Are you interested in starting to invest, but not sure where to begin? Whether you have a modest amount of money or just want to dip your toes into the world of investing, there are essential steps you can take to get started. One key aspect to consider is how you can diversify your investments to minimize risk and optimize potential returns. In this article, we will explore practical tips and strategies that can help you embark on your investment journey, regardless of your budget. Let’s delve into the exciting world of investing and discover how you can make your money work for you!

1. Setting Financial Goals

Define short-term and long-term financial goals

Setting financial goals is an important step in managing your finances and working towards financial independence. When setting your goals, it’s important to distinguish between short-term and long-term goals. Short-term goals are typically things you want to achieve within the next few years, such as saving for a vacation or buying a new car. Long-term goals, on the other hand, are aspirations that may take several years or even decades to accomplish, such as saving for retirement or buying a house.

To define your financial goals, start by identifying your priorities and what you hope to achieve financially in the short-term and long-term. Perhaps you want to save a certain amount of money for a down payment on a house, pay off your student loans within the next five years, or retire comfortably at a certain age. By having clear goals in mind, you can create a roadmap for your financial journey and make better decisions with your money.

Consider time frame and risk tolerance

When setting your financial goals, it’s important to consider the time frame and your risk tolerance. Time frame refers to the amount of time you have to achieve a particular goal. If you have a short time frame, such as a few years, you may need to allocate more of your income towards that specific goal. On the other hand, if you have a longer time frame, you can take advantage of compounding returns and potentially take on more investment risk.

Risk tolerance refers to your comfort level with potential investment losses. Some individuals are more conservative and prefer stable investments, while others are more willing to take on higher risks for potentially higher returns. Understanding your risk tolerance will help you determine the right investment strategies to achieve your goals.

By considering both the time frame and risk tolerance, you can create a personalized financial plan that aligns with your goals.

2. Building an Emergency Fund

Importance of having an emergency fund

Having an emergency fund is crucial for financial security and peace of mind. Life is full of unexpected events, such as medical emergencies, job loss, or major car repairs, and having a financial cushion in place can help you navigate these situations without experiencing financial hardship. An emergency fund provides a safety net and helps prevent you from going into debt or depleting your savings for unexpected expenses.

How much to save for emergencies

The general rule of thumb is to aim for three to six months’ worth of living expenses in your emergency fund. This amount can vary depending on your individual circumstances, such as your income stability, job security, and monthly expenses. If you have a higher risk of experiencing financial setbacks, you may want to err on the side of saving more.

To determine how much you need to save, start by calculating your monthly expenses, including rent or mortgage payments, utilities, groceries, transportation, insurance, and any other essential expenses. Multiply this amount by the number of months you feel comfortable having as a financial buffer. For example, if your monthly expenses amount to $3,000 and you want to have a six-month emergency fund, you should aim to save $18,000.

Building an emergency fund takes time and discipline, but it is an essential step in securing your financial future.

3. Paying Off High-Interest Debt

Why paying off high-interest debt is a priority

High-interest debt, such as credit card debt or personal loans, can be a significant financial burden and hinder your ability to save and invest. The interest charges on these debts can accumulate quickly and make it difficult for you to make progress with your financial goals.

By prioritizing the repayment of high-interest debt, you can save money on interest payments and free up more funds to put towards savings and investments. It’s important to tackle high-interest debt first because the interest rates on these debts are typically higher than the potential returns you can earn through investments.

Strategies to tackle debt

To effectively pay off high-interest debt, consider implementing the following strategies:

-

Debt Snowball Method: This method involves tackling your smallest debts first while making minimum payments on the rest. Once the smallest debt is paid off, you move on to the next smallest debt. This method can provide a sense of accomplishment and motivation as you see progress being made.

-

Debt Avalanche Method: With this method, you prioritize paying off debts with the highest interest rates first, regardless of the debt amounts. By focusing on high-interest debts, you can save more money on interest payments in the long run.

-

Consolidation: If you have multiple high-interest debts, consolidating them into a single loan or balance transfer credit card with a lower interest rate can help simplify your payments and potentially save you money on interest.

Choose a strategy that aligns with your financial situation and preferences, and remember to stay committed to your debt repayment plan until you become debt-free.

4. Determining Investment Amount

Assess available funds for investment

Before diving into the world of investing, it’s important to assess how much money you can allocate towards your investments. Take an honest look at your finances and identify the amount of disposable income you have after covering your basic expenses, debt payments, and emergency savings contributions. This is the amount that you can comfortably allocate towards investments without compromising your financial stability.

Consider affordability and risk tolerance

When determining the investment amount, it’s crucial to consider affordability and risk tolerance. While investing can offer potentially higher returns, it also carries risks, and there is always a chance of losing money. Be realistic about your financial situation and only invest an amount that you are comfortable with and can afford to lose.

Every individual’s risk tolerance is different, and it’s important to find a balance between accepting some level of risk for potential growth and maintaining peace of mind. If the thought of losing money keeps you up at night, you may want to choose more conservative investment options.

Consider consulting a financial advisor or doing thorough research to find the right investment amount that aligns with your financial goals, affordability, and risk tolerance.

5. Understanding Investment Options

Research various investment options

Understanding the different investment options available is essential before you start investing. Researching and educating yourself will help you make informed decisions and choose the right investments for your financial goals.

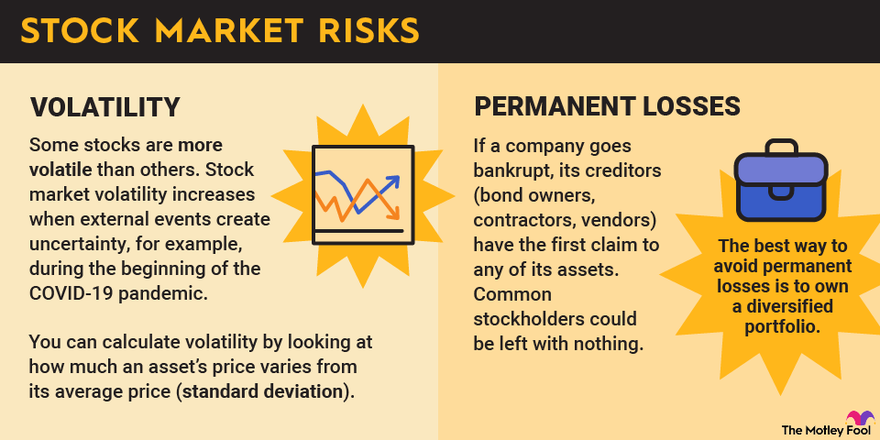

There is a wide range of investment options to consider, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Each investment option comes with its own set of risks and potential returns. Stocks, for example, represent ownership in a company and offer the possibility of significant gains but also carry the risk of losing value. Bonds, on the other hand, are considered safer and provide regular interest payments, but with relatively lower returns.

Explore stocks, bonds, mutual funds, and ETFs

Stocks are equity investments that represent shares of ownership in a company. They can provide growth and potential dividends but are also subject to market fluctuations. Bonds, on the other hand, are debt instruments issued by governments and corporations to raise capital. They pay fixed interest over a set period and are generally considered to be lower-risk investments.

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. They offer instant diversification and professional management but come with costs in the form of management fees. ETFs, or exchange-traded funds, are similar to mutual funds but trade on an exchange like a stock. They provide diversification and can be more cost-efficient due to lower expense ratios.

It’s important to understand the characteristics and risks of each investment option, as well as how they align with your financial goals and risk tolerance.

6. Choosing the Right Brokerage Account

Evaluate brokerage account options

Choosing the right brokerage account is crucial for successful investing. A brokerage account serves as a platform for buying and selling investments. When evaluating brokerage account options, consider the following factors:

-

Fees: Different brokerages charge various fees, such as commissions, account maintenance fees, and transaction fees. Compare the fee structures of different brokerages to find one that aligns with your investing strategy and budget.

-

Account Types: Brokerages offer different types of accounts, such as individual accounts, joint accounts, retirement accounts (like IRAs), and education savings accounts (like 529 plans). Consider your investment objectives and the type of account that best suits your needs.

-

Customer Support: Look for a brokerage that offers reliable customer support and educational resources to assist you throughout your investment journey. Good customer support can be valuable, especially if you’re new to investing.

It’s important to review and compare different brokerage options to find the one that provides the services, features, and fees that meet your needs.

7. Creating a Diversified Portfolio

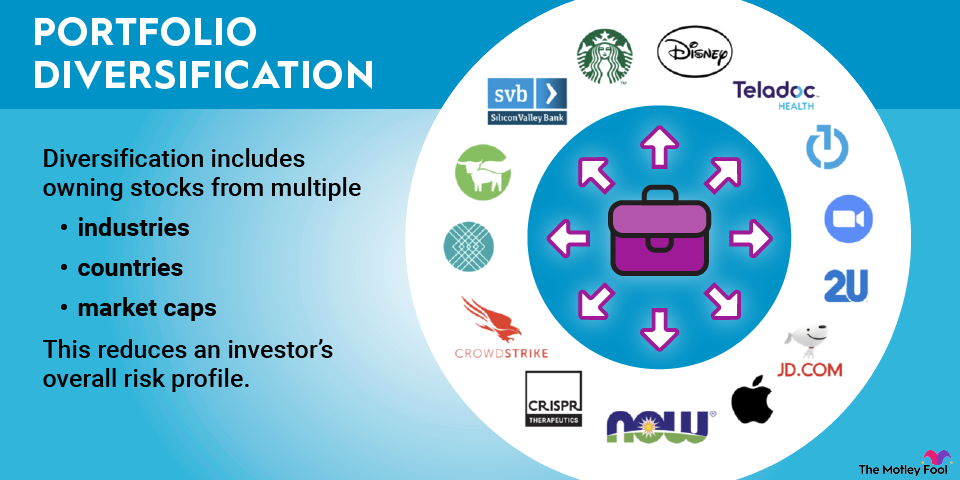

Importance of diversification in investment

Diversification is a fundamental principle of investing that involves spreading your investments across a variety of asset classes, sectors, and geographic regions. The goal of diversification is to reduce the impact of any single investment on your portfolio’s overall performance and to potentially mitigate risk.

By diversifying your portfolio, you can potentially increase your chances of generating returns while managing risk. Holding a mix of different types of investments can help offset losses in one area with gains in another, providing a more stable and consistent return over time.

Allocating investments across different asset classes

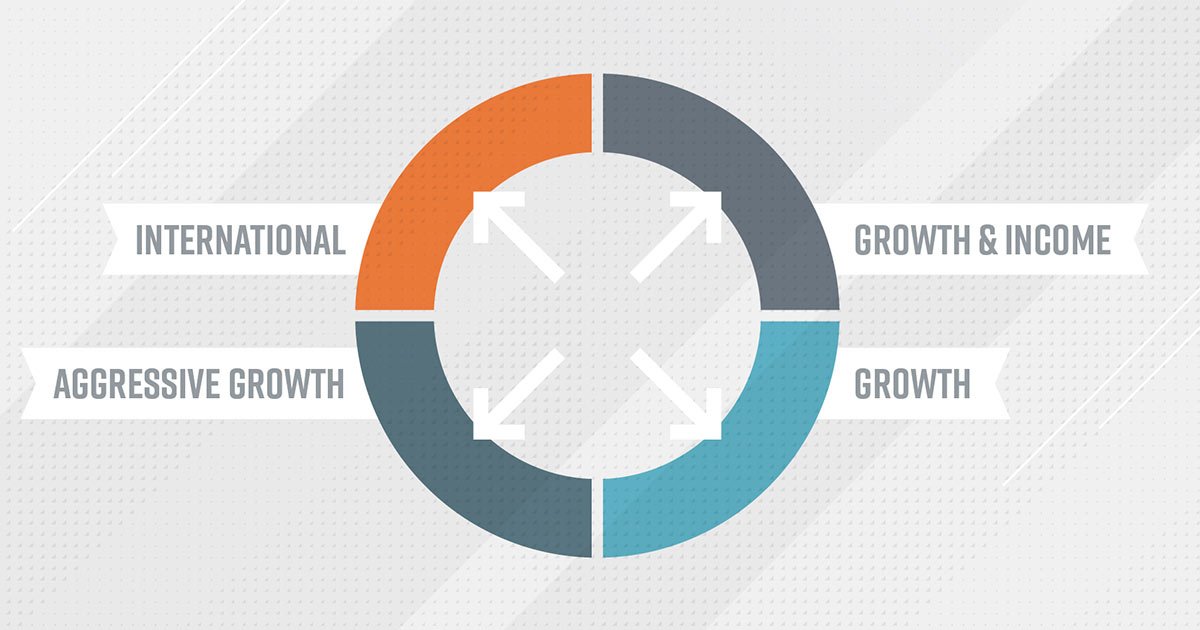

To create a diversified portfolio, it’s important to allocate your investments across different asset classes, such as stocks, bonds, and cash equivalents. The specific allocation will depend on factors such as your investment goals, risk tolerance, and time horizon.

For example, a young investor with a long time horizon and a higher risk tolerance may choose to allocate a larger portion of their portfolio to stocks for potential long-term growth. On the other hand, an older investor nearing retirement may opt for a more conservative approach with a larger allocation to bonds and cash equivalents for capital preservation and income generation.

It’s important to periodically review and rebalance your portfolio to maintain the desired asset allocation and ensure it aligns with your changing financial goals and risk tolerance.

8. Utilizing Dollar-Cost Averaging

Explanation of dollar-cost averaging

Dollar-cost averaging (DCA) is an investing strategy that involves regularly investing a fixed amount of money into the market at predetermined intervals, regardless of the investment’s price. This strategy allows you to buy more shares when prices are low and fewer shares when prices are high. Over time, this can potentially result in a lower average cost per share.

DCA is a disciplined approach to investing that helps reduce the impact of short-term market fluctuations. Instead of trying to time the market and make investment decisions based on short-term price movements, DCA focuses on the long-term performance of the investment.

Benefits of investing regularly over time

There are several benefits to utilizing dollar-cost averaging:

-

Discipline: DCA encourages regular investing and helps remove the temptation to make impulsive investment decisions based on emotions or short-term market trends.

-

Mitigating market volatility: By consistently investing over time, DCA helps smooth out the impact of market volatility. When markets are down, you can take advantage of lower prices and potentially buy more shares.

-

Long-term growth potential: Investing regularly over time allows you to participate in the long-term growth of the market. It also helps take advantage of the power of compounding returns.

Dollar-cost averaging is a strategy that can be utilized by investors of all levels and is particularly useful for those who want to start investing with a modest amount of money.

9. Monitoring and Adjusting Investments

Regularly review investment performance

Once you’ve started investing, it’s important to regularly review the performance of your investments. Monitoring your investments allows you to stay informed about how your portfolio is performing and make any necessary adjustments to stay on track with your financial goals.

Keep an eye on key factors such as investment returns, fees, and overall portfolio allocation. Pay attention to any changes in the market or economic landscape that may impact your investments.

Rebalance portfolio based on goals and market conditions

Rebalancing your portfolio involves periodically adjusting the asset allocation to maintain the desired balance based on your goals and market conditions. Over time, certain investments may outperform or underperform, causing your asset allocation to deviate from your original plan.

By rebalancing, you bring your portfolio’s allocation back in line with your target allocation. This ensures that you’re not taking on more risk than intended and allows you to take advantage of potential opportunities in the market.

It’s important to determine a rebalancing strategy that aligns with your investment goals and risk tolerance. Some investors choose to rebalance on a set schedule, such as annually or semi-annually, while others rebalance only when the allocation deviates significantly from the target.

Regularly monitoring and adjusting your investments will help you stay on track and make informed decisions to maximize your investment returns.

10. Seeking Professional Advice

Consider consulting a financial advisor

If navigating the world of investing feels overwhelming or you want personalized guidance tailored to your specific financial situation, it may be beneficial to consult a financial advisor. A financial advisor can provide expertise, advice, and create a customized plan that aligns with your goals and risk tolerance.

A qualified financial advisor can offer valuable insights and help you make informed decisions, particularly when it comes to complex investment strategies, tax planning, and retirement planning.

Get personalized guidance and expertise

Financial advisors can assist in creating a comprehensive financial plan, including setting goals, debt management, investment recommendations, and retirement planning. By leveraging their expertise, you can gain confidence in your financial decisions and leverage their knowledge and resources for your benefit.

When choosing a financial advisor, consider factors such as their credentials, experience, and fee structure. Remember that engaging with a financial advisor is a collaborative process, and it’s important to find someone who understands your needs and aligns with your values.

Even if you decide to consult a financial advisor, it’s important to educate yourself and ask questions to ensure that you understand the recommendations being made and are actively involved in the decision-making process.

In conclusion, starting your investment journey with a modest amount of money is possible by following these essential steps. By setting clear financial goals, building an emergency fund, paying off high-interest debt, determining your investment amount, understanding investment options, choosing the right brokerage account, creating a diversified portfolio, utilizing dollar-cost averaging, monitoring and adjusting investments, and seeking professional advice, you can lay a strong foundation for your financial future. Remember to continue learning and adapting your investment strategies as your goals and circumstances evolve.