1. The Power Of Compound Interest: How Money Grows Over Time

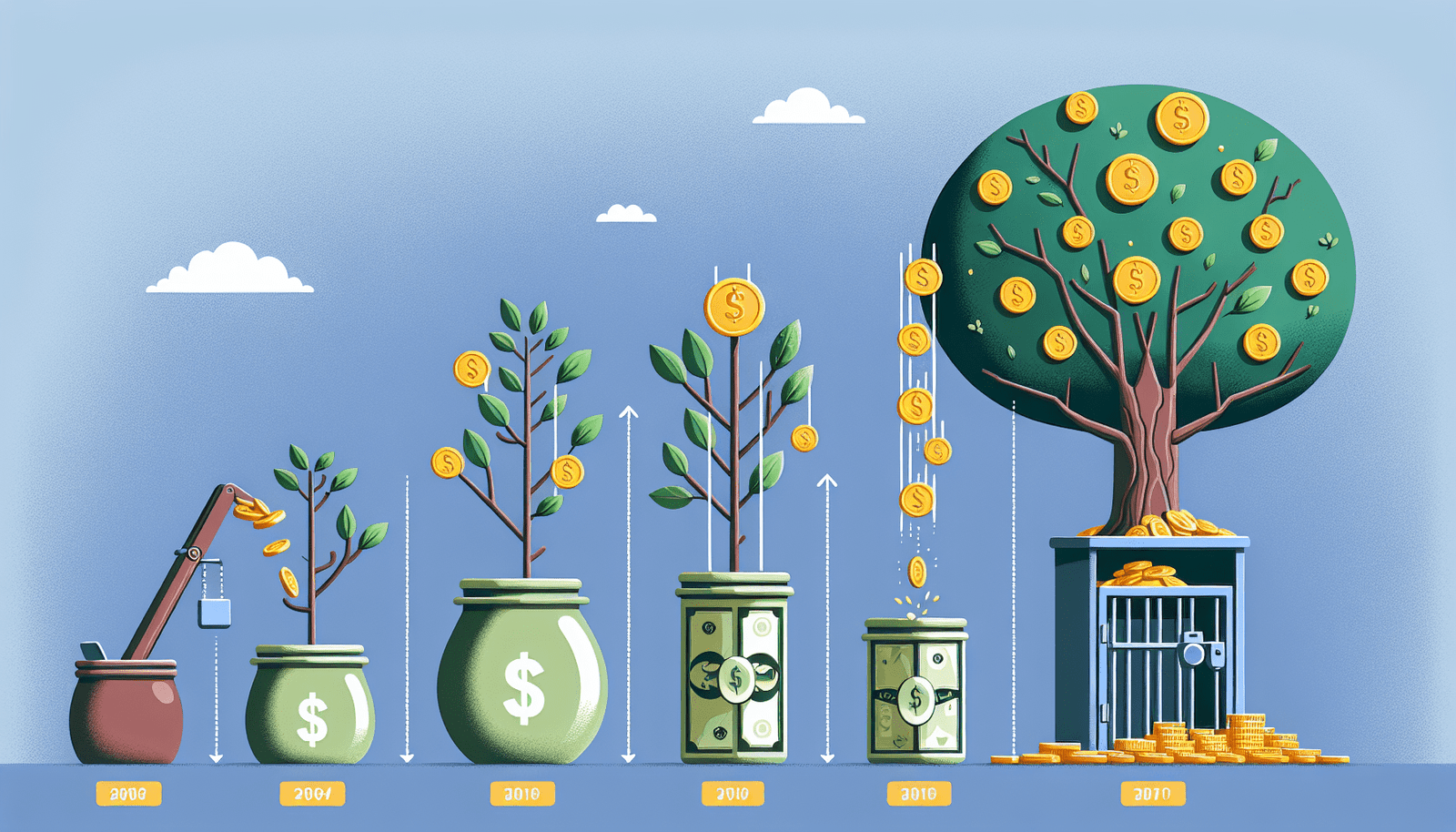

Imagine a world where your money has the ability to grow and multiply over time, all on its own. It may sound like a fantasy, but it’s actually the power of compound interest at work. Compound interest is an incredible financial concept that can turn your savings into a fortune if utilized wisely. In this article, we will explore the fascinating world of compound interest, understand how it works, and discover the potential it holds for your financial future. So sit back, relax, and prepare to be amazed by the power of compound interest.

2. What is Compound Interest?

Compound interest is a powerful financial concept that allows your money to grow over time. It is the interest earned on both the initial amount of money you invest or save (the principal) and the interest that has already been earned. In simple terms, compound interest is interest on top of interest.

2.1 Definition

Compound interest is the process of earning interest on both the initial investment and the previously earned interest. It allows your money to grow exponentially over time, thanks to the compounding effect.

2.2 How it works

Compound interest works by reinvesting the interest earned, allowing it to generate additional interest. As a result, your initial investment grows at an increasingly faster rate. This compounding effect is what sets compound interest apart from simple interest, which only earns interest on the principal amount.

2.3 Benefits of Compound Interest

Understanding the benefits of compound interest can motivate you to leverage its power to create long-term financial success.

2.3.1 Exponential Growth

One of the key benefits of compound interest is its ability to generate exponential growth. Over time, the interest earned on your initial investment adds up and starts to contribute significantly to your overall returns. The longer your money stays invested, the greater the compounding effect becomes. It’s like a snowball rolling downhill, gaining momentum and size as it goes.

2.3.2 Maximizing Investment Returns

Compound interest allows you to maximize your investment returns by earning interest not only on the principal but also on the accumulated interest. It is a snowball effect that amplifies your earnings over time, resulting in significant growth compared to investments without compound interest.

2.3.3 Building Wealth over Time

Compound interest can be a great tool for building wealth over time. By consistently reinvesting your earnings, you can harness the power of compounding to grow your savings and investments. By starting early and being consistent, compound interest can help you achieve your financial goals, such as saving for retirement or funding your child’s education.

2.4 Factors Affecting Compound Interest

Several factors influence how compound interest works and the final returns you can expect.

2.4.1 Interest Rate

The interest rate directly impacts the growth of your investment, as it determines how much interest is earned over time. A higher interest rate leads to faster growth, while a lower interest rate can slow down the growth rate.

2.4.2 Time

The time your money stays invested plays a crucial role in determining the final value of your investment. The longer your money is compounding, the more powerful the effect becomes. Time and patience are both important factors when it comes to making the most of compound interest.

2.4.3 Frequency of Compounding

The frequency at which interest is compounded also affects the growth of your investment. If interest is compounded annually, it means that interest is added to the principal once a year. On the other hand, compounding semi-annually, quarterly, or monthly can intensify the compounding effect and result in faster growth.

2.5 Compound Interest in Practice

Compound interest is applicable to various financial scenarios, such as savings accounts, investments, and loans.

2.5.1 Savings Accounts

Saving money in a compound interest-bearing account can be a smart way to grow your savings over time. By regularly depositing money and taking advantage of compound interest, your savings can steadily increase. Whether it’s a high-interest savings account or a certificate of deposit (CD), compound interest can help you reach your savings goals quicker.

2.5.2 Investments

Compound interest is also a significant factor in the world of investments. Whether you invest in stocks, bonds, mutual funds, or other financial instruments, the compounding effect can accelerate your returns. The longer your investments remain untouched, the more substantial the growth potential becomes.

2.5.3 Loans and Debt

Compound interest is not always beneficial. When it comes to loans and debt, compound interest can work against you. If you carry high-interest debt, such as credit card debt or payday loans, the interest can compound and grow rapidly, making it harder to pay off your debt. It’s essential to manage your debt wisely and avoid falling into a compounding debt trap.

2.6 Calculating Compound Interest

To calculate compound interest, you can use a simple formula that takes into account the principal, interest rate, time, and frequency of compounding.

Formula

The compound interest formula is:

A = P(1 + r/n)^(nt)

Where: A = the future value of the investment/loan, including interest P = the principal amount (initial investment/loan amount) r = the annual interest rate (expressed as a decimal) n = the number of times interest is compounded per year t = the number of years the money is invested/borrowed for

Examples

Let’s consider an example to illustrate how compound interest works:

You have $10,000 that you invest in a savings account with a 5% annual interest rate that compounds annually. After 10 years: A = $10,000 * (1 + 0.05/1)^(1*10) A = $10,000 * (1.05)^10 A = $10,000 * 1.6289 A = $16,289

So, your initial investment of $10,000 would grow to $16,289 over ten years, thanks to compound interest.

2.7 Importance of Starting Early in Compound Interest

Starting early is crucial when it comes to harnessing the full power of compound interest. Time is one of the most significant factors that influence the growth of your investments.

2.7.1 Time Value of Money

The concept of the time value of money illustrates that money available today is worth more than the same amount of money in the future. By starting early, you can take advantage of more time for your investments to grow. Even small contributions made early on can have a significant impact due to the compounding effect.

2.7.2 Effect of Compounding Over Time

Starting early allows your money to compound over a more extended period, leading to exponential growth. The longer your investments can generate compound interest, the greater the potential for significant wealth accumulation. Procrastination can cost you valuable time and limit the growth potential of your investments.

2.8 Strategies to Utilize Compound Interest

To reap the full benefits of compound interest, you can adopt various strategies in your financial planning.

2.8.1 Regular Savings

Consistently saving a portion of your income can help you leverage compound interest over time. Automating your savings through direct deposits or automatic transfers can make it easier to stay committed to regular contributions. By starting early and maintaining a disciplined savings routine, you can accelerate the growth of your savings.

2.8.2 Investing in High-Interest Accounts

Choosing high-interest savings accounts, certificates of deposit, or other investments with competitive interest rates can boost your earnings through compound interest. Researching and comparing different options can help you find the accounts or investments that offer attractive interest rates while maintaining a level of risk that aligns with your financial goals.

2.8.3 Diversifying Investments

Diversification is another key strategy when utilizing compound interest. By spreading your investments across different asset classes and sectors, you reduce the risk of significant losses while potentially benefiting from the compounding effect in multiple areas. Diversifying your investments can help you build a balanced and resilient portfolio.

2.9 Compound Interest vs Simple Interest

Compound interest and simple interest are two different ways of calculating the growth of your money over time.

2.9.1 Differences

The main difference between compound interest and simple interest is that compound interest earns interest on both the principal and the accumulated interest, while simple interest only earns interest on the principal amount. As a result, compound interest generally generates higher returns over time compared to simple interest.

2.9.2 Comparison of Growth Potential

By the nature of compound interest, it has a higher growth potential compared to simple interest. Compound interest allows your investment to grow exponentially as the interest compounds over time. Simple interest, on the other hand, grows linearly and does not offer the same compounding effect. Therefore, compound interest is often preferred for long-term wealth accumulation.

2.10 Famous Examples of Compound Interest

Several famous individuals have embraced the power of compound interest and achieved remarkable financial success.

2.10.1 Warren Buffett

Warren Buffett, one of the world’s most successful investors, is a living testament to the power of compound interest. Through consistent and disciplined investing strategies, Buffett has been able to powerfully compound his initial investments, allowing him to amass incredible wealth.

2.10.2 Benjamin Franklin

Benjamin Franklin, a renowned polymath and one of the Founding Fathers of the United States, emphasized the importance of compound interest. He recognized the long-term impact of regular investments compounded over time and left behind a significant example for future generations.

2.10.3 Albert Einstein

Albert Einstein, the brilliant physicist known for his theory of relativity, famously referred to compound interest as the “eighth wonder of the world.” He recognized the extraordinary potential of compound interest and credited it as a crucial factor in accumulating wealth.

3. Conclusion

Harnessing the power of compound interest is a key ingredient in building long-term financial success. By understanding how compound interest works and consistently leveraging its benefits, you can grow your wealth exponentially over time. Whether through savings accounts, investments, or minimizing debt, compound interest can be a powerful tool on your journey towards financial freedom. Start early, be patient, and watch your money grow with the magic of compound interest.