When it comes to your financial goals, it’s natural to feel overwhelmed by the multitude of options and decisions ahead. Should you focus on buying a home, planning for retirement, or prioritizing your children’s education? Balancing these aspirations can be a challenge. In this article ‘Strategic Financial Planning: How to Prioritize and Achieve Your Financial Dreams’, we will explore some helpful strategies that can guide you in prioritizing your financial goals, providing you with a clearer path to achieve your dreams. So grab a cup of coffee and let’s dive into this friendly conversation about how to best navigate your financial future.

1. Assessing your financial situation

1.1 Evaluating your income and expenses

Before you can effectively prioritize your financial goals, it’s important to have a clear understanding of your current financial situation. Start by evaluating your income and expenses. Take a look at your monthly income – this includes your salary, any additional sources of income, and even passive income streams. Next, analyze your expenses. Make a comprehensive list of all your monthly expenses, including bills, groceries, transportation costs, and any discretionary spending. This step will give you a realistic view of how much money is coming in and going out each month.

1.2 Calculating your net worth

In addition to assessing your income and expenses, calculating your net worth is another vital step in evaluating your financial situation. Net worth is the difference between your assets and liabilities. Start by determining the value of your assets, including your home, investments, savings, and any valuable possessions. Then, subtract the total amount of your liabilities, which may consist of mortgage payments, student loans, or credit card debt. The resulting number is your net worth. Calculating your net worth will help you understand your overall financial health and provide a foundation for prioritizing your goals.

1.3 Reviewing your current debts

As part of assessing your financial situation, it’s crucial to review your current debts. Take a close look at any outstanding debts you have, such as credit card debt, personal loans, or student loans. Make a note of the interest rates and monthly payments for each debt. By understanding the specifics of your debts, you’ll be able to better prioritize them and allocate your resources accordingly.

1.4 Considering your financial obligations

Another aspect of assessing your financial situation involves considering your financial obligations. This includes any recurring financial commitments, such as mortgage or rent payments, insurance premiums, and utility bills. It’s important to have a clear picture of your fixed expenses, as they will impact your ability to allocate funds towards your financial goals. Make a list of these obligations and ensure they are accounted for when deciding on goal prioritization.

2. Understand the importance of goal prioritization

2.1 Benefits of setting priorities

Setting priorities for your financial goals is crucial for several reasons. Firstly, it helps you avoid feeling overwhelmed by the multitude of goals you may have. By prioritizing, you can focus your energy and resources on the most important ones. Secondly, setting priorities allows you to make more informed decisions about how to allocate your financial resources. It helps you determine where to invest your money, how much to save, and when to pay off debts. Lastly, prioritization leads to a greater sense of clarity and purpose in your financial journey, giving you a roadmap to follow along the way.

2.2 Impact of misaligned priorities

Failure to prioritize your financial goals can have significant consequences. It may lead to a lack of progress in achieving important objectives, such as saving for retirement or buying a home. Without a clear hierarchy of goals, you may find yourself allocating resources inefficiently, resulting in missed opportunities and financial setbacks. Additionally, misalignment of priorities can cause unnecessary stress and confusion, as you may feel torn between competing objectives. To avoid these negative outcomes, it is crucial to understand the impact of misaligned priorities and take proactive steps towards goal prioritization.

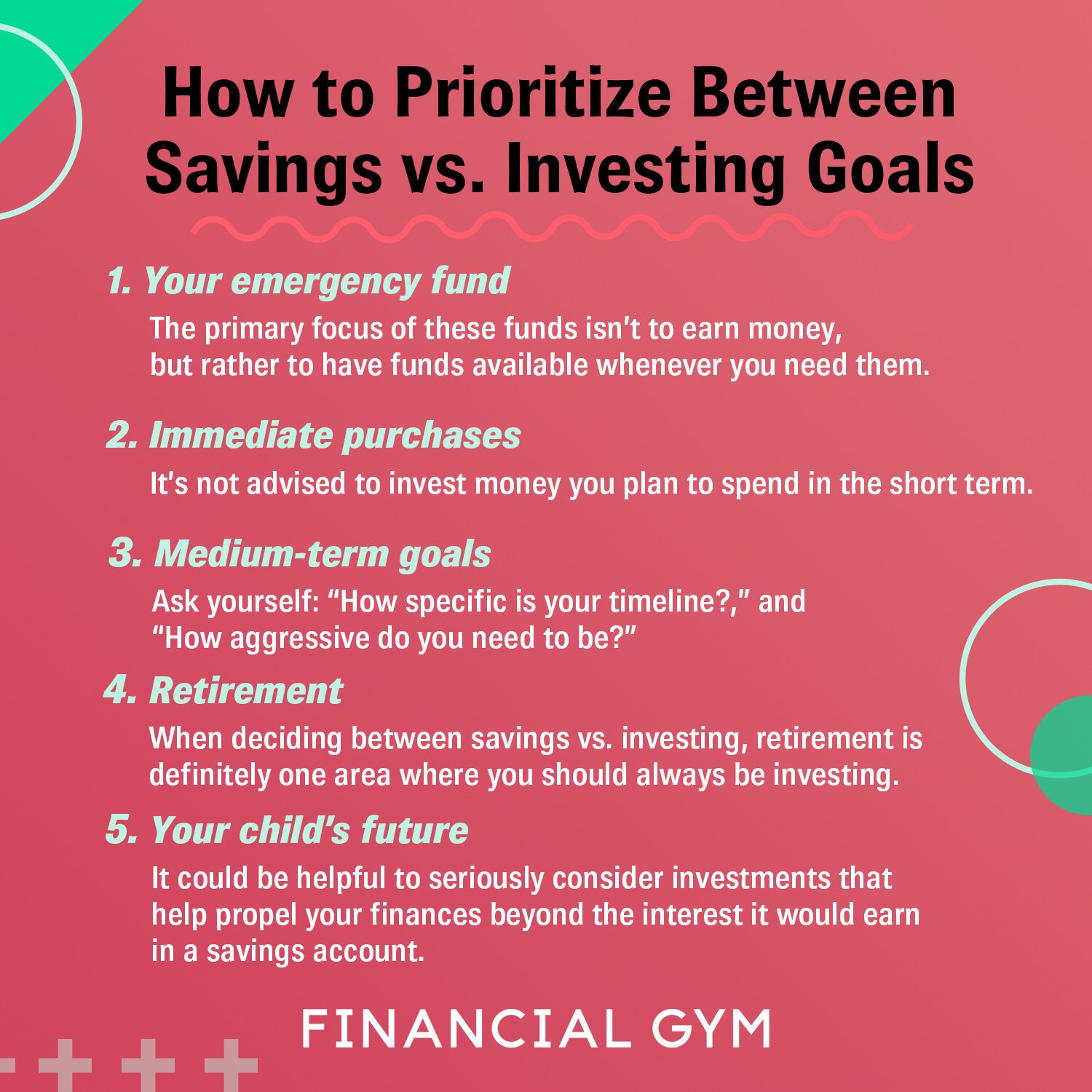

2.3 Balancing short-term and long-term goals

When prioritizing your financial goals, it’s important to strike a balance between short-term and long-term objectives. Short-term goals often include paying off debt, building an emergency fund, or saving for a specific purchase. These goals provide immediate benefits and contribute to your overall financial stability. On the other hand, long-term goals, such as retirement savings or funding your children’s education, require consistent planning and a focus on the future. Balancing short-term and long-term goals ensures that you address your immediate needs while also securing your financial well-being in the long run.

3. Analyzing your goals

3.1 Understanding the timeline for each goal

To effectively prioritize your financial goals, it’s important to understand the timeline associated with each goal. Some goals, like paying off high-interest debt, may have a shorter timeframe, while others, like saving for retirement, have a longer time horizon. By analyzing the timeline for each goal, you can better allocate your resources and create a realistic plan for achieving them.

3.2 Categorizing your goals

Categorizing your goals can help you gain clarity and prioritize more effectively. One way to categorize goals is by dividing them into short-term, medium-term, and long-term goals. Short-term goals typically have a timeframe of one to three years, medium-term goals range from three to ten years, and long-term goals extend beyond ten years. This categorization allows you to focus on goals that require immediate attention while also considering those that need longer-term planning and investment.

3.3 Determining the urgency of goals

Apart from understanding the timeline, it’s also important to determine the urgency of your goals. Some goals may be more time-sensitive than others, requiring immediate attention. For example, if you have high-interest credit card debt, paying it off should be a priority as the interest charges can quickly accumulate. Other goals, like saving for retirement or a down payment on a home, may be less urgent but still require consistent action. By evaluating the urgency of your goals, you can prioritize them accordingly and allocate your resources in a way that maximizes their impact.

4. Consider your risk tolerance and investment horizon

4.1 Assessing your risk tolerance

When prioritizing your financial goals, it’s essential to consider your risk tolerance. Risk tolerance refers to your ability and willingness to take on financial risks in pursuit of higher returns. It’s important to be honest with yourself about your comfort level with different types of investments and the potential volatility they may entail. Your risk tolerance will influence the allocation of your resources towards different goals, as well as the investment strategies you adopt.

4.2 Evaluating your investment horizon

In addition to risk tolerance, evaluating your investment horizon is crucial for setting realistic expectations and prioritizing your goals effectively. Your investment horizon refers to the length of time before you need to access the funds you have invested. Goals with a shorter time horizon, such as saving for a down payment on a home, may require a more conservative investment approach to protect against potential market fluctuations. On the other hand, goals with a longer time horizon, like retirement savings, may allow for a more aggressive investment strategy. By understanding your investment horizon, you can align your goals with appropriate investment vehicles and maximize the growth potential of your funds.

5. Prioritizing your financial goals

5.1 Establishing an emergency fund

One of the first financial goals to prioritize is establishing an emergency fund. An emergency fund acts as a safety net, providing you with the financial cushion necessary to cover unexpected expenses or temporary loss of income. Aim to save three to six months’ worth of living expenses in a liquid and easily accessible account. Having an emergency fund in place ensures you are prepared for any unforeseen circumstances that may arise.

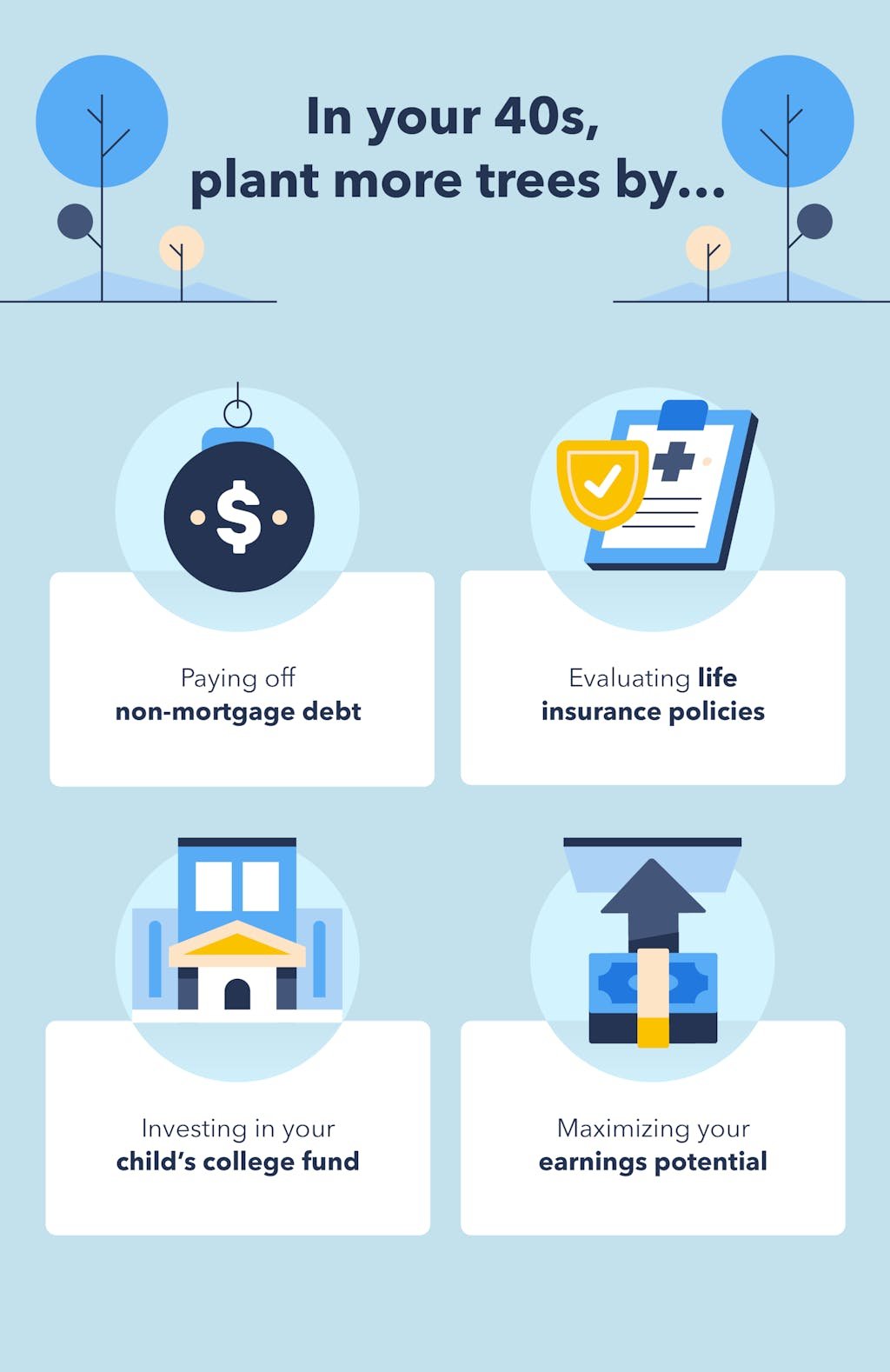

5.2 Paying off high-interest debt

Paying off high-interest debt should be a top priority when considering your financial goals. High-interest debt, such as credit card debt or payday loans, can quickly accumulate and hinder your financial progress. Make a plan to pay off these debts as soon as possible, starting with the one with the highest interest rate. By eliminating high-interest debt, you free up resources to allocate towards other goals and improve your overall financial health.

5.3 Saving for retirement

Saving for retirement is a long-term goal that should not be overlooked. The earlier you start saving for retirement, the more time your money has to grow through compound interest. Take advantage of retirement savings accounts such as 401(k)s or Individual Retirement Accounts (IRAs) to maximize your contributions and potential tax benefits. Consistently saving for retirement will ensure you have enough funds to support your desired lifestyle during your golden years.

5.4 Funding your children’s education

If funding your children’s education is a priority, it’s important to start planning early. College tuition costs continue to rise, and it’s crucial to have a strategy in place to meet these expenses. Consider opening a 529 college savings plan or exploring other education savings options available in your country. By regularly contributing to an education fund, you can help alleviate the financial burden of higher education for your children.

5.5 Saving for a down payment on a home

For many people, owning a home is a significant financial goal. Saving for a down payment is an important step towards achieving homeownership. Determine the amount you need for a down payment and create a savings plan to reach that goal. Consider setting up a dedicated savings account for your down payment funds and explore other options such as government assistance programs or assistance from family members. Saving for a down payment will put you on the path to homeownership and provide stability for you and your family.

5.6 Investing for other long-term goals

Once you have addressed your immediate financial obligations and established a solid foundation for your financial future, you can consider investing for other long-term goals. These goals may include starting a business, purchasing investment properties, or building a legacy for future generations. Consult with a financial advisor to determine the best investment strategies based on your risk tolerance, time horizon, and specific goals.

6. Seek professional guidance

6.1 Consulting with a financial planner

If you find it challenging to prioritize your financial goals or require assistance in creating a plan, consulting with a financial planner is a wise decision. A financial planner can help you analyze your financial situation, assess your goals, and develop a comprehensive strategy to achieve them. They can provide personalized advice based on your unique circumstances, taking into account factors such as income, expenses, and risk tolerance. Seeking professional guidance can provide you with the expertise and support needed to prioritize your financial goals effectively.

6.2 Seeking advice from real estate professionals

When prioritizing financial goals related to buying a home or investing in real estate, seeking advice from real estate professionals is crucial. Real estate professionals have in-depth knowledge of the housing market, financing options, and investment opportunities. They can help you navigate the complexities of purchasing a property, understanding mortgage rates, and identifying investment properties that align with your goals. By leveraging their expertise, you can make more informed decisions and prioritize your real estate goals effectively.

6.3 Exploring college savings options

When planning for your children’s education, it’s valuable to explore college savings options and seek advice from professionals in the field. Financial advisors specializing in education savings can guide you through the various investment vehicles available, such as 529 college savings plans or education savings accounts. They can help you understand the tax advantages, contribution limits, and investment options associated with each option. By exploring college savings options and seeking expert advice, you can prioritize your children’s education goals and ensure they have the financial support they need when the time comes.

In conclusion, prioritizing your financial goals is vital for a successful financial journey. Begin by assessing your financial situation, understanding the importance of goal prioritization, and analyzing your specific goals and their timelines. Consider your risk tolerance and investment horizon when making decisions, and establish a clear order of priority for your goals. Seek professional guidance when needed, whether it’s from a financial planner, real estate professional, or college savings specialist. With a strategic and well-planned approach, you can prioritize your financial goals effectively and work towards achieving financial security and success.