Are you wondering if your investment portfolio is properly diversified across various asset classes? In this article, we explore the importance of diversification and whether you may be too concentrated in one area. Additionally, we delve into the benefits of utilizing tax-advantaged accounts like IRAs and 401(k)s to maximize your investment returns. So, if you’re eager to evaluate your investment strategy and ensure you’re making the most of your financial opportunities, keep reading!

Assessing Diversification Across Asset Classes

Understanding the Concept of Diversification

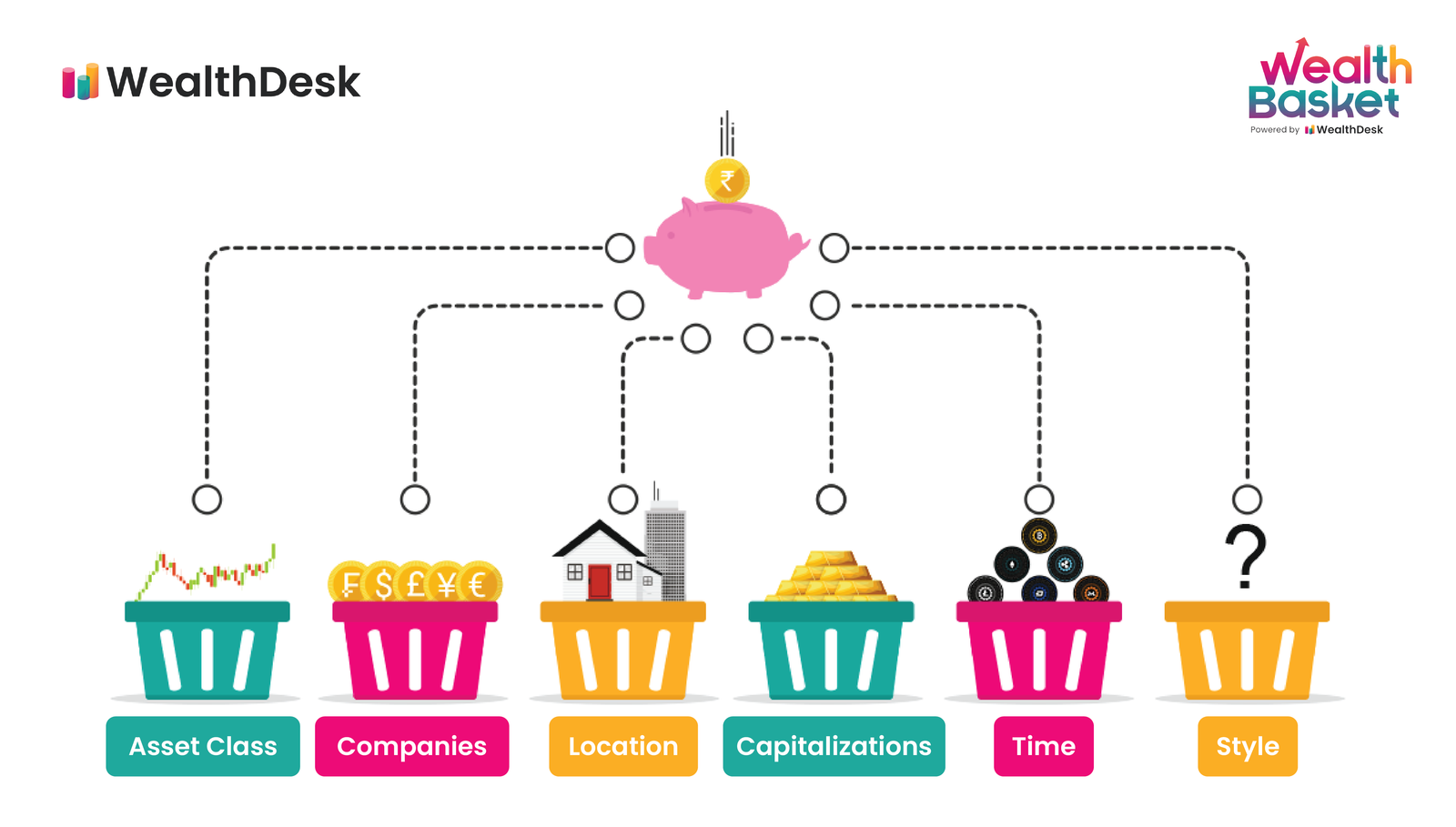

Diversification is a fundamental principle in investment strategy that involves spreading your investments across different asset classes. It aims to reduce the risk of losses by avoiding overconcentration in a single investment or asset class. By diversifying your portfolio, you can potentially increase your returns and mitigate the impact of any negative events that may affect a specific asset class.

Analyzing the Importance of Asset Allocation

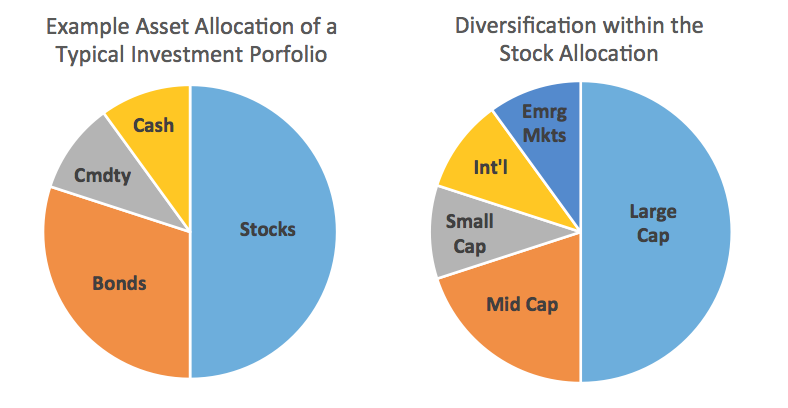

Asset allocation is the process of determining how much of your portfolio should be invested in different asset classes, such as stocks, bonds, real estate, commodities, and cash equivalents. It is a crucial aspect of investment management as it has a significant impact on portfolio performance. The goal of asset allocation is to strike a balance between risk and return based on your financial goals, risk tolerance, and time horizon.

Evaluating Portfolio Risk and Return

When analyzing your portfolio, it is essential to evaluate both the risk and return associated with your investments. Risk is the possibility of losing money or not achieving the expected returns, while return refers to the profits or gains generated from your investments. Different risk measures, such as standard deviation and beta, can help assess portfolio risk, while return measures such as total return and annualized return can evaluate the overall performance of your portfolio.

Identifying Different Asset Classes

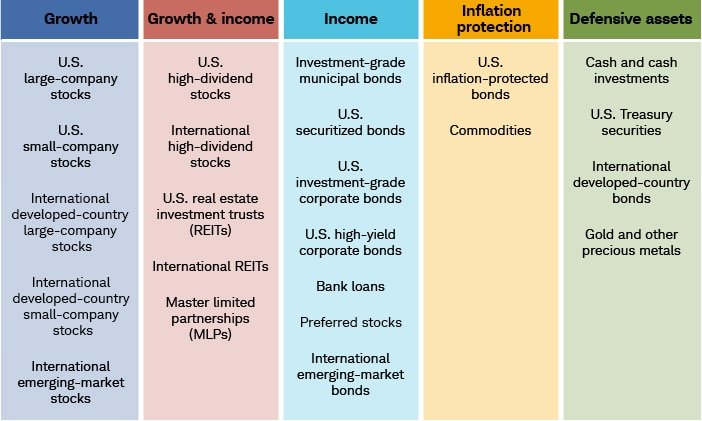

There are various asset classes that investors can consider for diversification. Stocks represent ownership shares in companies and offer the potential for capital appreciation. Bonds, on the other hand, are debt securities issued by governments, municipalities, or corporations, and provide fixed income to investors. Real estate offers the potential for rental income and capital appreciation, while commodities and precious metals provide opportunities for diversification beyond traditional investments. Cash and cash equivalents, such as savings accounts and money market funds, offer stability and liquidity.

Reviewing Current Asset Allocation

To assess your diversification, you should review your current asset allocation. It involves analyzing the allocation of your investments across different asset classes. By determining the percentage of your portfolio invested in stocks, bonds, real estate, commodities, and other asset classes, you can identify if you are too concentrated in one area. This review helps ensure that you have a well-balanced and diversified portfolio that aligns with your investment goals and risk tolerance.

Balancing Risk and Return

Finding the right balance between risk and return is crucial in optimizing your portfolio. Risk-return tradeoff refers to the idea that higher potential returns are often associated with higher levels of risk. It is important to consider your risk tolerance and financial goals when determining the appropriate asset allocation for your portfolio. By diversifying across different asset classes, you can reduce the overall risk of your portfolio while still seeking satisfactory returns.

Considering Market Conditions

Market conditions play a significant role in determining the performance of different asset classes. Economic factors, such as interest rates, inflation, and market cycles, can impact the returns and risks associated with specific investments. It is essential to stay informed about the current economic landscape and adapt your asset allocation accordingly. For example, during periods of economic expansion, it may be beneficial to allocate more towards stocks, while during recessions, a higher allocation to bonds and cash equivalents may be prudent.

Exploring the Benefits of Diversification

Diversification offers several benefits to investors. First and foremost, it helps to reduce the volatility of your portfolio. By spreading your investments across different asset classes with varying risk and return profiles, you can decrease the impact of any individual investment on your overall portfolio. Diversification also helps to mitigate unsystematic risk, which refers to risks that are specific to particular companies or industries. Additionally, diversification provides the potential to minimize potential losses and improve risk-adjusted returns by optimizing the combination of assets in your portfolio.

Examining the Drawbacks of Over-Diversification

While diversification is generally beneficial, there can be drawbacks to over-diversification. Over-diversification occurs when the number of investments in a portfolio exceeds the point where additional investments no longer contribute significantly to reducing risk. It can lead to diluted returns if the portfolio becomes too spread out. Over-diversification may also result in higher transaction costs and a lack of focus on investments that could have a more substantial impact on portfolio performance.

Seeking Professional Advice to Optimize Diversification

Optimizing diversification requires a thorough understanding of various asset classes, risk management, and market conditions. Seeking professional advice from financial advisors can be beneficial in achieving this goal. Financial advisors can provide personalized recommendations based on your financial goals, risk tolerance, and time horizon. They can also help regularly monitor and rebalance your portfolio to ensure that it remains aligned with your investment objectives. By working with a professional, you can navigate the complexities of diversification and make informed decisions for optimal portfolio performance.

In summary, diversification across asset classes is crucial in building a well-rounded investment portfolio. Understanding the concept of diversification, analyzing asset allocation, evaluating portfolio risk and return, identifying different asset classes, and reviewing current asset allocation are key steps in assessing and optimizing diversification. By considering market conditions and exploring the benefits of diversification, investors can enhance their risk-adjusted returns and work towards long-term wealth preservation. Seeking professional advice can further optimize diversification efforts, ensuring a balanced approach to portfolio management. Remember, diversification is a valuable strategy that can help you achieve your financial goals while managing risk effectively.