When it comes to managing your investments, understanding the fees and expenses involved is crucial in maximizing your returns. It’s important to ask yourself: do I truly grasp the various fees that eat into my investment gains? And more importantly, am I taking the necessary steps to minimize any unnecessary costs? In this article, we’ll explore the importance of fee transparency, how fees can impact your investment performance, and some practical tips to help you minimize expenses and make the most of your hard-earned money.

Understanding Investment Fees and Expenses

Investing can be a powerful tool to grow your wealth over time, but it is important to understand the fees and expenses that can eat into your investment returns. By gaining a clear understanding of the different types of investment fees and expenses, you can make more informed decisions and potentially minimize unnecessary costs.

Understanding the Different Types of Investment Fees

When you invest in various financial products, such as mutual funds, exchange-traded funds (ETFs), or individual stocks, you may incur different types of fees. This could include management fees, which are the costs associated with managing the investment product. It is important to carefully review the prospectus of an investment to determine the management fee and ensure it aligns with the value you will receive from the investment.

Additionally, transaction fees may be charged when you buy or sell investments, such as stocks or bonds, through a brokerage. These fees can vary depending on the brokerage you use, so it is crucial to compare and choose a low-cost brokerage if minimizing fees is a priority.

Common Investment Expenses to Be Aware Of

In addition to fees, there are other investment expenses that you should be aware of. These can include administrative costs, such as account maintenance fees, which are charged to cover the costs of administering your investment account. It’s important to understand the fee structure of your brokerage or investment platform to ensure you are not being charged excessive administrative fees.

Another expense to consider is the expense ratio, which is the annual fee that mutual funds and ETFs charge their shareholders. This fee covers the costs of managing and operating the fund. When evaluating investment options, it’s important to compare expense ratios to ensure you are selecting low-cost investments.

The Impact of Fees and Expenses on Investment Returns

It’s crucial to recognize that fees and expenses can have a significant impact on your investment returns over time. Even seemingly small fees can compound and erode your overall returns. For example, a 1% difference in fees may not seem significant initially, but over the course of many years, it can amount to a substantial reduction in your investment earnings.

By understanding the impact of fees and expenses, you can prioritize minimizing costs and focus on maximizing your investment returns.

Methods to Minimize Investment Costs

Now that you have a better understanding of investment fees and expenses, let’s explore some methods to minimize these costs. By utilizing low-cost investments, considering cost-efficient asset classes, and implementing cost-minimization strategies, you can potentially save a significant amount of money over time.

Comparing and Choosing Low-Cost Investments

One method to minimize investment costs is to compare and choose low-cost investments. This involves evaluating the expense ratios and fees associated with different mutual funds, ETFs, or other investment options. Look for funds with low expense ratios that offer competitive returns relative to their peers. By selecting low-cost investments, you can keep more of your investment earnings working for you.

Utilizing Index Funds and Exchange-Traded Funds (ETFs)

Index funds and ETFs are popular investment options due to their typically low expense ratios. These types of funds aim to track a specific market index, such as the S&P 500. By investing in index funds or ETFs, you can gain exposure to a broad range of investments while keeping costs relatively low.

Considering the Cost-Efficiency of Different Asset Classes

Different asset classes can have varying cost structures, so it’s important to consider the cost-effectiveness of each. For example, investing in individual stocks may result in higher trading fees compared to investing in mutual funds or ETFs. By diversifying your portfolio across different asset classes, you can strike a balance between minimizing costs and maximizing potential returns.

Evaluating the Total Cost of Investment

To truly understand the impact of fees and expenses, it’s essential to evaluate the total cost of investment. This involves calculating expense ratios, considering sales loads and commissions, and understanding the effects of taxes on investments.

Calculation of Expense Ratios and Other Fund Costs

When evaluating mutual funds or ETFs, it is important to calculate the expense ratio, which is expressed as a percentage of the fund’s assets. This ratio represents the ongoing costs of investing in the fund. Additionally, it’s essential to consider any other fund costs, such as trading fees or administrative expenses, to accurately assess the total cost of investment.

Determining the Impact of Sales Loads and Commissions

Sales loads and commissions are fees charged when you buy or sell certain investments. These fees can vary depending on the type of investment and the brokerage you use. It’s crucial to understand the impact of these fees on your overall investment returns and consider alternative investment options that may have lower or no loads or commissions.

Understanding the Effects of Taxes on Investments

Taxes can also have a significant impact on your investment returns. Different types of investments may be subject to different tax rates or tax treatments. For example, dividends from stocks are often taxed differently than interest from bonds. By understanding the tax implications of your investments, you can make more informed decisions and potentially minimize tax-related expenses.

Managing Brokerage Fees and Trading Costs

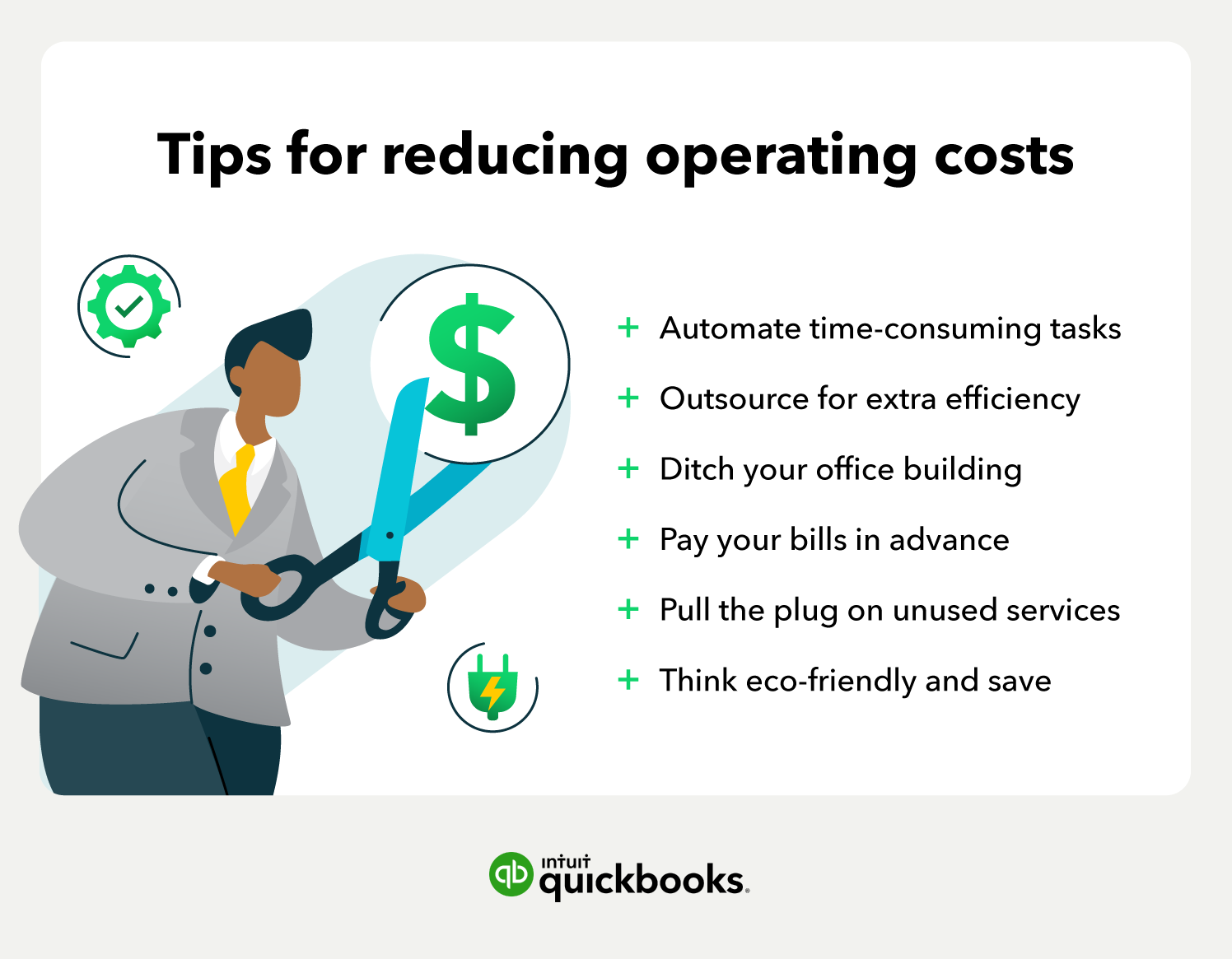

If you actively trade stocks or other investments, managing brokerage fees and trading costs is crucial to minimize unnecessary expenses. By comparing different brokerages, evaluating the cost-effectiveness of trading platforms, and utilizing cost-minimization strategies, you can potentially save a significant amount of money.

Comparing Different Brokerages and Their Fee Structures

Not all brokerages are created equal, and their fee structures can vary significantly. When choosing a brokerage, it is important to compare the fees associated with different trading platforms. This includes reviewing account maintenance fees, trading fees, and any additional costs that may be incurred. By selecting a brokerage with low fees, you can minimize the impact of trading costs on your investment returns.

Evaluating the Cost-Effectiveness of Trading Platforms

In addition to comparing brokerage fees, it’s important to evaluate the cost-effectiveness of the trading platform itself. Some platforms offer advanced trading tools and research at an additional cost, while others provide basic functionalities for free. It’s essential to determine the level of features you need and weigh the cost-effectiveness of different platforms accordingly. For casual investors, a no-frills platform with low fees may be more suitable, while active traders may require more advanced features.

Utilizing Cost-Minimization Strategies

There are also various cost-minimization strategies you can utilize when actively trading investments. For example, you can consider consolidating your trades to minimize transaction fees, or utilizing limit orders to potentially reduce the impact of bid-ask spreads. By being mindful of trading costs and implementing cost-minimization strategies, you can optimize your investment returns.

Avoiding Unnecessary Account Fees

In addition to brokerage fees and trading costs, it’s important to be aware of and avoid unnecessary account fees. By examining account maintenance and service fees, minimizing or eliminating transaction fees, and considering the costs of additional services and features, you can save money and maximize your investment returns.

Examining Account Maintenance and Service Fees

Different brokerage or investment platforms may charge account maintenance fees to cover the costs of administration and support. It’s important to carefully review the fee structure of your account and consider whether the services provided and potential benefits outweigh the associated costs. If you find that the account maintenance or service fees outweigh the value you receive, it may be worth exploring alternative options.

Minimizing or Eliminating Transaction Fees

Transaction fees can add up quickly, especially if you frequently buy or sell investments. Some brokerages offer fee-free transactions for specific funds or ETFs, while others may charge a fee for each trade. If minimizing transaction fees is a priority, you can consider utilizing fee-free options or consolidating your trades to minimize the number of transactions.

Considering the Costs of Additional Services and Features

Brokerages and investment platforms often offer additional services and features, such as access to research reports or personalized investment advice, at an additional cost. It’s important to carefully evaluate the costs and potential benefits of these services. For some investors, additional features may provide value and justify the associated costs, while others may prefer to rely on free or lower-cost alternatives.

Seeking Professional Advice Wisely

While minimizing investment costs is important, it’s also essential to consider the value of professional advice when making investment decisions. Understanding the costs of financial advisors and investment professionals, evaluating the value of professional guidance, and exploring alternatives to traditional advice can help you make informed choices.

Understanding the Costs of Financial Advisors and Investment Professionals

Financial advisors and investment professionals typically charge fees for their services. These fees can vary based on the advisor’s expertise, the complexity of your financial situation, and the services provided. It’s crucial to understand the fee structure and consider whether the potential benefits of professional advice outweigh the associated costs.

Evaluating the Value of Professional Guidance

Professional guidance can provide valuable insights, personalized recommendations, and help navigate complex investment strategies. By working with a knowledgeable advisor, you may be able to optimize your investment portfolio and potentially achieve better long-term results. It is important to weigh the potential benefits of professional guidance against the associated costs to determine if it aligns with your investment goals.

Exploring Alternatives to Traditional Advice

If the cost of traditional financial advisors is a concern, there are alternative options available. For example, robo-advisors utilize automated algorithms to provide investment advice at a fraction of the cost of traditional advisors. Online investment communities and forums can also provide insights and education, although it is important to approach these sources with caution and verify the information with trusted sources.

Diversification and Cost Considerations

Diversification is a key investment strategy that aims to reduce risk by spreading investments across different asset classes. When considering diversification, it is important to balance the costs and benefits and analyze the expense ratio of diversified portfolios. By maximizing returns while controlling costs, you can potentially achieve a balanced and cost-effective investment approach.

Balancing the Costs and Benefits of Diversification

Diversification can be a cost-effective way to manage risk and potentially enhance investment returns. By spreading your investments across different asset classes, you can potentially reduce the impact of a single investment’s poor performance on your overall portfolio. However, it’s important to balance the costs associated with diversification, such as transaction fees for buying multiple investments, with the potential benefits of risk reduction and enhanced returns.

Analyzing the Expense Ratio of Diversified Portfolios

When constructing a diversified portfolio, it’s crucial to consider the expense ratios of the various investments. The cumulative expense ratio of your portfolio can significantly impact your overall returns. By selecting low-cost investments within each asset class, you can minimize the expenses associated with diversification and potentially enhance your investment outcomes.

Maximizing Returns while Controlling Costs

The ultimate goal of investing is to maximize returns, and controlling costs is a vital part of achieving this goal. By staying mindful of fees and expenses, utilizing low-cost investments, and optimizing your investment approach, you can potentially enhance your investment returns over time. Regularly monitoring and reviewing your investment costs is important to adapt to changing conditions and market developments.

Costs of Investment Education and Resources

Investment education and resources can be important for making informed investment decisions. However, it’s crucial to recognize the expenses associated with investment courses and workshops, evaluate the value of investment newsletters and publications, and utilize low-cost or free educational resources to balance education and cost-efficiency.

Recognizing the Expenses of Investment Courses and Workshops

Investment courses and workshops can provide valuable knowledge and insights into various investment strategies and concepts. However, it’s important to recognize that these educational opportunities often come with a price tag. It’s essential to evaluate the cost of courses and workshops relative to the value you expect to gain. Consider alternative educational resources, such as online courses or books, that may provide similar knowledge at a lower cost.

Evaluating the Value of Investment Newsletters and Publications

Investment newsletters and publications can provide analysis, market insights, and investment recommendations. These resources often come with a subscription fee. When evaluating the value of investment newsletters or publications, it is important to consider the accuracy and relevance of their content. Take into account the cost of the subscription and assess if the insights provided are worth the expense.

Utilizing Low-Cost or Free Educational Resources

Fortunately, there are many low-cost or free educational resources available to investors. Online platforms, such as investment blogs, reputable financial websites, and educational videos, can provide valuable insights and education without the hefty price tag. By utilizing these cost-efficient resources, you can expand your investment knowledge while keeping expenses in check.

Technological Innovations and Their Cost Implications

Technological innovations have revolutionized the investment industry, offering new platforms and opportunities for investors. When exploring robo-advisors and analyzing the cost-effectiveness of automated investing platforms, it is important to consider the trade-offs between technology and human advice to make informed decisions that align with your investment preferences.

Exploring Robo-advisors and Their Fee Structures

Robo-advisors are automated investment platforms that utilize algorithms to provide investment advice and portfolio management. These platforms typically charge lower fees compared to traditional human advisors. When considering a robo-advisor, it’s important to review their fee structure, including management fees and any additional costs. Factor in the value you would receive from the platform and determine if the fees align with your investment goals.

Analyzing the Cost-Effectiveness of Automated Investing Platforms

Automated investing platforms offer convenience and accessibility, but it’s important to analyze their cost-effectiveness. Consider the fees charged by these platforms compared to the potential benefits they provide. Some automated platforms may have limited investment options or lack personalized advice, while others may offer advanced features and customization at a higher cost. It’s crucial to strike a balance between cost and features that align with your investment needs.

Considering the Trade-offs between Technology and Human Advice

While technological innovations can offer cost savings and convenience, it’s important to consider the trade-offs between technology and human advice. Human advisors can provide personalized guidance, emotional support, and adaptability to changing market conditions. On the other hand, technology-driven platforms may offer lower fees, convenience, and efficiency. Determine which factors are most important to you and weigh the cost implications before making a decision.

Regularly Monitoring and Reviewing Costs

Minimizing investment costs is an ongoing process that requires regular monitoring and review. By conducting periodic portfolio and fee reviews, reacting to changing conditions and market developments, and adjusting strategies for cost optimization, you can ensure that you are consistently managing costs and making informed investment decisions.

Conducting Periodic Portfolio and Fee Reviews

It’s important to regularly review your investment portfolio to ensure it continues to align with your financial goals. As part of this review, evaluate the fees and expenses associated with each investment and consider if they are still justifiable. This includes analyzing expense ratios, transaction costs, and any additional fees that may have been introduced. Conducting periodic portfolio and fee reviews can help you identify any unnecessary costs and make adjustments accordingly.

Reacting to Changing Conditions and Market Developments

The investment landscape is constantly evolving, and market conditions can change rapidly. It’s essential to stay informed and react to these developments to minimize costs and optimize your portfolio. For example, if an investment’s expense ratio increases significantly without a justifiable reason, it may be worth considering alternative options. Additionally, economic trends and market shifts may require adjustments to your investment strategy to control costs and maximize returns.

Adjusting Strategies for Cost Optimization

Investment costs should be regularly evaluated and adjusted to ensure cost optimization. This involves exploring new investment options, considering lower-cost alternatives, and reassessing the value provided by different investment products and services. By staying vigilant and proactive in managing investment costs, you can enhance your overall investment experience and potentially achieve better long-term results.

In conclusion, understanding investment fees and expenses is crucial for any investor seeking to minimize unnecessary costs and optimize their investment returns. By comprehensively evaluating the different types of fees and expenses, minimizing costs through various strategies, and regularly monitoring and reviewing expenses, you can make informed decisions and work towards achieving your financial goals. Remember to balance cost considerations with the value received from investments and the guidance of professionals to ensure a well-rounded approach to investing.