Imagine you are on a roller coaster, feeling the excitement and anticipation as the ride climbs to its peak, and the fear and thrill as it rapidly descends. Now, picture that same roller coaster as the stock market – the ups and downs, the highs and lows. Your risk tolerance and comfort level with those fluctuations can significantly impact your investment decisions. In this article, we will explore the concept of risk tolerance and help you determine just how comfortable you are with the unpredictable nature of the stock market. Get ready to assess your financial ride!

Understanding Risk Tolerance

Definition of Risk Tolerance

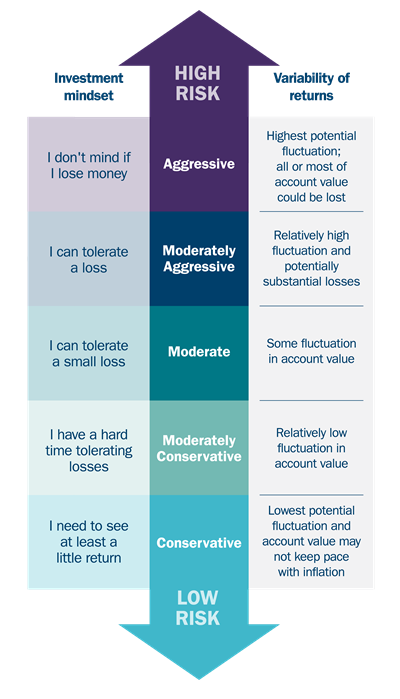

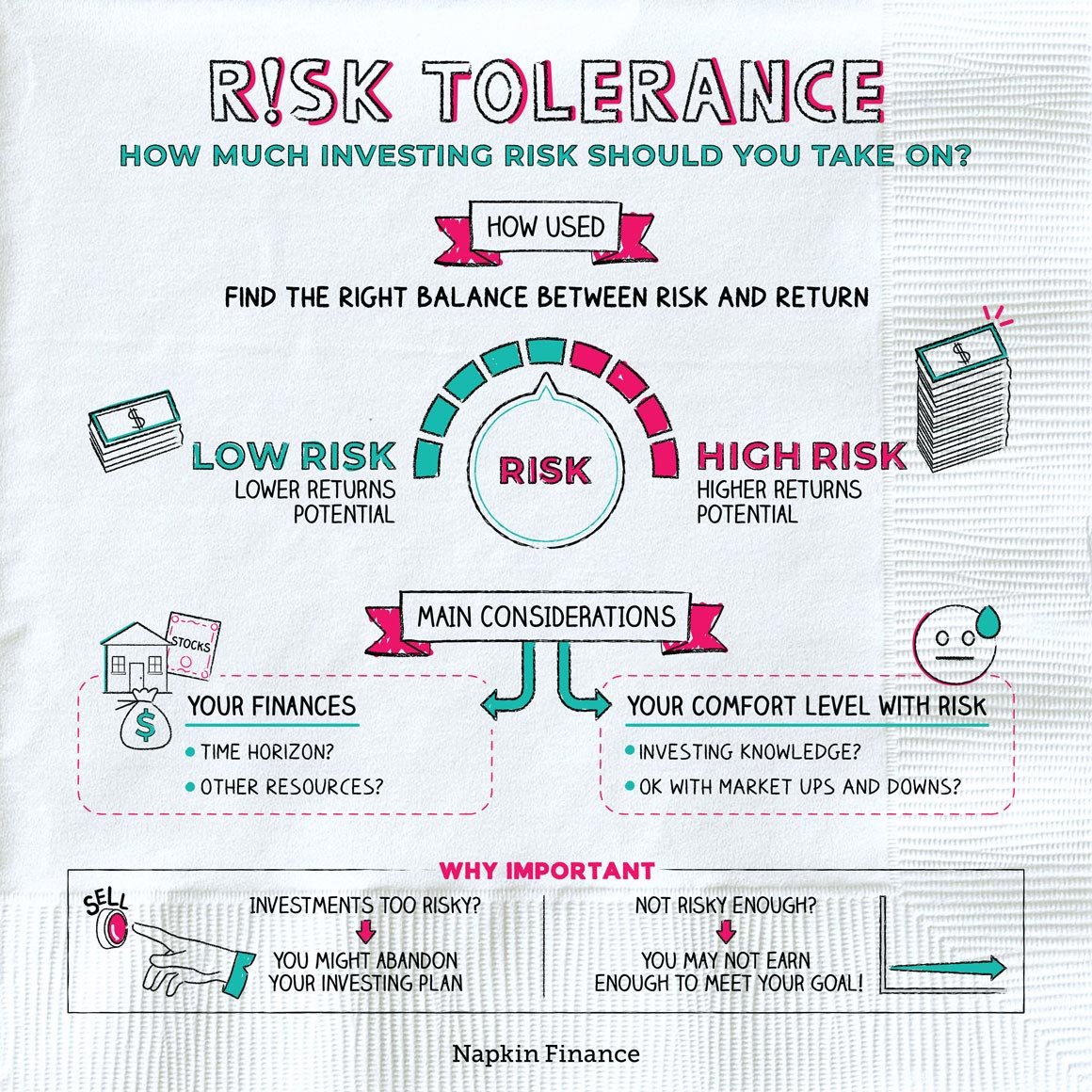

Risk tolerance refers to the level of uncertainty or volatility an individual is willing and able to endure when it comes to investing their money. It determines their ability to withstand losses and their willingness to take on risk for the potential of higher returns. Risk tolerance is a highly individualized concept and can vary greatly from person to person.

Factors Influencing Risk Tolerance

Several factors can influence an individual’s risk tolerance. These factors include their financial situation, investment goals, time horizon, and personal preferences. Financial stability, income level, and net worth can all play a role in determining risk tolerance. Investment goals, such as retirement savings or buying a house, can also shape one’s risk tolerance. Additionally, the length of time an individual has to invest and their personal comfort level with risk can impact their risk tolerance.

Importance of Identifying Risk Tolerance

Identifying your risk tolerance is crucial for successful investment planning. It helps you align your investment strategy with your financial goals, ensuring that the level of risk you take on is appropriate for your circumstances. Failing to understand your risk tolerance can lead to poor investment decisions, such as taking on too much risk and suffering significant losses or being overly conservative and missing out on potential returns. By accurately assessing your risk tolerance, you can make informed investment choices that are tailored to your needs and aspirations.

Assessing Personal Risk Tolerance

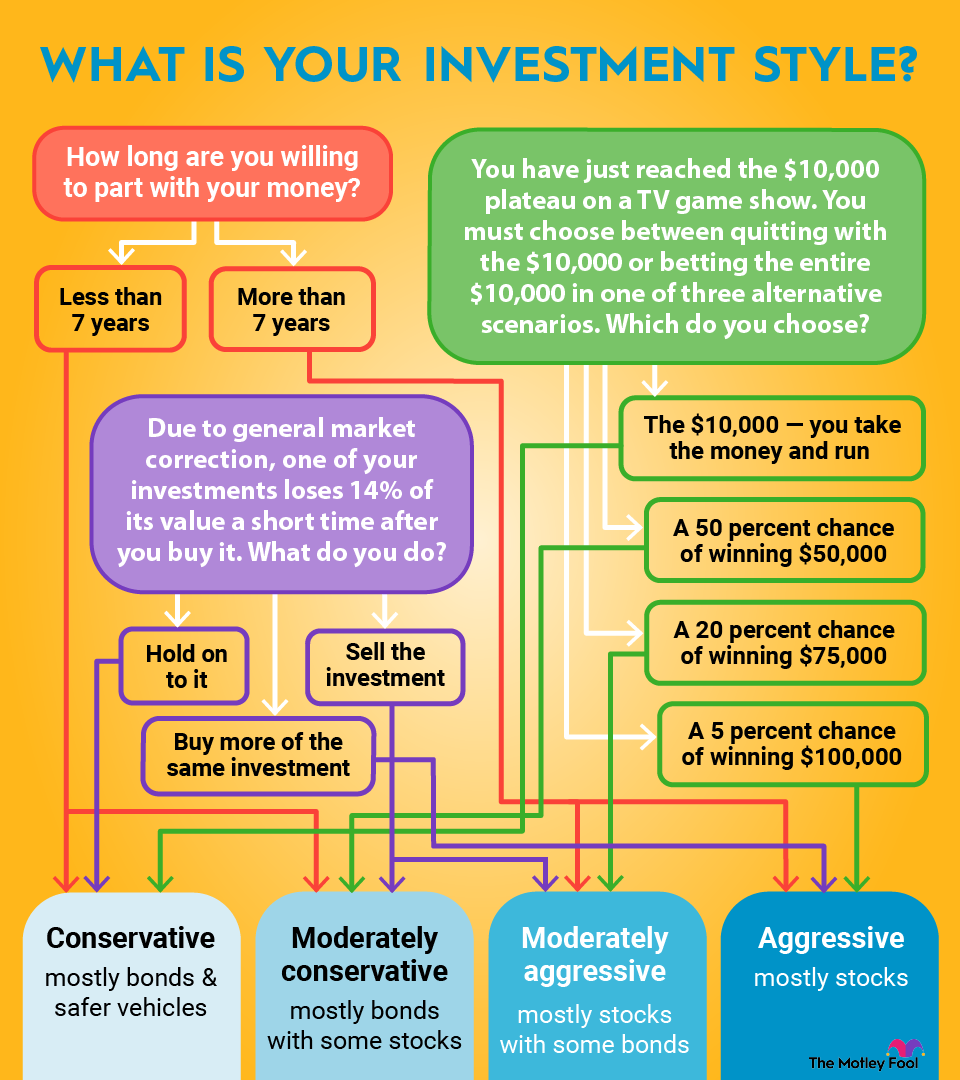

Risk Tolerance Questionnaires

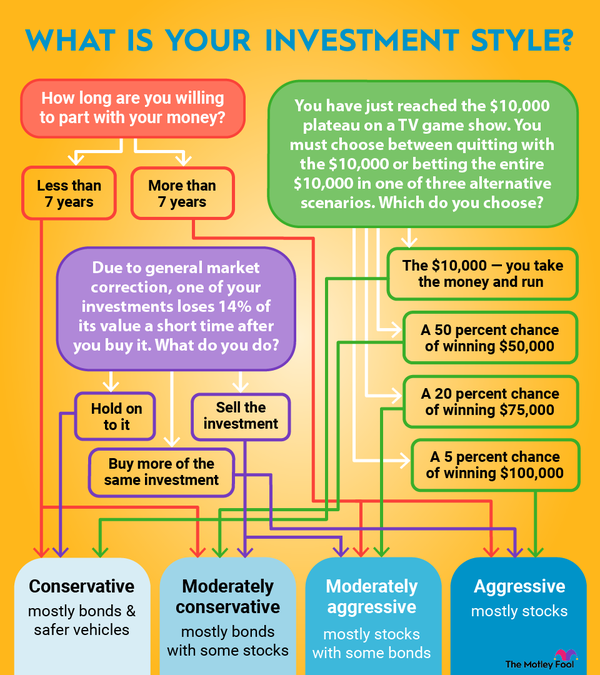

One way to assess your risk tolerance is by completing risk tolerance questionnaires. These questionnaires typically consist of a series of multiple-choice questions that assess your attitudes towards risk and financial goals. By answering questions about your investment knowledge, time horizon, and comfort with potential losses, these questionnaires provide a quantitative measure of your risk tolerance. While these questionnaires can be a helpful starting point, it’s important to remember that they are not definitive and should be combined with other considerations.

Consideration of Investment Goals

Your investment goals are crucial when assessing your risk tolerance. An investor with a long-term goal, such as retirement planning, may have a higher risk tolerance as they have more time to recover from short-term market fluctuations. Conversely, someone with a short-term goal, like saving for a down payment on a house, may have a lower risk tolerance as they cannot afford substantial losses in the short term.

Time Horizon and Risk Tolerance

Your time horizon, which is the length of time you have until you need to access your investment funds, also plays a significant role in determining your risk tolerance. The longer your time horizon, the more risk you can afford to take, as you have more time to potentially recover from any downturns in the market. Conversely, with a shorter time horizon, you may want to adopt a more conservative approach to avoid the potential for significant losses.

Financial Situations and Risk Tolerance

Your current financial situation is another important factor influencing your risk tolerance. If you have a stable income, low debt, and sufficient emergency savings, you may be more inclined to take on higher levels of risk. On the other hand, if you have limited income, significant debt, or ongoing financial obligations, you may have a lower risk tolerance and prefer more conservative investments.

Types of Risk Tolerance

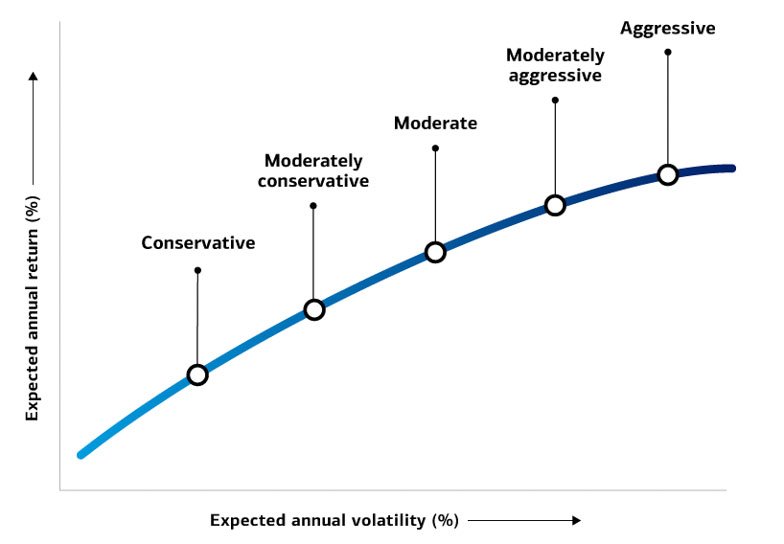

Conservative Risk Tolerance

Individuals with a conservative risk tolerance are generally more risk-averse and prioritize capital preservation over potential returns. They prefer lower-risk investments such as bonds, certificates of deposit (CDs), or money market funds. Conservative investors are often more comfortable with slower, steadier growth and are willing to sacrifice potential higher returns for a higher level of security.

Moderate Risk Tolerance

Investors with a moderate risk tolerance seek a balance between risk and reward. They are willing to accept some degree of market volatility in exchange for potentially higher returns. Moderate investors may allocate a portion of their portfolio to stocks or equity funds, while still maintaining a significant portion in more stable assets such as bonds or cash equivalents. They understand the importance of diversification and long-term growth potential.

Aggressive Risk Tolerance

An aggressive risk tolerance indicates a high tolerance for market volatility and a willingness to take on substantial risk in pursuit of maximum returns. Aggressive investors focus on capital appreciation and are more comfortable investing a significant portion of their portfolio in high-risk assets such as individual stocks or options. They understand the potential for larger losses but believe in the long-term growth potential and are willing to weather short-term market downturns.

Determining Comfort with Market Volatility

Understanding Market Volatility

Market volatility refers to the rapid and frequent price fluctuations in the stock market. It is a measure of the market’s uncertainty and can be influenced by various factors, including economic conditions, geopolitical events, and investor sentiment. Understanding market volatility is essential in assessing your comfort level with the ups and downs of the stock market.

Acceptance of Short-Term Fluctuations

Comfort with market volatility involves accepting the inevitable short-term fluctuations that occur in the stock market. It means recognizing that investment values may temporarily decline, but having confidence in the fundamental strength of your investments to recover and generate long-term growth. Being comfortable with short-term fluctuations is particularly important for long-term investors who can ride out market downturns.

Ability to Handle Market Downturns

Another aspect of comfort with market volatility is your ability to handle market downturns both emotionally and financially. Emotionally, it means staying calm and not making rash investment decisions based on short-term market movements. Financially, it involves having an emergency fund and a well-diversified portfolio that can withstand market downturns without significantly impacting your financial well-being.

Psychological Factors Affecting Comfort with Market Ups and Downs

Loss Aversion

Loss aversion refers to the human tendency to feel the pain of losses more acutely than the pleasure of gains. It means that individuals are more likely to take on less risk or make conservativedecisions to avoid potential losses, even if it hinders their long-term investment growth. Understanding your personal level of loss aversion can help you determine your comfort with market ups and downs.

Overconfidence Bias

Overconfidence bias is a psychological phenomenon where individuals overestimate their abilities and believe they have more control over outcomes than they actually do. Overconfident investors may be more comfortable with market volatility, assuming they can accurately predict or time market movements. However, this confidence can lead to excessive risk-taking and poor investment decisions.

Herding Behavior

Herding behavior occurs when individuals follow the actions and decisions of a larger group, often driven by a fear of missing out or a desire for safety in numbers. It can lead investors to ignore their own risk tolerance and comfort levels, instead following the crowd and potentially exposing themselves to unnecessary risks. Recognizing and avoiding herding behavior is essential for maintaining a balanced approach to investing.

Balancing Risk Tolerance and Comfort with Market Volatility

Aligning Risk Tolerance and Investment Strategy

To maintain a balance between risk tolerance and comfort with market volatility, it is crucial to align your investment strategy with your risk tolerance. This means selecting investments that match your risk tolerance level, whether conservative, moderate, or aggressive, and ensuring your portfolio reflects your comfort with market fluctuations.

Diversification and Risk Management

Diversification is a strategy that helps manage risk by spreading investments across different asset classes, industries, and geographic regions. It can help reduce the impact of market volatility on your overall portfolio. Additionally, risk management techniques such as hedging and setting stop-loss orders can also be employed to mitigate potential losses and minimize the impact of market downturns.

Seeking Professional Advice

If you find it challenging to balance your risk tolerance and comfort with market volatility, seeking professional advice from a financial advisor can be beneficial. A financial advisor can provide objective guidance based on your individual circumstances, help you assess your risk tolerance accurately, and develop an investment plan that aligns with your goals and comfort level.

Evaluating Risk Tolerance and Comfort Regularly

Reassessing Risk Tolerance Over Time

Risk tolerance is not a fixed attribute and can change over time. Life events such as marriage, retirement, or a significant change in financial circumstances can impact your risk tolerance. Therefore, it is essential to reassess your risk tolerance regularly to ensure your investment strategy remains aligned with your goals and comfort level.

Monitoring and Adjusting Portfolio

Regularly monitoring your investment portfolio is essential to ensure it continues to reflect your risk tolerance and comfort with market volatility. Periodic reviews can help identify any discrepancies and allow for adjustment in asset allocation or diversification as needed. Staying informed about market trends and understanding how they align with your investment strategy is crucial in maintaining a balanced approach.

Educating Yourself About Investment

Investing is a dynamic field, and staying updated on market trends, investment strategies, and financial concepts is crucial. Educating yourself about various investment options, risk management techniques, and the potential impact of market volatility can enhance your understanding and confidence in navigating the ups and downs of the stock market.

Steps to Take for Conservative Risk Tolerance

Investing in Low-Risk Assets

For individuals with a conservative risk tolerance, investing in low-risk assets is key. These assets typically include bonds, treasury bills, or savings accounts. These investments prioritize capital preservation over higher returns and offer a more stable and predictable income stream.

Emphasizing Preservation of Capital

With a conservative risk tolerance, the emphasis should be on preserving capital rather than maximizing returns. This means avoiding high-risk investments that may offer the potential for higher returns but come with a significant level of volatility. Instead, focus on investments that prioritize stability and reduce the risk of losing a substantial portion of your capital.

Avoiding High-Risk Investment Opportunities

To align with a conservative risk tolerance, it is important to avoid high-risk investment opportunities, such as speculative stocks or ventures with uncertain financial prospects. While the allure of quick and substantial returns may be tempting, it is crucial to stay true to your risk tolerance and prioritize safety and stability over short-term gains.

Steps to Take for Moderate Risk Tolerance

Balancing Risks and Potential Returns

As an investor with a moderate risk tolerance, striking the right balance between risk and potential returns is key. This involves diversifying your portfolio across different asset classes, including stocks, bonds, and cash equivalents. This approach allows you to participate in the growth potential of the stock market while still maintaining a level of stability.

Diversifying Portfolio

Diversifying your portfolio is an important step for an investor with a moderate risk tolerance. By allocating your investments across various asset classes, industries, and regions, you can spread risk and reduce exposure to any single investment. This diversification strategy helps mitigate potential losses and smooth out the impact of market volatility.

Gradually Increasing Exposure to Stocks

For investors with a moderate risk tolerance, gradually increasing exposure to stocks over time can be a suitable strategy. This allows you to benefit from the long-term growth potential of equities while still maintaining a level of stability through other asset classes. Systematic investment plans or dollar-cost averaging can be effective methods for gradually increasing exposure to stocks.

Steps to Take for Aggressive Risk Tolerance

Embracing Higher Risk Investments

With an aggressive risk tolerance, embracing higher-risk investments becomes a viable option. These investments may include individual stocks, growth-oriented mutual funds, or alternative investments with the potential for higher returns. An aggressive investor is comfortable with the inherent volatility and is willing to accept the possibility of substantial losses for the chance of achieving significant gains.

Accepting Instability of Returns

Investors with an aggressive risk tolerance must be prepared and accepting of the instability of investment returns. The stock market can experience significant fluctuations, and an aggressive investor must have the psychological fortitude to weather these ups and downs without being swayed by short-term outcomes. The focus remains on long-term growth and capital appreciation.

Active Stock Trading Strategies

For those with an aggressive risk tolerance, active stock trading strategies may be appealing. This involves frequent buying and selling of stocks with the goal of capitalizing on short-term market movements. Active trading requires considerable time, effort, and market knowledge, making it more suitable for investors who are willing to devote the necessary resources to monitor and analyze stock performance.

In conclusion, understanding your risk tolerance and comfort with market volatility is essential for successful investment planning. By considering various factors such as financial situation, investment goals, and time horizon, you can accurately assess your risk tolerance and align your investment strategy accordingly. Balancing risk tolerance with comfort with market ups and downs involves diversification, risk management, and seeking professional advice when needed. Regular evaluation of risk tolerance and comfort and taking appropriate steps based on your risk profile can help you achieve your investment goals while maintaining peace of mind. Remember, investing involves risk, and it’s important to educate yourself and make informed decisions that are in line with your risk tolerance and long-term financial objectives.