification

Diversification can be achieved by investing in a combination of different asset classes, including equities (stocks), fixed income securities (bonds), real estate, and cash equivalents. By allocating investments across different asset classes, investors can minimize the impact of a downturn in one sector or market on their overall portfolio.

Building a diversified portfolio

Building a diversified portfolio involves carefully selecting a mix of assets based on their risk and return characteristics. The allocation depends on factors such as investment goals, risk tolerance, and time horizon. By diversifying across different asset classes and rebalancing periodically, investors can achieve a well-diversified portfolio that can weather various market conditions.

Benefits of a diversified portfolio

A diversified portfolio offers several benefits. It helps reduce the impact of individual investment losses by spreading risk across various assets. Diversification can also enhance potential returns by capturing gains from different sectors or asset classes. Additionally, a diversified portfolio can provide a smoother investment journey, as the performance of one investment may offset the performance of another.

Setting Realistic Expectations

Importance of aligning expectations with risk tolerance

Aligning expectations with your risk tolerance is crucial for maintaining a disciplined investment approach. Setting realistic expectations ensures that you are not taking on excessive risk or chasing unrealistic returns. By aligning expectations with your risk tolerance, you can make informed decisions and avoid reacting impulsively to market fluctuations.

Recognizing the variability of market returns

Market returns can vary significantly from year to year. It is important to recognize that the stock market experiences both ups and downs over time. Understanding this variability helps set appropriate expectations and prevents overreactions to short-term market movements. By focusing on long-term trends, investors can better navigate market volatility.

Considering historical performance

Considering historical performance can provide insights into the potential returns and risks of different investments. It is important to note that past performance does not guarantee future results, but historical data can help investors evaluate the potential performance and risks associated with various investment options. Evaluating historical performance can provide a realistic foundation for setting expectations.

Long-term perspective and patience

A long-term perspective and patience are essential when setting expectations. Investing is a marathon, not a sprint. By maintaining a long-term perspective and staying committed to your investment strategy, you are more likely to achieve your financial goals. Avoid being swayed by short-term market fluctuations or chasing quick gains, and instead focus on the long-term potential of your investments.

Monitoring and Reassessing Risk Tolerance

Regular review of risk tolerance

Risk tolerance is not static and can change over time. It is important to regularly review your risk tolerance to ensure that your investments align with your current financial situation and goals. Life events, changes in financial circumstances, or shifting investment time horizons may warrant a reassessment of your risk tolerance.

Adapting to changing circumstances

As your circumstances change, such as a new job, marriage, a child’s education, or nearing retirement, your risk tolerance may also shift. Adapting to changing circumstances involves evaluating your goals, time horizon, and financial responsibilities and adjusting your investment strategy accordingly. It is essential to ensure that your risk tolerance remains in sync with your current circumstances.

Reassessing risk tolerance after major life events

Major life events, such as marriage, divorce, the birth of a child, or inheriting a significant sum of money, can significantly impact your financial situation and goals. It is important to reassess your risk tolerance after such events and adjust your investment strategy accordingly. Seek professional advice if needed to ensure your portfolio remains aligned with your risk tolerance and goals.

Periodic consultation with a financial advisor

Periodic consultation with a financial advisor can provide valuable insights and guidance in assessing and reassessing your risk tolerance. A qualified advisor can help you navigate changing circumstances, provide an objective perspective, and ensure that your investments are aligned with your goals and risk tolerance. Regular discussions with your advisor can help you stay on track and make informed investment decisions.

By understanding risk tolerance, determining your investment strategy, analyzing stock market ups and downs, managing emotional responses, assessing short-term vs. long-term goals, evaluating risk vs. reward, diversifying your portfolio, and setting realistic expectations, you can become a more informed and confident investor. Regularly monitoring and reassessing your risk tolerance, seeking professional advice when needed, and staying focused on your long-term goals will help you navigate the ever-changing world of investing.