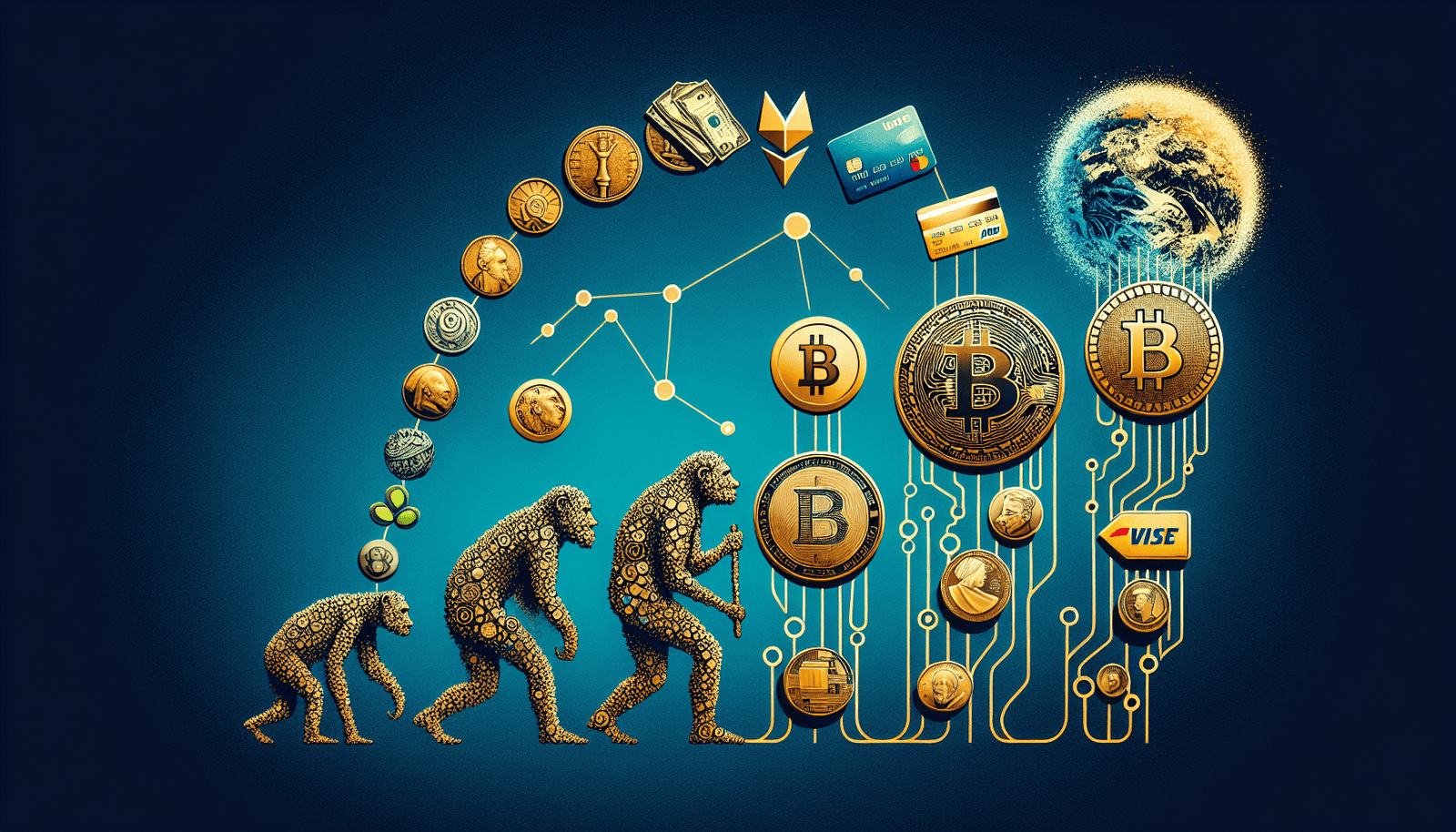

Exploring The History Of Money: From Barter To Cryptocurrency

Imagine a world before the convenience of digital payments and credit cards, a time when the concept of money was still in its infancy. In this captivating article, we take a thrilling journey through the fascinating history of money, tracing its origins from the ancient barter system to the revolutionary rise of cryptocurrency. Discover how our means of exchange evolved over millennia, shaping the way we interact, trade, and ultimately, understand the very essence of value. Embark on this enlightening exploration of money’s captivating past and gain a deeper appreciation for the financial landscape we navigate today.

Introduction to Money

Money is a fundamental concept in our everyday lives. It is a medium of exchange that facilitates trade and allows us to acquire goods and services. Defined simply, money is a universally accepted unit of account and a store of value. It has evolved over time and taken various forms, from barter systems to digital currencies. Studying the history of money is important as it provides insights into economic and social developments, and helps us understand the complexities and nuances of modern financial systems.

Money and its early forms of currency

Before the concept of money as we know it today, people relied on a system of barter, where goods and services were directly exchanged for other goods and services. However, the barter system had its drawbacks. It required a double coincidence of wants, meaning two parties had to desire what the other had to offer. This made trade difficult, inefficient, and time-consuming.

To overcome the limitations of barter, societies began using commodity money, which consisted of objects with intrinsic value that were widely accepted as a medium of exchange. Examples of commodity money include seashells, salt, livestock, and precious metals such as gold and silver. Commodity money provided a more efficient means of trade, as these items were universally desired and could be easily exchanged.

Over time, the use of commodity money evolved, leading to the development of standardized coins. Ancient civilizations, such as those in Mesopotamia and China, were among the first to mint coins. Coins offered several advantages over commodity money. They were portable, durable, and uniform in weight and purity. Moreover, their exchange value was determined by their metallic content, which made them more practical for everyday transactions.

The spread of coinage was a significant milestone in the history of money. It allowed for increased trade and economic growth, facilitating the exchange of goods and services across regions and civilizations. Coins became a symbol of power and prosperity, and their widespread usage laid the foundation for future advancements in monetary systems.

Paper Money and the Age of Empires

As ancient empires began to flourish, the need for a more convenient form of currency arose. This led to the introduction of paper money, which first emerged in China during the Tang Dynasty (618-907 AD). Paper money represented a profound shift in the history of money, as it marked the transition from physical objects as a medium of exchange to a system based on trust and faith in the value of a promissory note.

The use of paper money was greatly influenced by ancient empires. For example, the Mongol Empire under Kublai Khan issued paper money known as “chao” during the 13th century. This system of currency was widely accepted throughout the empire, facilitating trade and contributing to economic prosperity.

With the development of paper money came the establishment of banking systems. Banks played a crucial role in the issuance, regulation, and redemption of paper money. They provided a safe place for individuals to deposit their valuables and receive paper receipts or banknotes in return. These receipts were redeemable for the deposited valuables, making the banking system a trusted intermediary in financial transactions.

The Gold Standard

The 19th century saw the rise of the gold standard, a monetary system in which the value of a currency is directly linked to a fixed quantity of gold. Under the gold standard, individuals could exchange paper money for gold at a predetermined rate. This system provided stability and confidence in the value of money.

One of the key features of the gold standard was the discipline it imposed on governments and central banks. Since the amount of currency in circulation was tied to the gold reserves, governments had to ensure a balance between inflows and outflows of gold. This limited their ability to manipulate the money supply and helped maintain price stability.

However, the gold standard also had its limitations. The rigidity of the system prevented governments from using monetary policy to combat economic downturns. It also required a sufficient supply of gold, which could restrict economic growth and limit the expansion of credit.

The gold standard had a significant impact on global trade and the economy. It provided a stable foundation for international exchange rates and facilitated cross-border transactions. The system enabled countries to maintain a balance of payments, ensuring that imports and exports remained in equilibrium. While the gold standard eventually came to an end, its legacy shaped modern monetary systems and paved the way for further innovations.

Fiat Currencies and Central Banking

The transition from commodity-based money to fiat currencies marked a fundamental change in the nature of money. Fiat currencies derive their value from the trust and confidence placed in the government that issues them, rather than any intrinsic value. This shift allowed governments greater flexibility in managing their economies.

Central banks play a crucial role in the issuance and control of fiat currencies. These institutions are responsible for maintaining price stability, controlling inflation, and promoting economic growth. Central banks monitor and regulate the money supply, adjust interest rates, and act as lenders of last resort in times of financial crises.

In addition to their monetary policy functions, central banks also serve as custodians of financial stability. They supervise commercial banks, ensure the soundness of the banking system, and provide liquidity support during periods of market stress. Central banks act as the backbone of modern monetary systems, providing stability and confidence in the value of fiat currencies.

The Era of Digital Money

The advent of the internet and technological advancements brought about a new era in the history of money. Digital forms of payment emerged, revolutionizing the way we transact and manage our finances. Electronic banking, including the use of credit cards, became increasingly popular, offering convenience and efficiency in financial transactions.

Online payment platforms such as PayPal and Alipay gained widespread adoption, enabling individuals and businesses to make secure and instant transfers. These platforms not only accelerated the speed of transactions but also facilitated global commerce, breaking down barriers and expanding economic opportunities.

The rise of digital money also raised concerns about privacy and security. As financial transactions became more digitized, the need for robust cybersecurity measures became paramount. Governments and regulatory bodies introduced regulations and standards to protect consumers’ financial information and mitigate the risks associated with online payments.

Cryptocurrency: A New Frontier

Cryptocurrency represents the latest frontier in the evolution of money. It is a decentralized digital currency that utilizes cryptography for secure transactions and operates independently of a central authority. The most well-known cryptocurrency, Bitcoin, was invented in 2008 by an anonymous person or group known as Satoshi Nakamoto.

Bitcoin introduced several groundbreaking concepts, including blockchain technology. Blockchain is a distributed ledger that records all transactions and ensures transparency and immutability. This technology eliminates the need for intermediaries, reduces transaction costs, and provides a secure and efficient way to transfer and store digital assets.

Since the invention of Bitcoin, numerous other cryptocurrencies, commonly referred to as altcoins, have emerged. Each cryptocurrency offers unique features and functionalities, catering to specific niches and applications. Some cryptocurrencies, like Ethereum, go beyond simple digital currencies and provide platforms for developing and deploying smart contracts and decentralized applications.

Evolution of Payment Systems

The history of money has witnessed a remarkable evolution in payment systems. From the early days of barter to modern digital wallets, the way we transact has continually evolved to meet the changing needs of society.

In recent years, mobile payment solutions have gained significant traction. These solutions utilize mobile devices to facilitate payments, allowing individuals to pay for goods and services using their smartphones or wearables. The convenience and accessibility of mobile payments have made them increasingly popular, especially in developing economies where traditional banking infrastructure may be limited.

One of the most transformative technologies impacting payment systems is blockchain. Blockchain technology offers secure, transparent, and decentralized transaction processing. It has the potential to revolutionize the way we conduct financial transactions, removing the need for intermediaries and reducing transaction costs.

Future of Money

As we peer into the future, the landscape of money continues to evolve rapidly. Decentralized finance (DeFi) is gaining traction, offering alternative financial services such as lending, borrowing, and investing, all facilitated through blockchain technology. DeFi has the potential to democratize access to financial services and provide greater financial inclusion.

While the future holds exciting possibilities, it also presents challenges. As technology advances, issues such as cybersecurity, privacy, and regulatory frameworks will become increasingly important. Governments and regulatory bodies will need to adapt to ensure consumer protection, prevent illicit activities, and maintain financial stability.

The history of money has been a fascinating journey, driven by human innovation and societal needs. From the early forms of barter to the emergence of cryptocurrencies, each chapter in this history has shaped the way we trade, store value, and conduct financial transactions. As we continue to explore the future of money, it is essential to stay informed, adapt to new technologies, and embrace the potential opportunities that lie ahead.