Are you wondering if your investments are properly diversified across different asset classes? In this article, we will explore the importance of diversification and how it can help protect your portfolio from volatility and minimize risk. Whether you have investments in stocks, bonds, real estate, or other assets, understanding the level of concentration in your portfolio is crucial for long-term financial success. So, let’s dive into the world of asset allocation and determine if you are diversified or if your concentration needs a little tweaking.

Why Diversification Is Important

Diversification as a Risk Management Strategy

Diversification is an investment strategy that involves spreading your investments across different asset classes to mitigate risk. By diversifying your portfolio, you can potentially reduce the impact of a single investment or asset class performing poorly. This helps protect your overall investment portfolio from significant losses. When one investment is underperforming, others may be performing well, helping to balance out your returns.

Benefits of Diversification

Diversification offers several benefits to investors. Firstly, it can help reduce the volatility of your overall portfolio. By including assets that have a low correlation with each other, you can smooth out the ups and downs of your investments, leading to potentially more consistent returns over time. Secondly, diversification allows you to take advantage of different investment opportunities and market conditions. By holding a mix of asset classes, you have the potential to benefit from various economic environments, such as when bonds perform well during a stock market downturn. Lastly, diversification can provide a sense of security and peace of mind, as it spreads the risk across different investments and prevents you from relying too heavily on a single asset or sector.

Understanding Different Asset Classes

Stocks

Stocks represent ownership in a company and are considered a common investment choice for many individuals. Investing in stocks allows you to participate in the potential growth and profitability of the company. However, stocks can be volatile, and their value can fluctuate in response to various factors, such as economic conditions, industry trends, or company-specific news.

Bonds

Bonds are debt securities issued by governments, municipalities, or corporations to raise capital. When you invest in bonds, you are essentially lending money to the issuer in exchange for periodic interest payments and the return of the principal amount at maturity. Bonds are generally considered less risky than stocks and can provide a steady stream of income, making them an attractive option for investors seeking stability and regular cash flow.

Real Estate

Investing in real estate involves purchasing physical properties or investing in real estate investment trusts (REITs) that own income-generating properties. Real estate can offer both income and potential appreciation over time. This asset class can provide diversification benefits, as it has historically shown low correlation to other traditional asset classes such as stocks and bonds.

Commodities

Commodities are raw materials or primary agricultural products that can be bought and sold in the market. Examples include gold, oil, natural gas, wheat, and corn. Investing in commodities can serve as a hedge against inflation and currency fluctuations. However, commodities can be highly volatile, and their prices can be influenced by various factors such as supply and demand dynamics, weather conditions, geopolitical events, and economic indicators.

Cryptocurrencies

Cryptocurrencies are digital or virtual currencies that use cryptography for security. Bitcoin, Ethereum, and Ripple are some well-known cryptocurrencies. Investing in cryptocurrencies can be highly speculative and entails substantial risk due to their price volatility and regulatory uncertainties. While some investors view cryptocurrencies as a potential long-term investment, others perceive them as a speculative asset class.

Evaluating Your Asset Allocation

Assessing Portfolio Allocation

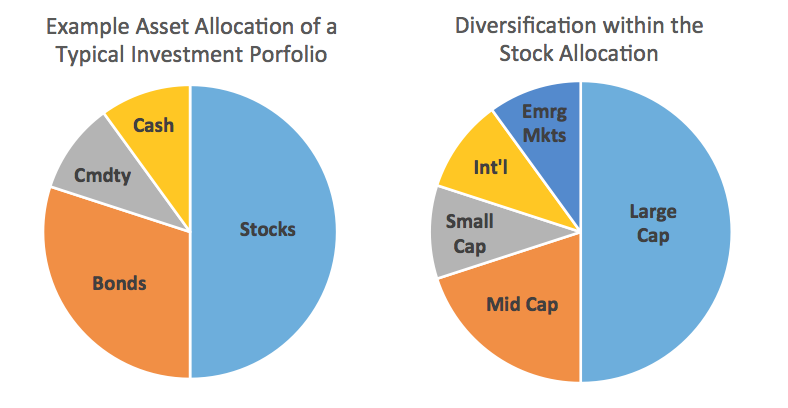

To determine whether you are adequately diversified, you must evaluate the current allocation of your portfolio across different asset classes. Analyze the percentage of your investments in stocks, bonds, real estate, commodities, and cryptocurrencies. It’s essential to have a clear understanding of your current asset allocation before making any changes or adjustments.

Determining the Ideal Asset Mix

The ideal asset mix varies depending on factors such as your risk tolerance, investment goals, and time horizon. Someone with a high-risk tolerance and a long-term investment horizon may have a higher proportion of stocks in their portfolio, while those with a lower risk tolerance may allocate more to bonds or real estate. It can be helpful to consult with a financial advisor to determine the asset mix that aligns with your financial objectives.

Consideration of Risk Tolerance

Risk tolerance refers to your ability and willingness to endure fluctuations in the value of your investments. It is important to consider your risk tolerance when determining your asset allocation. If you have a higher risk tolerance, you may be comfortable allocating a larger percentage of your portfolio to riskier asset classes such as stocks or cryptocurrencies. Conversely, if you have a lower risk tolerance, a larger allocation to more conservative options like bonds or real estate may be appropriate.

Long-Term Financial Goals

Your long-term financial goals should also play a role in determining your asset allocation. If you have specific financial objectives, such as saving for retirement or funding your child’s education, you may need to adjust your asset allocation to align with those goals. It’s crucial to consider the timeframe for achieving your goals and make investment decisions accordingly.

Signs of Over-Concentration in One Area

Lack of Asset Class Variety

One sign of over-concentration is a lack of asset class variety in your portfolio. If the majority of your investments are limited to just one or two asset classes, such as stocks or real estate, you may be too concentrated and exposed to the risks specific to those asset classes. Diversifying across different asset classes can help mitigate this risk and provide a more balanced portfolio.

Overwhelming Allocation to a Single Asset Class

Having an overwhelming allocation to a single asset class is another indication of over-concentration. For example, if the bulk of your portfolio consists of stocks from a particular industry or sector, you may face increased risk if that sector underperforms. By diversifying your investments across multiple sectors or industries, you can reduce the impact of any one sector’s poor performance on your overall portfolio.

Sector or Industry Concentration

Concentrating your investments in a particular sector or industry can be risky, as the performance of that sector or industry may be influenced by specific factors beyond your control. For instance, if you have a significant portion of your portfolio invested in technology stocks and the technology sector experiences a downturn, your portfolio could suffer significant losses. Diversifying across various sectors or industries can help mitigate this risk.

Consequences of Over-Concentration

Increased Portfolio Volatility

Over-concentration in one area can lead to increased portfolio volatility. When a significant portion of your investments are concentrated in one asset class or sector, the performance of that particular asset or sector will have a more substantial impact on your overall portfolio. If that asset class or sector experiences a downturn, your portfolio may suffer significant losses. Diversification helps to mitigate this volatility by spreading risk across different assets, potentially reducing the impact of any single investment.

Exposure to Sector-Specific Risks

Over-concentration in a specific sector or industry exposes your portfolio to sector-specific risks. Industries and sectors face unique challenges and opportunities that can impact their performance. By diversifying your investments across various sectors, you can reduce the impact of sector-specific risks by ensuring that poor performance in one sector is balanced by better performance in other sectors.

Lack of Diversification Benefits

By concentrating your investments in one area, you miss out on the benefits of diversification. Diversification allows you to potentially earn returns from different sources, as various asset classes tend to perform differently under different market conditions. By spreading your investments across multiple asset classes, you increase the likelihood of capturing upside potential and reducing downside risk.

Steps to Achieve Diversification

Assessing Current Portfolio Allocation

The first step toward achieving diversification is to assess your current portfolio allocation. Analyze the percentage of your investments in different asset classes and determine if there is an over-concentration in any one area. Understanding your current allocation will help you identify areas that need adjustment.

Identifying Underrepresented Asset Classes

Identify underrepresented asset classes in your portfolio. Look for asset classes that you may be lacking or have a minimal allocation to. For example, if you have predominantly invested in stocks and bonds, consider adding exposure to real estate, commodities, or cryptocurrencies. By adding underrepresented asset classes, you can broaden your diversification and potentially improve your risk-return profile.

Implementing a Diversification Strategy

Once you have identified underrepresented asset classes, it’s time to implement a diversification strategy. Determine the desired allocation for each asset class and make appropriate adjustments to your portfolio. This may involve buying or selling investments to rebalance your portfolio and bring it in line with your desired asset allocation. Regular monitoring and adjustments to ensure ongoing diversification are essential.

Considerations for Diversifying Across Asset Classes

Correlation Among Asset Classes

When diversifying across asset classes, it is crucial to consider the correlation among different asset classes. Correlation measures the relationship between the returns of two asset classes. Assets with a low or negative correlation tend to move differently, providing potential diversification benefits. Ideally, you want to include asset classes that have a low correlation with each other, as this can help reduce the overall volatility of your portfolio.

Different Investment Time Horizons

Different asset classes often have different investment time horizons. Some, like stocks, are more suitable for long-term investments, while others, like bonds, can provide shorter-term income generation. Consider your investment goals and time frame when selecting asset classes for diversification. Aligning the investment time horizons of different asset classes with your goals can help ensure you have sufficient liquidity and meet your financial needs at various stages.

Risk-Return Tradeoff

Diversification involves balancing risk and return. Some asset classes, such as stocks and cryptocurrencies, have the potential for higher returns but come with increased risk and volatility. On the other hand, assets like bonds and real estate can offer more stability but may have lower potential returns. When diversifying, consider the risk-return tradeoff and ensure that the asset mix aligns with your risk tolerance and return objectives.

Common Diversification Mistakes to Avoid

Ignoring International Markets

One common mistake is ignoring international markets when diversifying. Many investors focus primarily on their home market and overlook the potential benefits of investing in international stocks, bonds, or real estate. By diversifying globally, you can gain exposure to different economies, industries, and opportunities, reducing your reliance on a single market and potentially enhancing your risk-adjusted returns.

Chasing Hot Investment Trends

Chasing hot investment trends can also hinder effective diversification. Investors often get lured into investing heavily in the latest market fad without considering the long-term viability or the potential risks involved. Concentrating investments in a particular asset class or sector solely based on short-term performance can lead to over-concentration and increased portfolio risk. It’s important to focus on a well-rounded and diversified portfolio rather than chasing temporary market trends.

Neglecting Regular Portfolio Rebalancing

Neglecting regular portfolio rebalancing is another mistake that can lead to over-concentration. As market conditions change, the performance of different asset classes can diverge, causing your portfolio to deviate from your desired asset allocation. Regularly rebalancing your portfolio by selling overperforming assets and buying underperforming ones helps maintain the desired asset mix and ensures diversification is maintained.

Using Investment Vehicles for Diversification

Mutual Funds and Exchange-Traded Funds (ETFs)

Mutual funds and exchange-traded funds (ETFs) are investment vehicles that can provide instant diversification across various asset classes. These funds pool money from multiple investors and invest in a broad range of securities, such as stocks, bonds, and commodities. By investing in mutual funds or ETFs, you can gain exposure to a diversified portfolio without the need to individually select and manage multiple securities.

Diversified Index Funds

Diversified index funds are another investment option for achieving diversification. These funds aim to replicate the performance of a specific market index, such as the S&P 500 or the FTSE 100. By investing in diversified index funds, you gain exposure to a broad range of stocks or bonds that make up the index, providing instant diversification within a single investment.

Target-Date Retirement Funds

Target-date retirement funds are mutual funds or ETFs designed for investors who have a specific retirement date in mind. These funds automatically adjust the asset mix as the retirement date approaches, gradually reducing the allocation to higher-risk assets like stocks and increasing the exposure to more conservative options like bonds. Target-date retirement funds offer diversification and provide a convenient investment option for long-term retirement planning.

Seeking Professional Financial Advice

Consulting a Financial Advisor

Seeking professional financial advice is recommended, especially if you are uncertain about your asset allocation or lacking investment experience. A financial advisor can provide personalized guidance based on your individual financial goals, risk tolerance, and time horizon. They can help you design a diversified investment strategy that aligns with your objectives and assist in implementing the necessary adjustments.

Utilizing Robo-Advisors

Robo-advisors are digital platforms that use algorithms to provide automated investment advice and portfolio management. These platforms offer diversification strategies tailored to your risk profile and investment goals. Robo-advisors can be a cost-effective and convenient option for investors seeking professional guidance without the high fees often associated with traditional financial advisors.

In conclusion, diversification is a vital risk management strategy that can help protect your investment portfolio from major losses and provide a more balanced and potentially consistent return over time. By understanding different asset classes, assessing your asset allocation, avoiding over-concentration, and utilizing various investment vehicles, you can achieve effective diversification and improve your overall investment outcomes. Whether you seek professional financial advice or manage your portfolio independently, maintaining a diversified investment approach is crucial for long-term success.