Learn how to establish clear financial boundaries with friends and family. Foster trust, avoid misunderstandings, and maintain healthy relationships.

Is It a Real Emergency? Key Signs You’ve Used Your Emergency Fund Wisely

Learn how to determine if you’ve used your emergency fund for a genuine emergency. Assess the purpose, define true emergencies, and evaluate alternatives.

Mastering Monthly Expense Tracking: Never Miss a Cent Again

Learn how to accurately account for all your monthly expenses in this informative post. Discover the importance of thorough expense tracking and get practical tips to ensure you don’t miss a single cent. #budgeting #expensemanagement

Why Regularly Reassessing Your Savings Goals is Key to Financial Success

Reassess and adapt your savings goals to fit your evolving circumstances. Explore the importance of regular evaluation and adjustments in this informational post.

Benefits of Participating in Local Community Initiatives and Events

Did you know that participating in local community initiatives and events can bring a multitude of benefits to your life? From personal growth to financial gain, getting involved in your community can…

Smart Ways to Cut or Reduce Non-Essential Expenses

Discover smart ways to cut or reduce non-essential expenses. Learn how to create a budget, minimize housing and transportation costs, cut entertainment expenses, reduce utility bills, manage shopping habits, cut cable and phone costs, save on health and wellness, and evaluate subscriptions and memberships. Start saving money today!

Invest in Yourself: The Benefits of Personal Development for Career Advancement

Maximize your earning potential by investing in personal development. Explore the importance of self-improvement and discover how it unlocks new skills and opportunities for professional success. Start your journey of personal growth today.

Tackle Overspending: Tips to Control Expenses and Boost Savings

Learn how to identify and reduce overspending in specific categories to gain control over your finances. Find ways to save and make informed choices.

10 Lucrative Side Gigs to Boost Your Income

Looking to boost your earnings? Explore new sources of income through freelancing, renting out property, starting a small business, investing, peer-to-peer lending, affiliate marketing, creating online courses, renting out assets or storage space, or participating in market research. Diversify and maximize your earning potential!

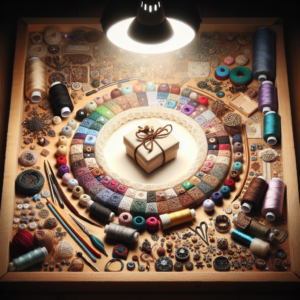

Creative Handmade Gifts: Personal Touch Presents That Save You Money

Imagine being able to give a heartfelt gift that doesn’t break the bank. With the rising costs of store-bought presents, it’s time to get creative and save some cash. By considering the option of craf…